- Whole life insurance combines lifelong coverage with guaranteed cash value growth and tax-deferred savings, making it a reliable retirement tool, especially for Canadians who have maximized RRSP and TFSA contributions

- Unlike registered plans, whole life insurance allows higher contributions and has no mandatory withdrawal age, offering greater long-term planning flexibility

- Retirees can use policy loans, dividends, or partial withdrawals to supplement CPP, OAS, or RRIF income while managing their taxable income more strategically

- The death benefit in whole life insurance is usually tax-free, bypasses probate, and can be used to transfer wealth efficiently or cover estate taxes, beneficial for individuals who are focused on legacy planning

In Canada, where retirement planning often revolves around RRSPs, TFSAs, and pension plans, whole life insurance offers a lesser-known but highly effective way to grow tax-sheltered savings while maintaining lifelong coverage. With guaranteed returns, stable cash value accumulation, and the flexibility to access funds later in life, whole life insurance is becoming an attractive option for Canadians planning their retirement.

According to a report by CLHIA, approximately 22 million Canadians owned $5.5 trillion in life insurance coverage in 2022. In this blog, you will learn how to use whole life insurance as a retirement savings tool that could reshape your financial future, help you build cash value, and save on taxes.

How does the cash value component in a whole life insurance policy work?

The cash value in a whole life insurance retirement investment policy grows slowly over time. When you pay your whole life insurance premium, a portion goes toward the cost of insurance. The insurance company manages the rest through a built-in component of the policy that accumulates cash value.

This cash value grows tax-deferred over time as your policy continues to age. If you choose a participating policy, you may also earn annual dividends. Although the dividends are not guaranteed, many Canadian insurers like Sun Life, Manulife, and Canada Life have strong dividend histories and continue to provide consistent dividend rates.

You can access your policy’s cash value in three main ways: policy loans, collateral loans, and cash withdrawals. It takes a few years for the cash value to build meaningfully. Hence, this strategy works best if you start early and hold the policy long-term.

How can you use whole life insurance as a retirement plan?

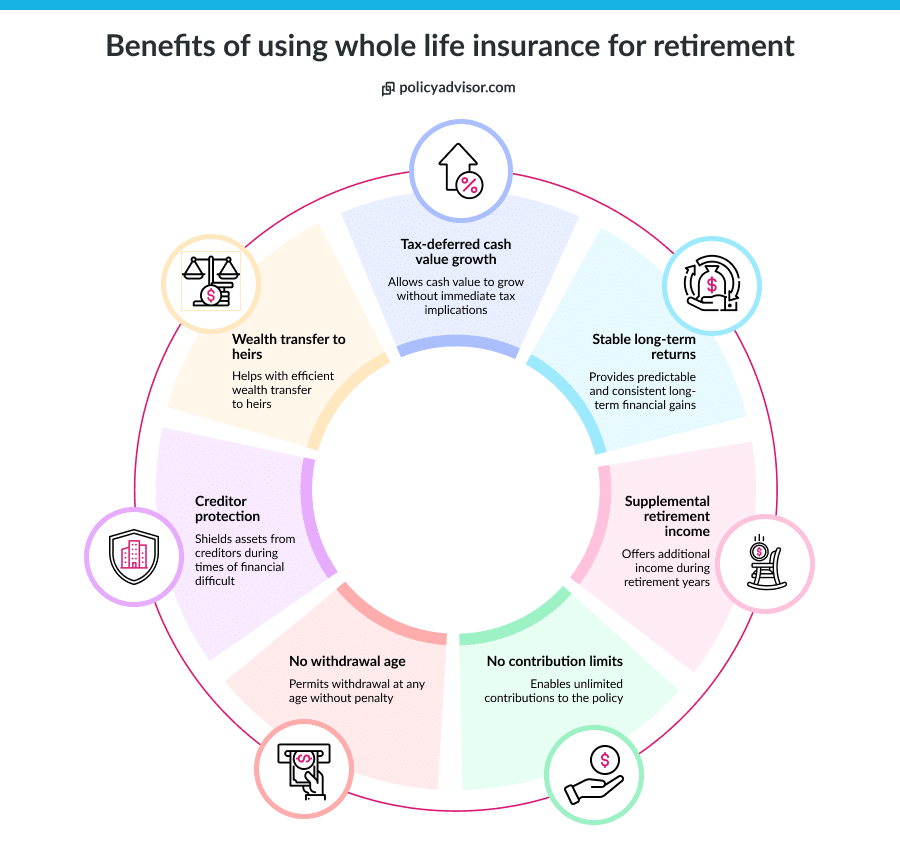

Whole life insurance as a retirement plan offers a unique combination of protection and long-term savings. For Canadians seeking to diversify their retirement planning beyond RRSPs, TFSAs, and government benefits, the following features make it a compelling option:

Tax-deferred cash value growth

The cash value inside a whole life policy grows tax-deferred under Canadian tax rules. This allows savings to compound more efficiently than in taxable, non-registered accounts. You only pay taxes if you withdraw more than your adjusted cost basis. It is ideal for those who have maxed out their RRSP and TFSA limits.

