- Top providers for whole life insurance in Canada for 2026 include Equitable Life, Manulife, Empire Life, Sun Life, and Foresters

- Empire Life is the best choice for balanced performance, offering steady long-term growth and dependable lifetime guarantees through its EstateMax and Optimax plans

- Equitable Life is ideal for Canadians who want the benefits of a true mutual company, where policyholders share in ownership and value instead of external shareholders

- Manulife is the best option for Canadians seeking strong overall performance from their whole life insurance

- Foresters Financial is the best choice for smokers, offering competitive rates and its unique Quit Smoking Incentive

- Sun Life is the best option for high-net-worth individuals, providing large coverage amounts and flexible whole life policy features

Choosing from the best whole life insurance companies in Canada feels overwhelming; there are dozens of insurers, each claiming strong performance and long-term value.

Dozens of insurers offer participating policies, each promising strong dividends, long-term cash value growth, and flexible coverage options.

To identify the best whole life insurance companies in Canada for 2026, our team reviewed financial strength, dividend performance, cash value growth, product flexibility, and customer experience.

Based on our review, the following five companies stand out for their combination of strong performance and flexible plans, with the remaining providers covered later in our full comparison.

Top 5 whole life insurance companies in Canada (2026)

- Equitable Life: Best mutual insurer

- Manulife: Best for overall performance

- Empire Life: Best for balanced performance

- Sun Life: Best for high-net-worth individuals

- Foresters: Best coverage for smokers

What is whole life insurance?

A whole life insurance policy is a type of permanent life insurance that provides lifelong coverage. It offers a guaranteed, tax-free death benefit and includes a built-in investment component that grows cash value over time. With a participating whole life policy, you receive dividends, although the amount is not guaranteed.

Most people choose whole life insurance in Canada to support estate planning, cover capital gains taxes at death, and leave a tax-free inheritance, while also handling final expenses and probate fees.

How does whole life insurance work?

Whole life insurance provides coverage for life, cash value component, optional dividends on par plans, and access to funds via loans/withdrawals. Dividends are not guaranteed and past performance doesn’t predict future results. Here’s how whole life insurance works.

- Lifetime coverage: You’re covered for life as long as premiums , and your beneficiaries receive a guaranteed tax-free death benefit

- Cash value growth: Part of each premium goes into a cash value account that grows tax-deferred and becomes a long-term asset you can use for education costs, emergencies, or retirement income

- Access to funds: You can access the accumulated cash value through policy loans or withdrawals for added financial flexibility, such as covering emergencies, education, or retirement income

- Dividends : Some participating policies pay dividends you can use to reduce premiums, buy more coverage, or take as cash

- Financial security: The policy provides stable long-term protection, covering final expenses and supporting your family with guaranteed benefits

The best whole life insurance companies in Canada

Our team reviewed leading Canadian insurers based on financial strength, dividend history, cash value growth, and underwriting to determine the best whole life insurance companies across different needs and profiles.

