- Tourists in Canada should buy health insurance as they are not covered by the country's free public healthcare system

- Coverage for tourists include visitors to Canada insurance and Super Visa insurance

- Without travel medical insurance in Canada, you can face significant financial burden from medical costs

- Having visitors health insurance ensures easy access to necessary medical care, allowing tourists to enjoy their visit without worrying about unexpected medical expenses

- The average cost of tourist health insurance typically ranges from $50 to $400 per month, depending on factors such as age, duration of stay, and the level of coverage chosen

Tourists planning to visit Canada can easily purchase visitor medical insurance to protect themselves from unexpected healthcare costs.

These travel health insurance Canada policies typically cover emergency medical services such as hospital visits, ambulance transportation, diagnostic scans, prescription medications, and more.

According to reports from the Travel Health Insurance Association (THIA), over 70% of visitors to Canada buy emergency medical insurance for tourists before their trip.

Since Canada’s healthcare system does not cover visitors from the moment they arrive, it is highly recommended to purchase a visitor insurance policy in advance. This is especially important for those applying under the Super Visa program, as meeting the Super Visa insurance requirements is mandatory for approval.

In this article, we’ll discuss the different types of visitor health insurance coverage in Canada, including options for single travellers, families, and long-term stays.

What are the best visitor insurance plans available in Canada?

In Canada, there are two main types of tourist health insurance: Visitors to Canada insurance, which is available for all non-residents, and Super Visa insurance, specifically designed for parents and grandparents of Canadian citizens or permanent residents.

Both options provide coverage for medical emergencies, but Super Visa Insurance meets the requirements of the Super Visa program, offering extended coverage for longer stays. Here’s a breakdown of the different types:

1. Visitors to Canada insurance

Visitors to Canada insurance is a travel medical insurance designed specifically for non-residents visiting Canada, to provide coverage in case of any medical emergencies.

It is an essential type of coverage for visitors on a visit visa, international students, work permit holders, new immigrants on PR, and returning Canadians who are not yet eligible for Canada’s provincial healthcare.

2. Super Visa insurance

This travel insurance for Canada visitors is designed for parents and grandparents of Canadian citizens or permanent residents who are applying for a Super Visa. Super Visa insurance must be purchased for at least one year with a minimum coverage amount of $100,000.

Is health insurance mandatory for tourists?

Health insurance is not legally mandatory for tourists in Canada, but it is strongly recommended. Having visitor health insurance for your Canada trip can protect you from financial burden, guaranteeing access to quality medical care, as non-residents cannot access public healthcare.

- Visa requirements: Super visa insurance is a requirement by the Canadian government as a part of their visa application process

- No provincial health coverage Tourists are not covered by Canada’s publicly funded healthcare system, making private insurance necessary

- Financial protection: Accidents or sudden illnesses can happen at any time, and insurance provides financial protection

- Access to quality medical care: With insurance, tourists can access a wider range of medical services and facilities, ensuring they receive proper care if needed

What happens if a tourist gets sick in Canada?

If a tourist gets sick in Canada, the Canadian government will not cover any expenses for hospitalisation, medication, or other medical services. Tourists in Canada who do not have visitor coverage will be liable to pay any medical expenses out of their own pockets. To avoid this situation, tourists can get Visitors to Canada insurance before their arrival.

Can I see a doctor in Canada as a tourist?

Yes, you can see a doctor in Canada as a tourist, but you will pay out-of-pocket for all services unless you have visitor health insurance. Given the costs involved, visitor health insurance is highly recommended for financial protection.

What is covered and not covered by temporary health insurance for visitors in Canada?

Tourist medical insurance provides coverage for medical emergencies such as physician consultations, prescription drug coverage, diagnostic tests, paramedical services, and more.

However, this insurance policy does not cover any unstable pre-existing condition, non-emergency procedures, pregnancy and maternity care, mental health services, etc. Here is a detailed outline of the coverage options:

Tourist medical insurance inclusions and exclusions

| Tourist medical insurance coverage inclusions | Tourist medical insurance coverage exclusions |

| Physician consultations | Any unstable pre-existing condition |

| Prescription drug coverage | Non-emergency procedures such as elective procedures and planned surgeries |

| Pathological tests and diagnostic procedures | Pregnancy and maternity care-related emergencies |

| Emergency paramedical services | Mental health services such as counselling, therapy, and psychiatric care |

| Emergency dental care | Any injury or accident caused under the influence of drugs or alcohol |

| Accidental death and dismemberment (AD&D) | Self-inflicted injuries resulting from attempted suicide or self-harm |

| Trip breaks and side trips | Any injury resulting from a state of war or terrorism |

| Childcare coverage for a dependent child | Injuries sustained while piloting an aircraft or other aviation-related accidents |

How much does a hospital visit cost for tourists in Canada?