Stable and predictable long-term returns

Whole life insurance offers guaranteed cash value growth and stable returns. Participating policies may also pay annual dividends from the insurer’s surplus. These features appeal to conservative savers who prefer low-risk, steady growth. Unlike the stock market, volatility does not affect the policy’s value.

Supplemental retirement income

You can access the cash value through withdrawals or tax-free policy loans. This can supplement other income sources like CPP, OAS, RRIFs, or pensions. It offers flexibility when managing cash flow during low-income retirement years. This helps reduce pressure on registered accounts and avoids large taxable withdrawals.

No contribution limits

Unlike RRSPs or TFSAs, there are no set contribution limits for whole life premiums. You can build substantial savings as long as the policy remains tax-exempt. This is useful for high-income earners looking for additional savings options. It creates a long-term, tax-efficient reserve beyond traditional retirement plans, which can help you build significant wealth over time.

No mandatory withdrawal age

RRSPs must convert to RRIFs by December 31st of the year you turn 71, with mandatory minimum withdrawals. Whole life insurance does not have such rules; you can access it when needed. This gives retirees more control over when and how to draw income.

Creditor protection (in most provinces)

Provincial insurance laws may protect the policy from creditors when you name a spouse, child, parent, or grandchild as the beneficiary. This makes it appealing for incorporated professionals or business owners.

Efficient wealth transfer to heirs

The death benefit passes directly to named beneficiaries, often tax-free. It avoids probate in most provinces, ensuring quick and private transfers. This supports estate planning and helps preserve family wealth. It can also help offset estate taxes or equalize inheritances.

How to access the whole life insurance cash value during retirement?

Whole life insurance for retirement allows policyholders to access the cash value they have accumulated over the years in several ways. These options offer flexibility and can support retirement income needs without disrupting your overall financial plan.

- Policy loans: Policyholders can borrow against the cash value of their whole life insurance without triggering immediate taxes. As long as you keep the policy active and in good standing, the loan does not count as taxable income

- Direct cash withdrawals: You can withdraw funds directly from the policy’s cash value to meet your financial needs. If the withdrawal exceeds the policy’s adjusted cost base (ACB), the excess will be taxable and will reduce the policy’s value and death benefit

- Premium offset with dividends: Your participating whole life insurance policy may generate dividends over time. These dividends can help cover future premium payments, reducing or eliminating your need to pay out of pocket

- Collateral loans against the policy’s cash value: Many Canadian banks allow you to use the policy’s cash value as collateral for a personal or investment loan. This method does not trigger taxation and may offer additional advantages if the loan can generate income

- Receiving dividends as cash income: You can also take annual dividends as cash instead of reinvesting them or using them to buy additional coverage. For retirees or individuals planning their retirement, this offers a modest and flexible income stream

What's your retirement outlook?

Calculate how much you need to save for a comfortable retirement and see if you're on track to meet your goals.

What can you do with your whole life insurance dividend options?

When your whole life insurance policy earns dividends, you can use them to reduce premiums, pay off policy loans, or collect dividends as cash. You can also use your whole life insurance dividend options to participate in paid-up additions or leave it in a side account to accumulate additional interest. A side account is a separate account where dividends can be left to accumulate interest, typically at a rate set by the insurer.

- Paid-up additions (PUAs): In paid-up additions, your dividends are used to buy small amounts of additional whole life insurance coverage. These PUAs will increase both your death benefit and cash value, and they grow tax-deferred inside the policy

- Reduce premiums: You can use your dividends to lower or fully cover your future premium payments towards the insurance policy. This can make your policy more affordable in the long run

- Take the dividends as cash: You can also receive your dividends as direct cash payments. But keep in mind that cash dividends may become taxable once they exceed the value of premiums you’ve paid

- Leave dividends to accumulate with interest: Some insurers offer an interest-bearing side account where your dividends can sit and grow over time. The original dividend isn’t taxable, but the interest earned is taxable each year

- Pay off policy loans: If you’ve borrowed against your policy’s cash value, you can use your dividends to repay that loan. This helps restore your policy’s full value, and you can avoid any interest buildup

Comparing whole life insurance with other retirement planning tools

While whole life insurance for retirement planning is not a popular choice for Canadians, it has some benefits over other retirement savings plans in terms of guaranteed and tax-deferred cash value growth, no contribution room limits, and creditor protection.