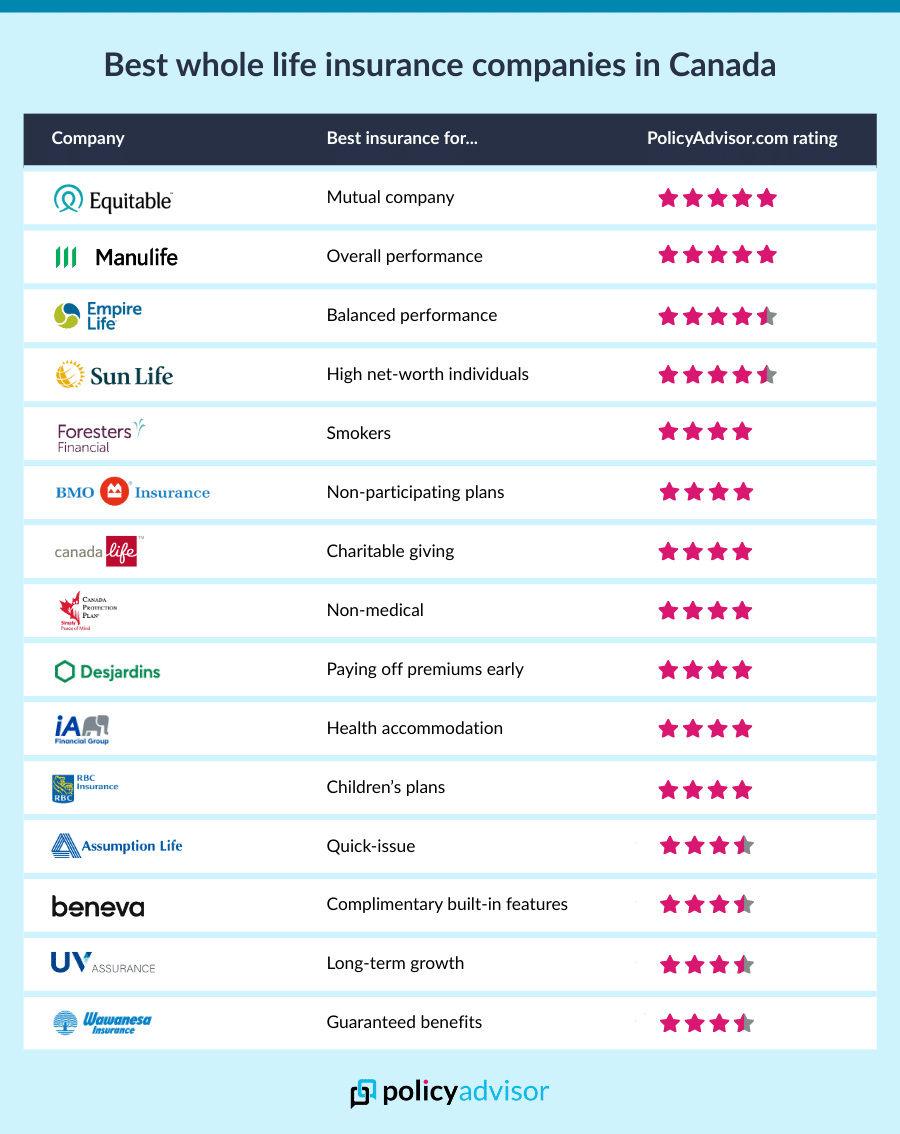

15 best whole life insurance companies in Canada

- Equitable Life: Mutual company

- Manulife: Overall performance

- Empire Life: Balanced performance

- Sun Life: High-net-worth individuals

- Foresters: Smokers

- BMO Insurance: Non-participating plans

- Canada Life: Charitable giving

- Canada Protection Plan: Non-medical

- Desjardins: Early and flexible pay-off

- iA (Industrial Alliance): Health accommodation

- RBC Insurance: Children’s plans

- Assumption Life: Quick-issue

- Beneva: Complimentary built-in features

- UV Insurance: Long-term growth

- Wawanesa: Guaranteed benefits

Let’s take a closer look at what makes these whole life insurance companies among the best in Canada.

1. Equitable Life: Best for mutual company

Equimax Wealth Accumulator

20-pay

pay-to-100

PolicyAdvisor Rating

We give Equitable Life 5/5 because it stands out as one of Canada’s strongest whole life providers, particularly for Canadians who value the long-term security of a true mutual company.

The company supports its participating plans, Equimax Estate Builder and Equimax Wealth Accumulator, with a growing $2.73 billion par fund, demonstrating its financial strength and commitment to stable, long-term results. Both plans offer 10-pay, 20-pay, and pay to 100 options.

Equimax Wealth Accumulator is built for earlier cash value access, making it ideal for clients who want flexible liquidity for education, business needs, or retirement planning. Conversely, Equimax Estate Builder emphasizes long-term value and supports estate planning by helping cover taxes and fees at death.

New Equimax participating whole life policies include Equitable’s built-in KIND program. It provides compassionate and snap advances, access to policy cash value in cases of severe disability, and bereavement counselling benefits.

Equitable Life’s key financial strengths:

- $2.73 billion participating fund

- 6.40% dividend scale interest rate

- Dividend rate above 6% for more than 12 years

- 30-year average return of 7.59%

- Exceptionally low 1.25% standard deviation over 30 years, one of the most stable in Canada

- Par fund asset mix: 49% fixed income, 38% non-fixed income, 2% cash, 11% policy loans

- Long-term smoothing approach that reduces market volatility and supports consistent dividend results

Why choose Equitable Life

- Delivers extremely stable long-term returns and minimizes volatility

- Strengthens long-term growth through a highly diversified par-fund portfolio

- Directs profits back to policyholders through its mutual ownership structure

- Achieves strong investment performance through disciplined, conservative par-fund management

Unique selling point (USP): Equimax Estate Builder and Equimax Wealth Accumulator suit Canadians who want stable long-term value, reliable dividends, and accessible cash value backed by a trusted mutual insurer.

Equimax Estate Builder: Slower early growth; strong long-term value

Equimax Wealth Accumulator: Faster early growth; accessible earlier

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

2. Manulife: Best for overall performance

Manulife Par with Vitality Plus

Performax Gold

20-pay

pay-to-100

PolicyAdvisor Rating

We give Manulife 5/5 for being the top choice for Canadians seeking whole life insurance backed by exceptional capital strength, global diversification, and advanced risk management

Manulife Par, Manulife Par with Vitality Plus, and Performax Gold plans provide lifetime coverage with 10-pay, 20-pay, and pay to 100 options. A $15.98 billion participating account backs the plans, supporting long-term guarantees, stable dividends, and reliable performance for policyholders.

Manulife Par focuses on stable long-term growth with guaranteed premiums, immediate cash value buildup, and annual dividend payouts. Manulife Par with Vitality Plus offers strong early guaranteed cash values while also providing access to the Manulife Vitality program, which rewards healthy living with perks and member benefits. Program features vary by eligibility and do not reduce premiums for participating whole life. Performax Gold provides additional flexibility for clients seeking a blend of guaranteed protection and dividend-driven long-term value.

Manulife’s key financial strengths and performance:

- $15.98 billion participating account

- 6.35% dividend scale interest rate

- 138% LICAT ratio, among the highest capital strength levels in Canada

- Diversified global operations across Canada, the U.S., Asia, and global asset management

- Strong balance sheet supported by investment-grade assets

- Disciplined risk-management framework that supports long-term financial stability

Why choose Manulife

- Maintains exceptionally strong capitalization that supports long-term dividend stability

- Reduces performance volatility through global geographic and asset diversification

- Generates consistent profitability through strong core earnings and disciplined risk management

- Enhances sustainability through advanced underwriting analytics and the Vitality program

Unique selling point (USP): Manulife Par, Manulife Par with Vitality Plus, and Performax Gold are ideal for Canadians who want affordable lifetime coverage with flexible payment terms, and steady cash value.