For tourists visiting Canada, the cost of a hospital visit can be quite high. A doctor’s visit or walk-in clinic appointment can cost between $100 and $600, while a trip to the emergency room or hospitalisation could reach up to $6,000 per day!

The following table is a comparison between what non-residents will pay while availing treatment in Canada:

Hospital charges for tourists in Canada

| Hospital Service | Cost for Non-Residents in Canada |

| Doctor’s appointments | $100-$900 |

| Emergency visit | $100-$600 |

| X-ray (including hospital visit fee) | $49 and up |

| MRI (plus hospital visit fee) | $2,030 |

| CT scan (plus hospital visit fee) | $2,130 |

| High-risk ultrasound (plus hospital visit fee) | $359 |

| Lab tests, each (plus hospital visit fee) | $360 |

| Ambulance charges | $240 |

| Rehabilitation & mobility appliances | $2-$240 |

| Ward room – Regular | $964 per day |

| Ward – Intensive care | $4,049 per day |

| Semi-private room | $1,184 per day |

| Private room | $1,224 per day |

*Charges as per a popular hospital in Ontario, Canada

How much does it cost a tourist to visit the ER in Canada?

The cost for a tourist to visit the ER in Canada typically ranges from $300 to $1,000, depending on the severity of the condition and the treatments required. Additional tests, specialist consultations, or hospital stays, can significantly increase the total cost. Without health insurance for visitors, tourists will have to pay these expenses out-of-pocket.

Is healthcare free for tourists in Canada?

No, healthcare is not free for tourists in Canada. Canada’s public healthcare system is reserved for citizens and permanent residents, so tourists must pay for any medical services they receive.

To avoid high out-of-pocket expenses, it’s strongly recommended that you purchase tourist medical coverage before arriving in Canada. This travel insurance in Canada helps cover expenses like doctor visits, hospital stays, and emergency medical treatments during their stay.

Cost of tourist health insurance in Canada

The average cost of visitor health insurance for travellers to Canada typically ranges from $50 to $400 per month, depending on factors such as age, duration of stay, and the level of coverage chosen.

For instance, younger travellers (under 40 years) may pay between $50 and $100 monthly, while those aged 70 years and older may see costs rise between $200 and $400 per month.

Cost of tourist health insurance in Canada

| Visitor’s age | Premiums without pre-existing condition coverage | Premiums with pre-existing condition coverage |

| 25 years | $72.30/mo. | $92.70/mo. |

| 35 years | $90.90/mo. | $100.20/mo. |

| 45 years | $101.70/mo. | $115.50/mo. |

| 55 years | $110.70/mo. | $129.60/mo. |

| 65 years | $133.20/mo. | $168.60/mo. |

| 75 years | $240.0/mo. | $328.80/mo. |

| 85 years | $405/mo. | $453.92/mo. |

*Cost of $100k in coverage for a visitor travelling to Canada for a 30-day period

What factors impact the cost of health insurance for tourists in Canada?

The cost of visitor health insurance in Canada depends on factors like age, duration or stay, pre-existing conditions, coverage type, deductibles, and some other factors explained below:

What happens if you don’t have a health card in Canada?

If you don’t have a health card in Canada, you won’t have access to the publicly funded healthcare system. This means you will need to bear the expense for any medical services, including doctor visits, hospital stays, and other types of emergency treatments. Without a health card, you may face significant costs for healthcare, as you won’t be eligible for free healthcare facilities.

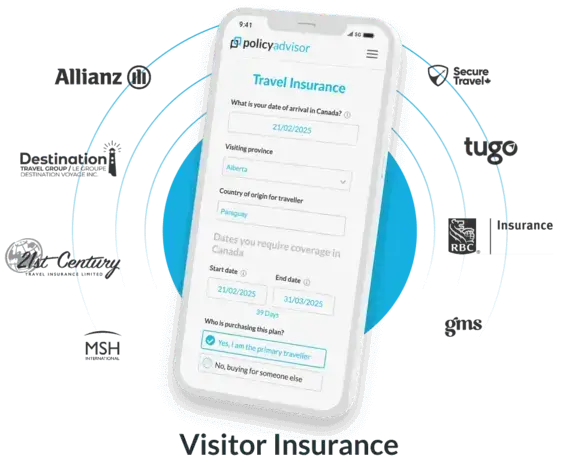

What are the best tourist health insurance providers in Canada?