Unlike traditional retirement plans like RRSPs and TFSAs, it also has a lower investment risk profile, which ensures that you will have some amount of money during your retirement.

Whole life insurance vs RRSPS, TFSAs, and other retirement savings plans

| Feature | Whole Life Insurance | RRSP | TFSA | Non-Registered Account |

| Primary Purpose | Insurance, as well as long-term savings | Retirement savings with tax deferral | Flexible, tax-free savings | General investing or saving |

| Tax Treatment on Growth | Tax-deferred cash value growth | Tax-deferred until withdrawal | Tax-free growth and withdrawals | Fully taxable on interest, dividends, and capital gains |

| Withdrawal Taxes | Tax-free if structured as a loan; taxable if withdrawn directly | Fully taxable as income upon withdrawal | No tax on withdrawals | Tax applicable on capital gains, dividends, and interests |

| Contribution Limits | No fixed limit (subject to MTAR rules for tax-exempt status) | Annual limit based on income (18% of the previous year’s earned income) | Annual limit indexed to inflation | No contribution limits |

| Access in Retirement | Loans, withdrawals, or dividend income | Withdrawals reduce RRSP balance and trigger tax | Easy access without tax consequences | Full access but with tax implications |

| Estate Planning Benefits | Tax-free death benefit; bypasses probate (in most provinces) | Taxable at death and may trigger a large tax bill | Passes tax-free to heirs | Subject to probate and capital gains tax at death |

| Creditor Protection | Often protected if certain family members are beneficiaries | Not protected | Not protected | Not protected |

| Risk Profile | Low risk, guaranteed cash value, and stable growth | Depends on investments; may involve market risk | Depends on investments; can be low to high risk | High flexibility, but exposed to market risk |

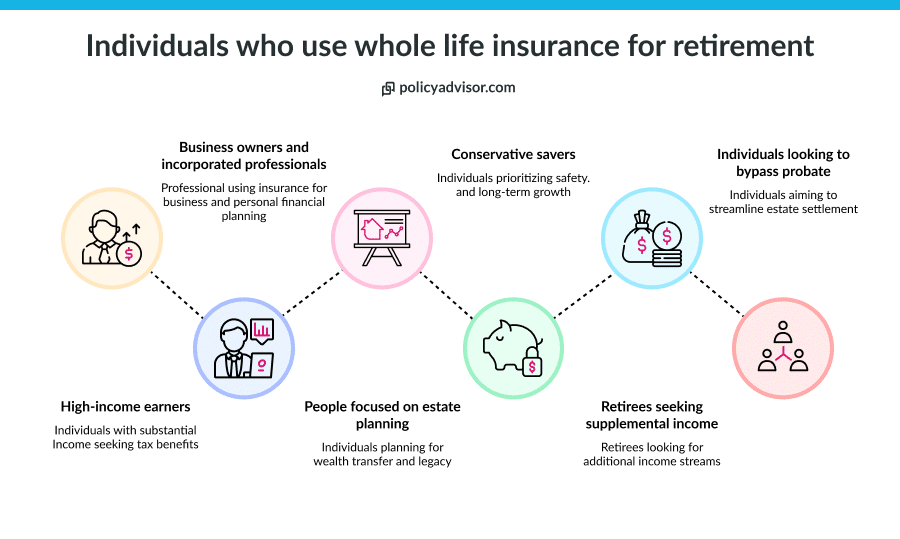

Who should use whole life insurance for retirement?

Whole life insurance is best suited for individuals with specific financial needs and long-term goals. It can complement traditional retirement accounts by offering stable, tax-efficient growth.

- High-income earners: Canadians with a high income source who have already maximized their RRSP and TFSA contributions may benefit from the tax-deferred growth inside a whole life policy

- Business owners and incorporated professionals: Corporate-owned policies can grow cash value tax-efficiently and provide a tax-free death benefit through the Capital Dividend Account

- People focused on estate planning: Those who wish to leave a tax-free inheritance or cover estate taxes can use whole life insurance as a reliable estate planning legacy tool

- Conservative savers: Individuals looking for stable and guaranteed growth that is independent of market fluctuations may prefer the predictability of whole life insurance

- Retirees seeking supplemental income: The cash value in the policy can offer flexible, tax-efficient income to support government benefits and registered plans

- Individuals looking to bypass probate: If you name a beneficiary, the insurer can pay life insurance proceeds directly, avoiding probate delays and maintaining privacy

How to maximize whole life insurance cash value for your retirement savings?