Manulife Par: Cash value starts after 1 year

Manulife Par with Vitality Plus: Cash value starts after 1 year; includes Vitality benefits

Performax Gold: Cash value starts after 5 years (slower early buildup)

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

3. Empire Life: Best for balanced performance

Optimax Wealth

10-pay

20-pay

pay-to-100

PolicyAdvisor Rating

We give Empire Life 4.5/5 because its whole life plans offer balanced, steady performance, making it a top choice for Canadians seeking reliable long-term value. The company backs its participating plans, EstateMax and Optimax Wealth, with a disciplined $1.21 billion par fund renowned for stability and long-term results.

EstateMax is built for conservative estate growth, offering steady dividend performance and strong long-term accumulation. In comparison, Optimax Wealth provides smoother, more predictable cash value growth over time, giving policyholders reliable access to liquidity while maintaining long-term security. EstateMax is available with 20-pay and pay to 100 premium options. Optimax Wealth offers flexible payment structures, including 10-pay, 20-pay, and pay to 100. Empire Life also offers Solution Series, a non-participating plan with a 10-pay option.

Empire Life’s key financial strengths:

- $1.21 billion participating fund with a stability-focused investment approach

- 6.25% dividend rate

- Dividend history above 6% for more than 10 years

- 30-year average return of 6.97%

- Par fund asset mix: 64% bonds, 29% equities, 7% cash/other

- Long-duration bond structure with smoothing to reduce volatility

Why choose Empire Life:

- Delivers stable long-term value growth and reduces volatility

- Maintains reliable dividend performance that supports confident planning

- Builds strong cash value and provides access to liquidity over time

- Supports conservative estate planning and predictable long-term growth needs

Unique selling point (USP): EstateMax and Optimax Wealth are ideal for Canadians seeking stable cash accumulation and steady dividend performance.

EstateMax: Steady long-term growth

Optimax Wealth: High early cash values

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

4. Sun Life: Best for high-net-worth individuals

Sun Par Accumulator II

Sun Par Accelerator

SunSpectrum Permanent Life II

10-pay

15-pay

20-pay

pay-to-100

PolicyAdvisor Rating

We give Sun Life 4.5/5 for being a leading choice for high-net-worth Canadians who want whole life insurance backed by exceptional global diversification and long-term financial strength. Sun Life backs its Par Protector II, Par Accumulator II, and Par Accelerator with a $21.2 billion par fund. This fund supports more than 400,000 active participating policies, making it one of the strongest par structures in Canada.

The Protector II and Accumulator II provide flexible payment options, including 10-pay, 15-pay, 20-pay, and pay-to-age-100, while the Sun Par Accelerator comes with a 8-pay premium option that is fully paid in just eight years. Accumulator II emphasizes early cash-value growth, allowing easier access to funds for investments, business needs, or other financial goals through policy loans or withdrawals. Meanwhile, Protector II focuses on maximizing long-term death benefits for estate and legacy planning. Accelerator builds cash value quickly, giving policyholders faster access to funds.

For those preferring non-participating plans, SunSpectrum Permanent Life II also offers 10-pay, 20-pay, and pay to 100 payment structures.

Sun Life’s key financial strength

- $21.2 billion participating account

- 6.25% dividend scale interest rate

- 154% LICAT ratio, one of the strongest among major Canadian insurers

- Global earnings diversification across Canada, the U.S., Asia, and asset-management operations

- Consistent profitability supported by strong insurance and wealth-management businesses

Why choose Sun Life

- Strengthens long-term performance through global diversification and multi-market earnings stability

- Supports long-term guarantees with exceptional capital strength and a 154% LICAT ratio

- Offers flexibility through multiple par product designs, including estate, accumulation, and 8-pay options

- Provides scalable planning advantages for affluent and corporate clients seeking tax-efficient wealth transfer and surplus management

Unique selling point (USP): Sun Par Protector II, Sun Par Accumulator II, and Sun Par Accelerator suit Canadians who want lifetime protection paired with strong cash-value potential and effective estate planning.

Sun Par Protector II: Cash value starts after 5 years

Sun Par Accumulator II: Cash value starts after 1 year

Sun Par Accumulator II: Cash value starts after 1 year

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

5. Foresters Financial: Best for smokers

Non-Par Whole Life

20-pay

pay-to-100

PolicyAdvisor Rating

We give Foresters Financial 4/5 for being a top choice for smokers and former smokers, who need more flexible underwriting. The insurer leverages a strong Canadian capital position, including a Life Insurance Capital Adequacy Test (LICAT) ratio of 182% and $2.1 billion in surplus. This robust financial strength enables Foresters to accept higher-risk applicants while actively maintaining dependable long-term guarantees and stable dividends.

Advantage Plus II offers early cash value accessibility, dependable long-term guarantees, and dividend-driven growth, making it an attractive option for Canadians who may face stricter underwriting at larger insurers. Foresters Non-Par Whole Life offers guaranteed cash value.

