- In general, term life insurance rates are the cheapest in Canada

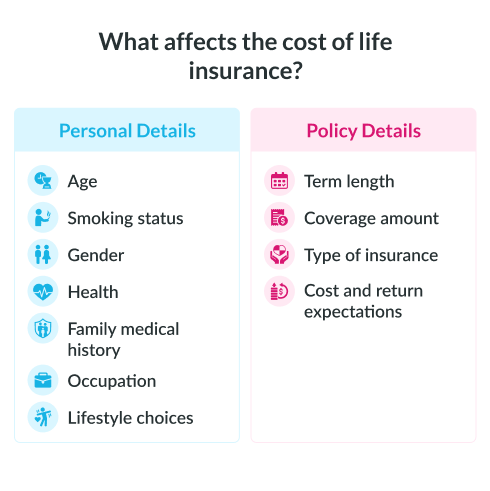

- Premiums also cost less if you are young, healthy, and don't smoke

- The cheapest policy may not always give you the best value for your dollar

- You should work with a licensed life insurance broker who can help you with strategies to save on premium costs

Life insurance doesn’t have to be expensive, especially if you know how to compare your options. Many Canadians are beginning to recognize the value of buying life insurance and taking a crucial step to protect the financial future of their families.

In fact, a 2024 report by LIMRA shows that 57% of Canadians now have life insurance, reflecting a steady rise in coverage since 2019. As demand grows, insurers continue to offer competitive rates, making it easier than ever to find affordable protection.

In this 2025 guide, we’ll walk you through how to get the cheapest life insurance quotes in Canada, explore the most budget-friendly policy types, and highlight top providers offering low-cost plans.

What are the different types of life insurance options in Canada?

Canada offers several types of life insurance options to meet different financial needs and goals. The main types include term life insurance, whole life insurance, and universal life insurance.

-

- Term life insurance: This insurance type provides coverage for a specific period, such as 10, 20, or 30 years, and is often the cheapest life insurance option available. It’s ideal for temporary needs like mortgage protection or income replacement

- Whole life insurance: It offers permanent coverage for the policyholder’s lifetime, along with a guaranteed death benefit and a savings component that grows over time. The premiums are higher than term insurance but remain fixed, providing stability and long-term value

- Universal life insurance: This insurance also offers lifelong coverage but adds flexibility in premium payments and a customizable investment component. Policyholders can adjust their coverage and savings contributions as their needs change, making it a more versatile but complex product

What is the cheapest life insurance policy in Canada?

The cheapest life insurance policy in Canada is typically term life insurance. This type of policy offers coverage for a fixed period, such as 10, 20, or 30 years, making it an affordable option for those who need temporary protection.

Unlike permanent life insurance plans that provide lifetime coverage and often include investment components, term life focuses solely on providing a death benefit, which keeps premiums low. Several factors can lower your term life insurance premiums:

- Choosing a shorter coverage period

- Opting for a lower coverage amount

- Applying when you’re younger

- Being in good health and a non-smoker

For example, a healthy 20-year-old non-smoker who buys a basic term life policy will likely receive some of the cheapest life insurance quotes in Canada.

The average monthly cost of term life insurance for a young, healthy Canadian under 40 years of age ranges from $22 to $25 per month. As you age, the premiums increase. The cost of term life insurance depends on age, so prices may increase as you get older.

Cost of term life insurance for a 10-year period

| Age | Male | Female |

| 20 years | $22/month | $14/month |

| 30 years | $22/month | $15/month |

| 40 years | $27/month | $19/month |

| 50 years | $61/month | $45/month |

| 60 years | $200/month | $145/month |

*Illustrating the cost of term life insurance for a 10-year period for individuals of various age ranges opting for $500,000 in coverage

What is the cost of the cheapest whole life insurance policy in Canada?

Whole life insurance in Canada typically costs more than term life because it offers lifetime coverage and, in many cases, includes a cash value component. However, if you’re looking for the cheapest whole life insurance, you need to choose between participating and non-participating policies.