Maximizing the cash value of a whole life insurance policy requires proper planning, consistent contributions, and the right strategy. Here are several ways to get the most from your policy over time:

- Start early: The earlier you begin, the more time your cash value has to grow. Getting whole life insurance during your 20s and 30s can help accelerate cash value accumulation without losing tax-exempt status

- Choose a participating policy: Opt for a participating whole life policy from a reputable Canadian insurer. These policies may pay annual dividends, which you can reinvest to purchase paid-up additions (PUAs), boosting both your cash value and death benefit over time

- Use paid-up additions (PUAs) strategically: Reinvesting dividends into PUAs helps increase the policy’s value more rapidly. PUAs grow tax-deferred and immediately contribute to the policy’s cash value, compounding returns more efficiently

- Avoid unnecessary policy loans early on: Allowing the cash value to grow undisturbed during the accumulation phase leads to better long-term results. Early loans or withdrawals may slow growth and reduce the compounding effect

- Work with a financial advisor: A licensed advisor can guide you in managing contributions, optimizing dividend options, and timing withdrawals or loans for maximum tax efficiency in retirement

- Review policy regularly: Review your policy regularly to ensure it aligns with your goals. As your financial situation evolves, you may need to adjust your funding strategy, dividend use, or access plans to stay on track

How to buy whole life insurance for retirement planning in Canada?

Getting whole life insurance as a retirement plan in Canada starts with choosing the right provider and policy tailored to your long-term financial goals. At PolicyAdvisor, we simplify this process with expert guidance and smart technology that puts your needs first.

Our experienced insurance advisors understand the unique needs of Canadian retirees and work with you to recommend the most suitable whole life policy, whether you are focused on building cash value, estate planning, or supplementing future income. Additionally, with access to Canada’s top insurers, we help you compare plans transparently and confidently.

Using our AI-powered whole life insurance calculator, you can view personalized whole life insurance quotes from leading providers in under 60 seconds. Plus, our exceptional after-sales support ensures you’re not left alone after purchasing. Schedule a call with us today to get cash value life insurance for retirement in Canada.

Frequently asked questions

Can I use whole life insurance to pass wealth tax-free to my children?

Yes, whole life insurance can be an effective tool for tax-efficient wealth transfer. Insurers pay out the death benefit tax-free to named beneficiaries and typically bypass probate in most provinces.

This makes it a strategic option for passing on assets privately and without delay. Also, some parents also use it to equalize inheritances when other assets, like property or business shares, are unevenly distributed.

What happens to the whole life insurance cash value when I pass away?

When the policyholder dies, the insurer pays the death benefit to the beneficiary. In most cases, the insurer keeps the accumulated cash value and does not pay it out separately. However, if the policy includes paid-up additions or enhanced death benefit riders, the final payout may reflect a higher amount.

Does accessing cash value from a whole life policy affect my Old Age Security (OAS) payments?

It depends on how you access the cash value. Policy loans do not count as taxable income, so they won’t affect OAS. However, direct withdrawals may count as income if they exceed the policy’s adjusted cost base (ACB). In that case, they could push your income above the OAS clawback threshold.

Can I rely on whole life insurance alone to fund my retirement in Canada?

No, whole life insurance should not replace your RRSP, TFSA, or pension plans. It works best as a complementary strategy, offering tax-efficient cash value growth and a guaranteed death benefit.

While it provides stable returns, the growth is slower compared to market-based investments. Also, use it to supplement income or provide liquidity during retirement, especially in years you want to control taxable income or preserve your estate.

Whole life insurance in Canada serves as a powerful retirement savings tool by combining permanent life coverage with tax-deferred cash value growth. Unlike RRSPs and TFSAs, it has no annual contribution limits or mandatory withdrawal age, allowing greater flexibility for long-term planning. Policyholders can access the accumulated cash value through tax-free policy loans, direct withdrawals, or dividends. Whole life insurance policy also offers creditor protection in many provinces and allows for tax-free wealth transfer to beneficiaries. It is especially beneficial for high-income earners, incorporated professionals, and those focused on estate planning. When used strategically, it complements traditional retirement accounts.

Canadian Life and Health Insurance Association (CLHIA). Canadian Life and Health Insurance Facts, 2023 Edition. Toronto: CLHIA, 2023.