Foresters’ key financial strengths:

- $2.1 billion in surplus / net assets supporting long-term claims and guarantees

- 182% LICAT ratio, demonstrating excellent capital adequacy

- Member-owned structure where profits support policyholders rather than shareholders

Why choose Foresters:

- Offers flexible underwriting for smokers and former smokers

- Maintains strong financial resilience with a 182% LICAT ratio and $2.1 billion surplus

- Operates a member-first fraternal model that directs value back to policyholders

- Provides additional member benefits including wellness rewards, scholarships, community grants, and family support programs

Unique selling point (USP): Advantage Plus II is an attractive option for Canadians who may face stricter underwriting at larger insurers.

Advantage Plus II: Cash value starts after 1 year

Foresters Non-Par Whole Life: Guaranteed cash values; slower growth

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

6. BMO: Best for non-participating whole life insurance

Wealth Accelerator

20-pay

pay-to-100

PolicyAdvisor Rating

We give BMO 4/5 because its non-participating whole life plans make it a reliable choice for Canadians seeking guaranteed values, predictable premiums, and no dividend-related volatility. The company offers two plan options, Estate Protector and Wealth Accelerator, both of which exclude a participating account or dividends. These plans set themselves apart with a Performance Bonus (5.75%), increasing both the death benefit and cash value without relying on traditional dividends. BMO supports its policies with a robust insurance net income of $95 million.

Estate Protector is designed for long-term estate planning, offering strong guaranteed cash value growth and a steadily increasing death benefit to help preserve wealth and offset taxes at death (e.g., deemed disposition and probate fees). Wealth Accelerator provides faster guaranteed cash value accumulation and higher early liquidity, making it an attractive option for business owners and high-income earners who want accessible long-term value. Both plans are available with 10-pay, 20-pay, and pay to 100 premium options.

BMO’s key financial strengths

- $95 million net insurance income

- 5.75% Performance Bonus Rate used to enhance non-participating whole life policy values (not a DSIR and not guaranteed)

- Operates within BMO Wealth Management, supported by diversified earnings and enterprise-wide risk management

Why choose BMO

- Supports long-term financial stability by consistently growing insurance profitability

- Strengthens guaranteed policy values through a competitive 5.75% performance bonus rate

- Enhances stability through diversified revenue sources and favorable business performance

- Benefits from operational scale and strong risk oversight within BMO’s wealth-management platform

Unique selling point (USP): Estate Protector and Wealth Accelerator are ideal for Canadians who want lifetime coverage with guaranteed values, predictable performance, and payment flexibility.

Estate Protector: Strong guaranteed cash values; long-term estate growth

Wealth Accelerator: Faster liquidity; quicker cash value access

Not available. BMO offers a performance bonus that is used to buy additional paid-up insurance coverage (Paid-up additions)

7. Canada Life: Best for charitable giving

Wealth Select

My Par Gift

20-pay

pay-to-100

PolicyAdvisor Rating

We give Canada Life 4/5 because it is a leading choice for Canadians who want to use whole life insurance to support charitable giving. Its My Par Gift plan is specifically designed for charitable contributions, with a single premium and cash value starting from year 1.

Canada Life’s participating lineup, Estate Select, Wealth Select, and My Par Gift, is backed by one of the largest and most stable participating accounts in the country. It’s anchored by a $61.9 billion par fund, the largest in Canada. The company also has about 1.4 million participating life insurance policies in force.

Estate Select focuses on long-term growth, helping maximize the death benefit for estate planning. Wealth Select, on the hand, is designed for earlier cash value access, allowing for withdrawals or policy loans when needed. Both plans come with flexible payment options, including 10-pay, 20-pay, and pay to 100.

Canada Life’s key financial strengths

- $61.9 billion participating account, the largest par fund in Canada

- 5.75% Dividend Scale Interest Rate, supporting long-term dividend stability

- Disciplined investment governance, guided by formal policies that address liability matching, liquidity needs, tax considerations, and interest-rate risk

- Strong asset-liability management (ALM) using cash-flow matching to ensure long-term obligations to policyholders are met

- Diversified asset mix with 60.0% fixed income and 30.7% non-fixed income (real estate, public equity, private equity)

Why choose Canada Life

- Delivers exceptional long-term stability through Canada’s largest par fund ($59.2B) and deep diversification

- Supports resilient investment performance using a balanced asset mix designed to generate stable returns across market cycles

- Reduces volatility through disciplined ALM and cash-flow matching practices that protect DSIR sustainability

- Preserves long-term policyholder value with strict investment parameters and governance oversight

Unique selling point (USP): My Par Gift suits Canadians who want charitable giving with single-premium simplicity.

Estate Select: Cash value starts in year 1, with a focus on long-term growth and maximizing the death benefit for estate planning

Wealth Select: Cash value starts in year 1, with earlier cash value access through withdrawals or policy loans

My Par Gift: Cash value builds over time, with access for the charity through withdrawals or policy loans

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

8. Canada Protection Plan: Best for non-medical whole life insurance

Simplified Elite

Guaranteed Acceptance Life

Deferred Life

20-pay

pay-to-100

PolicyAdvisor Rating

We give Canada Protection Plan (CPP) 4/5 for being a leading choice for Canadians who want whole life insurance without medical exams, offering fast approvals and guaranteed lifetime coverage. Its non-participating whole life lineup, Express Elite, Simplified Elite, Guaranteed Acceptance Life, and Deferred Life, provides predictable premiums, stable cash values, and simplified underwriting for applicants with various health profiles. As part of Foresters Financial, Canada Protection Plan is backed by a Life Insurance Capital Adequacy Test (LICAT) ratio of 182% and consolidated surplus of $2.1 billion, giving policyholders confidence in the company’s long-term financial strength and the security of their coverage.