For $100,000 in coverage, the cheapest whole life insurance premiums start at approximately $45 to $47 per month for a 20-year-old buying a non-participating policy. For participating policies, the monthly cost is slightly higher, ranging from $52 to $54 per month for the same age and coverage.

Cost of whole life insurance in Canada

| Age | Male | Female |

| 20 years | $22/month | $14/month |

| 30 years | $22/month | $15/month |

| 40 years | $27/month | $19/month |

| 50 years | $61/month | $45/month |

| 60 years | $200/month | $145/month |

*Illustrative cost for a male individual of various age ranges seeking a whole life insurance policy with $100,000 in coverage

Which are the cheapest life insurance providers in Canada?

In 2025, several top Canadian insurers like Manulife, Equitable Life, iA, Sun Life, Canada Life, etc., continue to offer competitive rates, especially for term life insurance.

Manulife

Manulife offers some of the most competitively priced term life insurance policies in Canada. Their CoverMe Term Life Insurance is popular among young families and individuals looking for basic protection at a low cost. Manulife also provides online tools to help you get instant quotes and apply with ease.

Equitable Life

Equitable Life consistently ranks among the cheapest life insurance providers in the country. Known for personalized service and flexible term lengths, Equitable Life offers low premiums, especially for non-smokers and younger applicants. Their underwriting process is also straightforward, which helps keep costs down.

Sun Life

Sun Life provides a wide range of life insurance products, including affordable term life plans that cater to various budgets. Their term policies are known for offering strong value and flexibility, with options to convert to permanent insurance later. Sun Life’s easy-to-use online quote system makes comparing prices simple.

Canada Life

Canada Life is a trusted name in the insurance industry and offers low-cost life insurance solutions tailored to Canadian residents. Their term life insurance rates are competitive, and they frequently offer discounts for bundling policies or choosing electronic delivery and payment options.

iA Financial Group

iA Financial Group is known for offering some of the most affordable life insurance quotes in Canada, particularly for healthy individuals under 40. Their term policies come with flexible coverage options and the ability to apply online. iA also has simplified issue products that require no medical exams, making them ideal for those who want quick and easy approval.

Comparing term vs. whole life insurance: Which policy offers affordable coverage?

When comparing life insurance policies in Canada, term life insurance is typically the most affordable option. However, whole life offers a significant death benefit, accumulated cash value and a portion of the company’s profit in the form of dividends, making it a favourable life insurance choice for individuals looking to build an estate or accumulate wealth.

Here’s a quick comparison between term life and whole life insurance in Canada to help you choose ideal choice for each policy:

Comparing term life and whole life insurance policy

| Feature | Term life insurance | Whole life insurance |

| Cost | Lower premiums; most affordable option | Higher premiums; more expensive over time |

| Coverage length | Fixed term (10, 20, 30 years) | Lifetime coverage |

| Cash value | No cash value or investment component | Builds guaranteed cash value over time |

| Flexibility | Can’t be changed once the term starts | Can include paid-up options and dividends (in some cases) |

| Pros | Affordable, simple, good for temporary needs | Lifetime protection, cash value, fixed premiums |

| Cons | Expires after term, and no payout is made if you outlive the term | High cost, more complex, slower cash value growth early on |

| Best for | Young families, mortgage protection, short-term needs | Estate planning, lifelong dependents, wealth transfer |

What are the cheapest life insurance options for seniors?

The cheapest life insurance quotes for seniors in Canada typically come from traditional life insurance or no-medical policies. While the life insurance premiums for seniors are higher due to age and health risks, they can still find affordable coverage by comparing plans and choosing basic coverage amounts.

On average, life insurance premiums for seniors start at around $100/month based on coverage amount, policy type and underwriting criteria. Healthy seniors in their early 60s may find term life insurance policies with $100,000 in coverage starting from $52/month, while older individuals (80 years) may pay $200/month for the same coverage. The cost of whole life insurance for seniors ranges between $110-$130/month for $100,000 coverage.