When visiting Canada, having reliable health insurance is essential. Companies such as Manulife, Secure Travel, 21st Century, and GMS have different offerings that can be beneficial to a wide range of visitors. Here is a detailed breakdown:

- Allianz Global Assistance: Ideal for international students needing comprehensive coverage

- MSH International: Great for travelers planning longer side trips outside of Canada

- Secure Travel: Known for its affordability and budget-friendly plans

- 21st Century: Offers companion discounts for additional savings

- Travelance: Provides monthly payment plans, making it easier for long-term visitors

- Destination Canada: Flexible monthly plans for added convenience

- GMS: Offers great pricing with various deductible options

- Manulife: Offers comprehensive coverage for medical emergencies

- Tugo: Provides coverage for unstable pre-existing conditions

- Blue Cross: Includes a “trip break” option, allowing travelers to return to their home country temporarily without losing coverage

What are the steps to purchase tourist health insurance in Canada?

To purchase tourist health insurance in Canada, it’s best to buy coverage before arriving, ideally to start on your date of entry. Most travellers choose online providers for speed and convenience, though in-person options exist through licensed brokers. You’ll also need basic documents like your passport, travel dates, and health details.

- When to buy insurance: Buy your tourist health insurance before arriving in Canada. Most providers require coverage to begin on your arrival date, and purchasing early ensures eligibility and peace of mind

- Online vs. in-person purchases: Most visitors buy insurance online for convenience and faster approval. In-person purchases are possible through licensed brokers but may take longer and offer fewer options

- Documentation required: You’ll typically need your passport, travel dates, Canadian address (if available), and basic health information. For plans covering pre-existing conditions, a medical questionnaire may also be required

How to file a claim for tourist health insurance in Canada?

To file a claim for tourist health insurance in Canada,you can follow the below-mentioned steps:

- Start by reviewing your policy to understand the coverage and required documentation

- Contact your insurance provider as soon as possible after receiving medical treatment, and inform them of your situation

- Gather necessary documents, including the original invoices from the healthcare provider, receipts for any related expenses, and a completed claim form provided by your insurer

- Submit your travel medical insurance claim online, via email, or by mail, following the insurer’s guidelines

How to choose the best tourist health insurance policy in Canada?

When choosing the best visitor insurance for your stay in Canada, you can start by assessing your needs, comparing costs, and consulting an insurance broker.

- Assess your needs: Start by assessing your needs based on your length of stay, health status, and planned activities to determine the appropriate level of coverage

- Compare options: Next, compare cost and coverage options by reviewing what different policies offer, such as emergency medical services and hospitalisation, and weigh deductibles and co-payments to ensure they align with your budget.

- Work with an experienced advisor: Handling all your insurance needs on your own can be challenging and may lead to mistakes or application rejections. That’s where the insurance advisors at PolicyAdvisor can help!

Frequently Asked Questions

Can I get health insurance in Canada as a visitor?

Yes, you can get health insurance through visitor medical insurance Canada plans. These plans provide coverage for emergency medical expenses, hospital stays, and other unexpected healthcare needs. It’s essential to purchase a plan that fits your specific needs and review the coverage details, including exclusions and limits, to ensure adequate protection during your stay in Canada.

Can I enter Canada without health insurance?

Yes, you can enter Canada without health insurance since it is not mandatory. However, it is highly recommended to have visitors medical insurance before your visit. Without health insurance, you would be responsible for paying out-of-pocket for any medical services, which can quickly add up to thousands of dollars.

Can non-residents get health insurance in Canada?

Yes, non-residents can get tourist health insurance in Canada from insurance providers such as Manulife, Secure Travel, 21st Century, etc. These providers offer tailored plans that include coverage for medical emergencies, hospital stays, doctor visits, and additional healthcare services. Visitor medical insurance plans ensure that non-residents are financially protected in case of illness or injury while in Canada.

How much medical cover do I need for visiting Canada?

It’s recommended to have travel health insurance Canada with a minimum coverage of $100,000 to cover emergency medical expenses, such as hospital stays and emergency room visits.

Can a tourist get medical treatment in Canada?

Yes, tourists can receive medical treatment in Canada, but it is not free. Foreigners must pay for all medical services, including doctor consultations, emergency room visits, and hospital stays. These expenses can add up to thousands of dollars, which can be a significant financial burden, especially in a foreign country.

Can I get visitor insurance for pre-existing conditions in Canada?

Yes, insurance providers like Tugo and Manulife offer coverage for stable pre-existing conditions, such as controlled diabetes, if stable for 90–180 days. You will be required to complete a medical questionnaire to confirm your eligibility.

Tourists visiting Canada are not covered by provincial healthcare. Visitors including short-term tourists or long-term visitors such as parents and grandparents on super visas should get visitor’s insurance for any medical emergencies while they are in Canada. Health insurance for visitors to Canada provides financial protection and peace of mind, ensuring tourists can access necessary medical care without exorbitant expenses.

Travel Health Insurance Association of Canada. Travel Health Insurance Association. Accessed June 5, 2025.