Canada Protection Plan’s key financial strengths:

- Backed by Foresters Financial, benefiting from a 182% LICAT ratio and $2.1 billion in consolidated surplus that supports long-term guarantees

- $630 million in claims paid, demonstrating strong and reliable claims fulfillment

- Member-focused structure, reinvesting surplus into member programs, scholarships, and community support

Why choose Canada Protection Plan

- Delivers leading access to coverage as Canada’s largest provider of no-medical life insurance

- Approves a wide range of health profiles, serving smokers, chronic-condition applicants, and higher-risk clients

- Provides predictable long-term costs through fully guaranteed non-participating plans with no dividend risk

- Supports applicants who were previously declined, offering strong impaired-risk options

- Expands accessibility with higher maximum issue ages and a Quit Smoking incentive

- Simplifies the process with fast approvals, e-signatures, and a digital application system

Unique selling point (USP): An ideal choice for Canadians who want whole life insurance without medical exams, offering fast approvals and guaranteed lifetime coverage.

Guaranteed Acceptance Life: Cash values begin after policy year 5

Deferred Life: Cash values begin after policy year 5

Deferred Elite Life: Cash values begin after policy year 5

Simplified Elite Life: Cash values begin after policy year 5

Preferred Life: Cash values begin after policy year 5

Preferred Elite Life: Cash values begin after policy year 5

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

9. Desjardins: Best for early and flexible pay-off

Estate Enhancer

Accelerated Growth

10-pay

20-pay

pay-to-100

PolicyAdvisor Rating

We give Desjardins 4/5 because it is a top choice for Canadians who want to pay off their whole life premiums early, combining a rare 5-pay participating option with the more standard 10-pay, 20-pay, pay to 100 structures across its par lines.

The company backs its participating lineup with one of the strongest capital positions in Canada, maintaining a Tier 1A capital ratio of 23.1%.

The flagship 5-Pay PAR plan completes premiums in just five years while still building strong early cash values. Desjardins serves around 5 million insurance policyholders across its life and health portfolio.

Its participating lineup includes three plans: 5-Pay PAR, Estate Enhancer, and Accelerated Growth. Estate Enhancer focuses on long-term estate value and strong future growth, while Accelerated Growth prioritizes earlier cash value access with long-term accumulation potential.

Desjardins’ key financial strengths and performance

- 6.30% Dividend Scale Interest Rate (DSIR)

- $1.115 billion in surplus earnings, demonstrating strong overall performance

- $174 million surplus earnings from Wealth Management and Life & Health Insurance, confirming insurance profitability

- 23.1% Tier 1A capital ratio, significantly above regulatory requirements and one of the strongest in the industry

- Co-operative ownership model, where profits are reinvested into member value rather than shareholder returns

Why choose Desjardins

- Offers one of the only 5-pay participating whole life plans in Canada, delivering fast paid-up coverage and strong early cash values

- Reinvests profits to support members, improving long-term stability through a cooperative structure instead of shareholder pressure

- Strengthens par performance durability with exceptionally strong capital ratios that safeguard dividend stability

- Grows underlying insurance performance, supported by rising surplus earnings and expanding wealth operations

- Provides flexible par product options, including fast-pay and long-term accumulation designs

Unique selling point (USP): Desjardins’ 5-Pay PAR plan delivers full coverage in five years while building early cash value, making it ideal for Canadians seeking fast, predictable, and long-term life insurance.

5-Pay PAR: Steady long-term growth

Estate Enhancer: Steady long-term growth

Accelerated Growth: Fastest access to cash value during the first 10 to 15 years of the policy

5-Pay PAR: Enhanced insurance

Estate Enhancer and Accelerated Growth: Paid-up additions (PUA), premium reduction, cash dividends, deposit at interest, enhanced coverage

10. Industrial Alliance (iA): Best for health accommodation

iA PAR Estate

iA PAR Wealth

Life and Serenity 65

20-pay

pay-to-100

PolicyAdvisor Rating

We give Industrial Alliance (iA) 4/5 for being a leading choice for Canadians who need whole life insurance with more flexible underwriting, making it especially appealing for clients with health conditions or non-standard risk profiles.

iA offers Canadians whole life solutions for different needs: Child Life and Health Duo provides participating coverage with early protection and gradual long-term growth, while Life and Serenity 65 delivers non-participating coverage with disability and illness benefits, with cash values beginning in later policy years.