To get the cheapest life insurance rates for seniors, it’s important to compare quotes from multiple providers and consider simplified or no-medical exam options that offer fast approval and reduced underwriting.

Depicting the cost of life insurance for seniors

| Age | 10-year term policy | Whole life policy |

| 50 years | $35/month | $111/month |

| 60 years | $55/month | $149/month |

| 70 years | $94/month | $99/month |

| 80 years | $205/month | $131/month |

*Quote for $100,000 in life insurance coverage for a non-smoking female resident of Ontario in good health

What are the cheapest life insurance options for individuals with pre-existing conditions?

For individuals with unstable pre-existing conditions, the cheapest life insurance option is usually no-medical or guaranteed issue life insurance. These policies do not require medical exams and offer fast approval, making them accessible to those who may not qualify for traditional coverage.

Some of the best life insurance providers like Manulife, Canada Life, Sun Life, Empire Life, Canada Protection Plan, iA Financial Group, and Assumption Life offer affordable no-medical life insurance options in Canada. The monthly premiums for basic coverage (e.g., $25,000 to $50,000) typically range from $75 – $240/month, depending on the age, gender, medical history and smoking status of the individual.

These plans often cover individuals with stable pre-existing conditions such as:

- Diabetes with complications

- Heart disease or recent heart surgery

- Cancer history (recent or in remission)

- COPD or other chronic respiratory conditions

- Mental health disorders like severe depression or bipolar disorder

- Liver or kidney disease

These life insurance policies come with a two-year waiting period, meaning full benefits are only paid after two years. However, they still provide immediate accidental death coverage and guaranteed approval regardless of health status.

What is the most affordable life insurance option for smokers?

For smokers in Canada, the most affordable life insurance option is typically a term life insurance policy. While smokers do pay significantly higher premiums than non-smokers, term life still offers the lowest premium rates compared to other types of life insurance.

Premiums for smokers reflect the increased health risks and shorter life expectancy associated with tobacco use. For example, a 30-year-old smoker in average health may pay over $60 per month for a 20-year term life policy with $500,000 in coverage. Alternatively, a non-smoker of the same age would pay around $30 per month for the same policy.

Some of the best life insurance companies like Canada Life, Manulife, Sun Life, and iA Financial Group offer competitive term life policies for smokers. While premiums are higher, term life insurance remains the most budget-friendly life insurance option for smokers seeking substantial coverage at manageable rates.

What are the common mistakes to avoid while getting the cheapest life insurance plan?

Buying the cheapest life insurance plan in Canada can be a smart financial move. While keeping costs low is important, it’s equally essential to make sure the policy actually meets your long-term needs. If you want to avoid compromising on protection, you need to strike the right balance between affordability and value.

Here are the most common mistakes to avoid when choosing a low-cost life insurance plan in Canada:

- Choosing the lowest premium without reviewing coverage details: A cheap plan might come with limited coverage or shorter terms that don’t align with your financial responsibilities

- Ignoring policy exclusions and fine print: Failing to read the terms can lead to claim denials or uncovered situations when your family needs support the most

- Delaying your purchase to get a better rate later: Life insurance only gets more expensive as you age or develop health issues, and waiting can cost you more in the long run

- Underinsuring to save money: Choosing a lower coverage amount to reduce premiums may not be enough to support your family’s needs after you’re gone

- Not disclosing your full medical history: Hiding or misrepresenting health conditions can result in policy cancellation or denied claims

- Overlooking convertibility options: Some term plans allow you to convert to permanent coverage later and missing out on this can limit your flexibility as your needs change

- Skipping a quote comparison across insurers: Life insurance prices and features vary widely. Not shopping around may lead you to overpay or miss better, cheaper options

How to apply for the most affordable life insurance plan in Canada?