Additionally, iA PAR Estate and iA PAR Wealth are backed by a $69.36 million par account and offer flexible premium options, including 10-pay, 20-pay, and pay to 100. iA PAR Estate focuses on long-term growth of total surrender value and death benefit, while iA PAR Wealth prioritizes short-term growth by maximizing total cash surrender value in the early years, alongside long-term estate growth.

iA’s key financial strengths

- $69.36 million par fund

- 6.35% dividend rate

- 13.0% return on equity (16.1% core ROE), demonstrating strong profitability and efficient capital deployment

- 132% solvency ratio, indicating strong capitalization and long-term financial stability

- Diversified business model, generating momentum across Individual Insurance, Group Benefits, Wealth, and U.S. operations

Why choose iA

- Delivers strong and growing earnings, contributions broadly across Individual Insurance, Wealth, Group, and U.S. operations

- Supports reduced volatility with a highly diversified business model and multiple profit streams beyond life insurance

- Demonstrates robust financial strength, boasting a 132% solvency ratio and strong organic capital generation that sustains long-term par stability

- Leads market position, ranks number one in segregated fund sales and strong momentum in Individual Insurance

- Consistently generates profitability, reflected in a 16.1% core ROE, demonstrating durable earning power for sustaining long-term guarantees

- Strategically expands through acquisitions, which strengthens distribution and recurring revenue sources

Unique selling point (USP): iA PAR Estate and Wealth suit Canadians with health conditions who want flexible underwriting.

Child Life and Health Duo: Gradual long-term growth with early lifetime protection

iA PAR Estate: Long-term cash value accumulation

iA PAR Wealth: Early access to cash value

Life and Serenity 65: Cash values begin in later policy years

Paid-up additions (PUA), premium reduction, cash dividends, deposit with interest available for Child Life and Health Duo, iA PAR Estate, and iA PAR Wealth

11. RBC Insurance: Best for children’s plans

RBC Growth Insurance Plus

20-pay

pay-to-100

PolicyAdvisor Rating

We give RBC Insurance 4/5 as the top choice in Canada, for families who want whole life insurance designed specifically to protect a child’s long-term future. RBC backs its participating plans, Growth Insurance and Growth Insurance Plus, with a $9.60 million par account. Both plans feature the Juvenile Guaranteed Insurability Benefit, which lets a child buy additional coverage later without a medical exam.

Growth Insurance focuses on tax-deferred accumulation and a steadily increasing death benefit, making it ideal for long-term family legacy planning. Growth Insurance Plus accelerates cash value access, giving families greater flexibility for education, investment opportunities, or liquidity needs through policy loans or collateral.

RBC’s key financial strengths

- $9.60 million participating fund

- 6.30% dividend rate

- Stable long-term DSIR history, supported by smoothing techniques that reduce short-term volatility

- 50/50 target asset mix between fixed income (bonds, mortgages) and non-fixed income (equities, commercial real estate)

- Prudent investment strategy focused on disciplined risk management and long-term performance stability

Why choose RBC

- Reduces volatility through smoothing techniques that help stabilize returns and support consistent dividends

- Strengthens long-term stability by serving more than 5 million clients across diversified segments

- Supports predictable returns with a balanced 50/50 asset allocation that aligns long-term growth with risk control

- Maximizes policyholder value through disciplined risk oversight and a long-term investment approach

Unique selling point (USP): RBC Growth Insurance and Growth Insurance Plus are ideal for Canadians who want guaranteed cash values, long-term growth, and early access to policy funds when needed.

RBC Growth Insurance: Cash values accessible after policy year 5

RBC Growth Insurance Plus: Faster early cash value accumulation vs. base plan

Paid-up additions (PUA), cash dividends, premium reduction, deposit at interest, enhanced coverage

12. Assumption Life: Best for quick-issue policies

Golden Protection Elite

FlexOptions

20-pay

pay-to-100

PolicyAdvisor Rating

We give Assumption Life 3.5/5 for offering some of Canada’s strongest fast-approval whole life options, making it an excellent fit for clients who want lifetime coverage without medical exams or long underwriting queues. Backed by a 165% solvency ratio and more than 135 years as a Canadian mutual insurer, Assumption Life provides a highly stable foundation for its quick-issue non-participating whole life lineup, including Golden Protection, Golden Protection Elite, and FlexOptions.

These plans pair simplified, primarily digital applications with streamlined underwriting and rapid decisions, and are available with flexible payment options such as pay to 100 and select limited-pay structures, giving clients guaranteed premiums, level lifetime coverage, and predictable long-term costs.

Assumption Life’s key financial strengths:

- 5.75% dividend rate

- $12.6 million in net earnings, reflecting strong profitability growth

- $2.3 billion in total assets

- $197 million in policyholder surplus, reinforcing long-term financial strength

- 165% solvency ratio, demonstrating excellent capital adequacy

- Mutual ownership structure, where profits support policyholders instead of external shareholders

Why choose Assumption Life:

- Puts policyholders first, with a mutual-company model that prioritizes long-term value over shareholder returns

- Strengthens long-term guarantees with high surplus levels and a strong solvency position

- Improves accessibility and speed through a fully digital underwriting and application experience

- Balances growth and risk, ensuring steady financial performance and disciplined management

- Delivers reliable profitability, supporting long-term dividend performance and stability

- Ideal for clients seeking simplicity, fast approvals, and dependable guaranteed coverage

Unique selling point (USP): Assumption Life excels in fast approvals and simplified underwriting for guaranteed, no-exam whole life coverage.

Golden Protection/Elite: Guaranteed cash values with steady growth

FlexOptions: Flexible accumulation tailored to client needs

Paid-up additions (PUA), enhanced coverage, cash, premium reduction, and deposit

13. Beneva: Best for complementary additional features

Beneva Non-Participating Whole Life

Simplified and Guaranteed Issue Whole Life

20-pay

pay-to-100

PolicyAdvisor Rating

We give Beneva 3.5/5 for being an excellent choice for Canadians who want whole life insurance backed by a strong mutual-company foundation and enhanced by valuable built-in features at no added cost. Supported by a $27.5 billion asset base and a 150% solvency ratio, Beneva’s participating whole life plan offers lifetime protection with complimentary benefits designed to enhance coverage, service, and long-term value.

Beneva’s key financial strengths:

- $27.5 billion in total assets

- $589 million in consolidated net income, demonstrating strong profitability growth

- 15.2% return on equity

- $4.2 billion in consolidated equity

- 150% solvency ratio, reflecting excellent capital strength

Why choose Beneva

- Reinvests profits into member benefits through a mutual, member-first ownership model

- Strengthens long-term financial stability with large asset scale and rising business volume

- Builds trust and claim-paying credibility, backed by strong ratings and governance oversight

- Enhances value through bundled benefits and competitive pricing without extra rider costs

- Supports long-term performance stability with disciplined financial management and strong capital reserves

Unique selling point (USP): As Canada’s largest mutual insurer, Beneva reinvests its profits into member benefits and product improvements, allowing policyholders to enjoy added value without paying extra premiums.

Beneva Participating Whole Life: Cash value begins after policy year 1

Beneva Non-Participating Whole Life: Guaranteed cash value

Simplified and Guaranteed Issue Whole Life: Cash values available in later years

Beneva Participating Whole Life: Paid-up additions (PUA), premium reduction, cash dividends, deposit at interest

14. UV Insurance: Best for long-term growth

Adaptable Whole Life

Non‑participating whole life (simplified issue)

20-pay

pay-to-100

PolicyAdvisor Rating

We give UV Insurance 3.5/5 for being an excellent choice for Canadians who want long-term, reliable whole life growth backed by a mutual-style insurer with over 130 years of operations. Supported by a strong 172% solvency ratio, UV delivers the kind of financial stability that long-term whole life policyholders depend on. Its participating whole life plans focus on steady, predictable cash value accumulation with conservative investment management and policyholder-first governance.

UV Insurance’s key financial strengths

- 130+ years as a mutual-style insurer, operating under a policyholder-owned structure

- $6.6 million in net income

- 172% solvency ratio, indicating a strong capital buffer

- $256.4 million in mutual members’ equity, reinforcing a solid policyholder-backed capital base

- Conservative investment and disciplined long-term risk management

- Fully digital platform using the web-based My Universe system to streamline underwriting and client experience

Why choose UV Insurance

- Supports policyholder value directly, reinvesting profits and surplus into members rather than external shareholders

- Protects long-term guarantees with a very high solvency ratio and disciplined capital management

- Improves application speed and convenience with a fully digital underwriting experience

- Strengthens community impact, allocating more than 10% of profits to health, education, and social initiatives

- Delivers operational stability, backed by over a century of mutual-model stewardship and financial discipline

Unique selling point (USP): UV prioritizes long-term growth with high cash value potential (up to 50% of coverage by age 65 in select plans) and digital simplicity.

Whole Life High Values: High long-term growth; cash values can reach up to 50% of the coverage amount by age 65

Adaptable Whole Life: Cash value begins in later policy years; paid-up value available from the 10th anniversary

Non‑participating whole life (simplified issue): Cash value begins from the 5th contract anniversary

N/A (primarily non-participating focus)

15. Wawanesa: Best for value and guaranteed benefits

pay-to-100

PolicyAdvisor Rating

We give Wawanesa 3.5 for being a leading choice for Canadians who want whole life insurance with dependable guarantees, conservative investment management, and long-term affordability. The Wawanesa Life Par offers both 20-pay and pay to 100 premium options. Wawanesa backs this participating plan with a strong financial foundation, including $311 million in life division equity. The plan delivers predictable, steady cash value growth and consistent dividend performance, supported by a disciplined bond-focused investment strategy.

Wawanesa’s key financial strengths

- 6.00% dividend scale interest rate

- $1.9 billion life insurance asset base

- $4.7 billion group equity / surplus supporting strong capitalization across the mutual group

- $311 million life division equity supporting long-term participating guarantees

- Conservative investment strategy anchored by a high-quality, low-volatility bond portfolio

Why choose Wawanesa:

- Supports dependable dividend performance through conservative asset management and a bond-focused mix

- Stabilizes long-term returns with a high-quality, low-volatility bond portfolio

- Reinforces policyholder security using strong surplus reserves from a leading Canadian mutual insurer

- Directs profits to policyholders rather than shareholders under its mutual ownership model

- Provides competitive, affordable pricing with reliable guarantees and steady cash-value growth

Unique selling point (USP): Wawanesa Life Par delivers predictable, steady cash value growth and consistent dividend performance, supported by a disciplined bond-focused investment strategy.

Guaranteed cash values; dividend-eligible

Paid-up additions (PUA), premium reduction, cash payment, or accumulation at interest

Methodology: How we determined the best whole life insurance companies in Canada

We selected the best whole life insurance companies in Canada by evaluating financial strength, policy design, cash value performance, and overall customer value using advisor expertise and industry data.