Applying for the most affordable life insurance plan in Canada is simple if you know where to look and what to compare. At PolicyAdvisor, you can get life insurance instant quotes in under 60 seconds using our AI-powered life insurance calculator. We partner with 30+ top Canadian insurers like Manulife, Canada Life, and Sun Life etc, to help you compare the cheapest life insurance rates side by side.

Once you find the right policy, you can apply online instantly or speak with our licensed advisors for personalized support. PolicyAdvisor also offers reliable after-sales assistance, helping you manage your policy even after purchase. Schedule a call to get the most affordable life insurance quotes based on your unique needs.

Frequently Asked Questions

What is the cheapest type of life insurance policy?

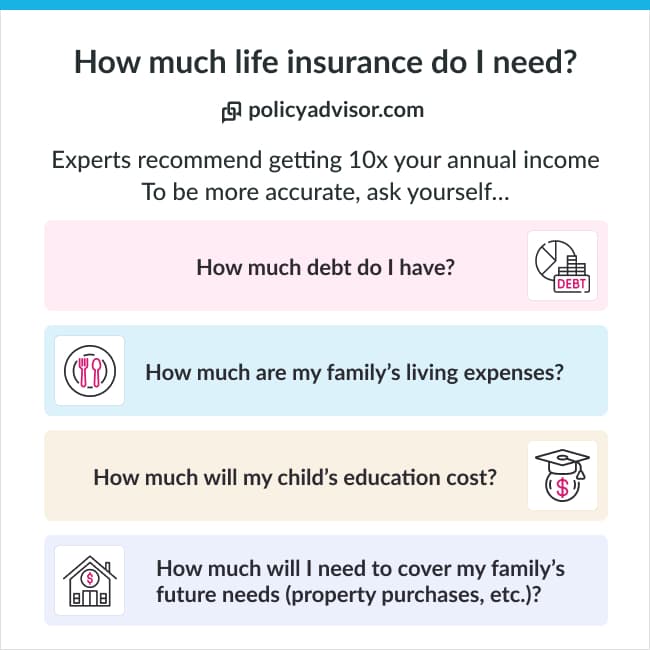

The cheapest form of life insurance is a term policy. The shorter the term, the cheaper the policy. But the cost is also dependent on other factors as well, such as your personal health history, family history of medical conditions, your coverage amount, and more.

What is the lowest death benefit I can get?

Canada’s biggest insurance companies will give life insurance coverage amounts as low as $50,000. Whole life insurance policies can go as low as $10,000 because most people use them for end-of-life expenses or estate planning instead of short-term needs.

But, you should compare online insurance quotes before buying just the minimum. In a lot of cases, policies that give you more coverage can cost less.

What is a 1-year life insurance policy?

A 1-year life insurance policy is a term life insurance product where your term is for one year. If you die within that year, the insurance company will pay your beneficiaries a tax-free death benefit.

You may also see them called an annual renewable term policy. These kinds of policies usually seem great at first glance because their premiums are extremely cheap.

But, read the fine print before you buy. Every year you renew this policy, your premiums will increase. Over time, you’ll end up paying a lot more than if you just got a policy with a longer term.

Take it from our experts — it’s usually better for you, your family, and your wallet if you get a policy that lasts 5+ years instead. At least then, your rate is locked in for a longer time.

What is the most expensive life insurance policy in Canada?

Permanent insurance and no-medical insurance are the most expensive types of insurance policies.

A permanent policy gives you lifelong coverage and has something called a cash value component. You can use this cash value to access growth and build wealth during your lifetime. These are the main reasons why it costs more.

No medical insurance is usually an option for people with severe medical issues. It guarantees you’ll be approved for a policy. But the insurance company also takes a bigger risk to do that, so the cost is higher.

In general, term life insurance policies are the cheapest type of life insurance. But life insurance prices can vary a lot with so many different providers and policy types. Still, there are several things you can do to lower your premiums and make sure you get the cheapest life insurance policy possible.

LIMRA. “Nearly One-Third of Canadian Adults Report Living with a Life Insurance Coverage Gap.” LIMRA, March 26, 2024