- Financial strength ratings: We prioritize insurers with strong, stable financial ratings to ensure long-term claim-paying ability and dividend reliability. Our team reviews ratings across multiple agencies to confirm consistency and stability

- Policy details: Each policy must match real client needs. We analyze premium payment periods, cash value schedules, guarantees, and available riders to ensure policies offer meaningful flexibility and protection

- Key features: Features and riders can significantly increase a policy’s value. We compare options such as accelerated benefits, waiver of premium, and guaranteed insurability to highlight policies with strong, practical enhancements

- Premium costs: Value matters. We review quotes across insurers to identify policies that balance affordability with robust benefits, ensuring you get strong coverage without overpaying

- Coverage amounts: Coverage must align with your financial goals. We assess minimum and maximum coverage options and how well they meet needs like income replacement, estate planning, and final expenses.

- Cash value growth potential: Cash value is a major differentiator. We examine long-term growth potential, interest crediting, and historical performance to identify policies that provide strong liquidity and retirement flexibility

- Dividend options: For participating policies, we review dividend history and available dividend options. Insurers with consistent dividend performance and flexible choices rank higher

Cost of whole life insurance in Canada

Whole life insurance premiums vary depending on your age, health, coverage amount, plan type, and payment term. Several factors influence the cost:

- Age: Younger applicants lock in lower premiums

- Health: Better health and non-smoking status reduce costs

- Coverage amount: Higher death benefits increase premiums

- Payment term: Shorter terms (e.g., 10-pay) cost more annually but finish sooner

- Plan type and riders: Participating policies, optional benefits, and extra coverage add to the total premium

The table below compares annual premiums, cash value growth, and death benefits for $100,000 life-pay whole life policies for a healthy 30-year-old female non-smoker across major Canadian insurers.

| Insurer | Annual premium | Cash value: year 20 | Cash value: year 40 | Death benefit: year 40 |

| BMO | $1,230 | $21,482 | $116,483 | $246,237 |

| Canada Life | $800 | $13,419 | $68,267 | $121,507 |

| Empire Life | $689 | $14,574 | $67,845 | $132,540 |

| Equitable Life | $818 | $21,481 | $90,510 | $163,023 |

* Illustrative values for a $100,000 life-pay participating whole life policy for a healthy 30-year-old female non-smoker. Cash values and death benefits are not guaranteed and depend on dividends, insurer performance, and policy design. Actual premiums and results vary by underwriting and product options.

Who should consider whole life insurance

Whole life insurance is suitable for people who:

- Want permanent coverage with predictable premiums

- Are seeking cash value growth for retirement, education, or estate planning

- Prefer long-term financial security for dependents or business planning

- Value mutual or financially strong insurers that return profits to policyholders

How to choose the best whole life insurance in Canada

Choosing the best whole life insurance policy comes down to comparing costs, features, flexibility, and the insurer’s financial strength. Here are the key factors to review before you decide:

- Premiums and charges: Compare premium levels across companies and check for extra fees such as admin charges or rider costs

- Customer support: Look for strong service ratings, easy policy management, and responsive support

- Claims handling: Choose insurers with a reputation for fast, hassle-free claims during critical times

- Policy flexibility: Prioritize plans that offer useful riders and customization options so you can tailor coverage to your needs

- Underwriting requirements: Review medical exams or health questionnaires. No-exam options offer convenience but may come with higher premiums

- Company standing: Check financial strength ratings and long-term performance to ensure the insurer is stable and reliable

What is the difference between participating, non-participating life insurance, and term life insurance?

Participating, non-participating, and term life insurance offer different levels of protection, costs, and cash value features. Participating whole life creates lifetime protection and builds cash value while giving you the chance to earn dividends. Non-participating whole life keeps lifetime coverage simple by offering guaranteed growth with no dividends. Term life focuses on affordable, temporary protection and does not build cash value.

| Feature | Participating whole Life | Non-participating whole life | Term life |

| Coverage Duration | Lifetime | Lifetime | 10-30 years, renewable |

| Premiums | Higher, level | Lower, fixed | Lowest, may increase |

| Cash Value | Builds tax-deferred | Guaranteed growth | None |

| Dividends/Bonuses | Possible (not guaranteed) | None (e.g., BMO bonus) | None |

| Death Benefit | Guaranteed + potential | Guaranteed | Guaranteed if active |

| Best For | Estate planning, growth | Predictable costs | Temporary needs, budget |

How to get the best whole life insurance quotes

Get the best whole life insurance quotes in three easy steps:

- Provide your basic details: Age, health status, coverage amount, and preferred payment term

- Compare top plans: Review premiums, riders, cash value, and insurer strength side-by-side

- Consult a licensed advisor: Lock in your rate and get expert guidance at no cost.

Licensed PolicyAdvisor advisors will help you compare options, answer questions, and ensure your coverage aligns with long-term goals.

Frequently asked questions

Learn about the best whole life insurance companies in Canada. We’ve used our years of experience and careful research to create our list of the 15 best whole life insurance companies in Canada to help you choose a provider that fits your family’s needs. Many top insurers made the list, but we evaluated more than size and popularity. Read our reviews to see what we ranked each company “best for.”