- An immediate financing agreement (IFA) is an estate planning tool that helps individuals access coverage without high upfront costs

- A permanent life insurance policy is used as collateral, and you can borrow up to 100% of the amount you paid in premiums or cash surrender value (CSV)

- An IFA is an advanced financial strategy that can have many benefits, including instant access to cash flow, potential tax savings, flexibility, etc

For business owners and high-net-worth individuals, a life insurance policy can offer additional ways to help accomplish financial objectives, and one of those is an Immediate Financing Arrangement or IFA. It is similar to a policy loan, but offers a lot more flexibility and value, instantly. In this article, we’ll explain what an IFA is, how it works, and how it can help maximize cash flow.

What is an immediate financing arrangement (IFA)?

An Immediate Financing Arrangement or IFA is an advanced financial strategy that allows you to secure permanent life insurance coverage, while retaining access to cash to invest in your income-producing assets or businesses.

In other words, an IFA is an estate planning tool that allows an individual to plan for future tax bills or other lifelong insurance coverage needs without setting aside hefty upfront premium payments for life insurance. An IFA frees up the cash flow that would otherwise be locked in life insurance premium payments, so the liquidity can be used to grow their investment portfolio or businesses instead.

To set up an IFA, an individual can use whole life insurance or universal life insurance as collateral to access a line of credit through a bank or lender immediately.

An IFA gives you a way to effectively:

- Give your beneficiaries the financial protection that comes with insurance coverage

- Continue building cash value growth that can be accessed whenever required

- Instantly recover back the money you paid for premiums

- Have liquid cash you can use for more gainful purposes

An IFA is designed such that the amount you borrow upon setting up of the life insurance policy can be repaid during your life or from the proceeds of your life insurance policy after you pass away.

Normally, you only have to pay interest on the borrowed amount. Most business owners and investors will have access to investment opportunities that can cover the cost of the interest. Further, you may also be able to offset the interest expense against your income and lower your taxes paid.

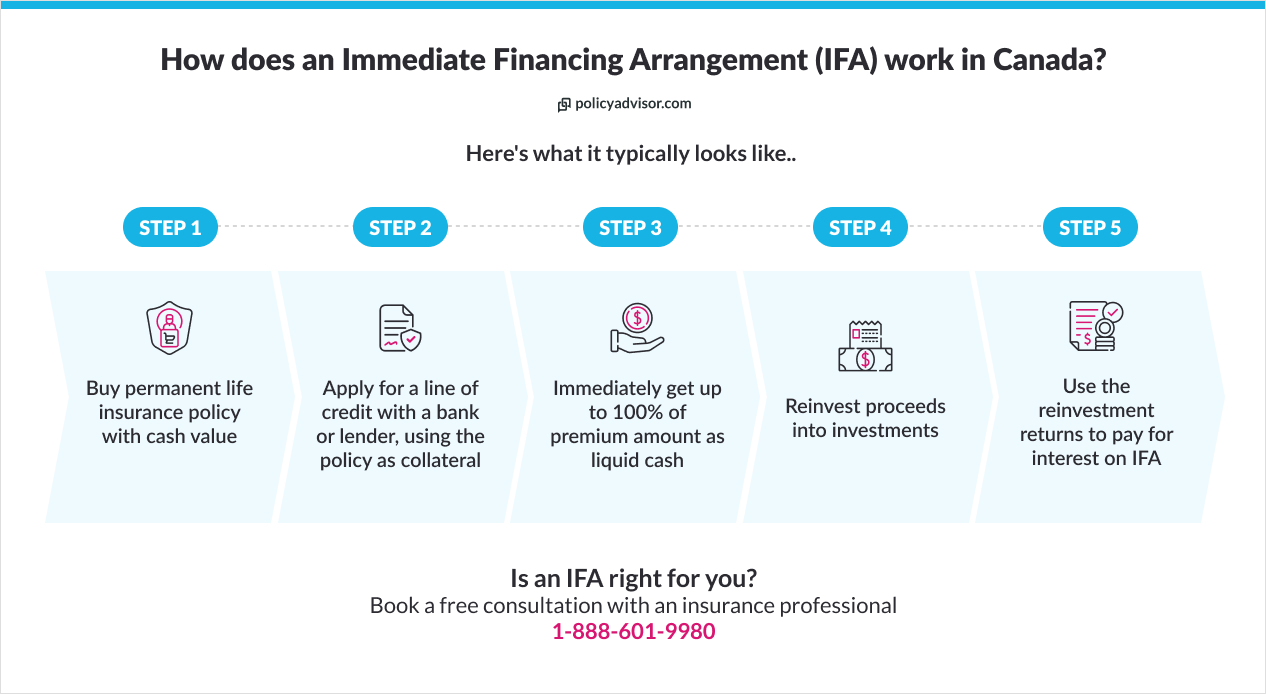

How does an immediate financing arrangement work in Canada?

In Canada, an immediate financing arrangement works almost the same way that opening a line of credit with a bank does, except your life insurance policy is used as collateral. You:

- Buy a whole life insurance policy that creates significant cash surrender value (CSV) in the initial years

- Secure a line of credit with a bank, lender, or specialized financial institution, using your life insurance policy as collateral

- Get immediate financing for up to 100% of the cash value of your policy or even up to 100% of your paid premiums

- Make regular monthly interest payments

- Pay annual recurring insurance premiums

- Steps 3 to 5 are repeated annually

- You can either pay back the loan while you’re alive or have the remaining balance taken out from the death benefit of your insurance policy after you pass away. The remaining proceeds of the whole life insurance policy are paid out to your beneficiaries upon your passing away.

Your policy will continue to build cash value growth for the entire time it is active.

What are the benefits of an IFA strategy?

Understanding the benefits of an IFA is crucial to assessing whether this approach aligns with your business, estate planning, or investment goals. So, listed below are some of the benefits of the IFA strategy:

- Immediate liquidity: One of the key benefits is immediate access to cash. Instead of locking money inside a policy, the IFA gives you liquidity almost immediately

- Flexibility: Whether you want to expand a business, invest in real estate, or simply improve cash flow, IFA adapts to your financial needs

- Peace of mind: Even while you borrow against it, your life insurance remains fully intact. You still get lifelong coverage, stable cash value growth, and a tax-free death benefit

- No savings lost: The cash surrender value continues to grow, potentially increasing the death benefit as well

- Time-saving: Full underwriting may not be required, which can make the process faster than other types of loans

- Interest-saving: The interest rates may be lower than those of getting a bank loan

- Lenient: An IFA loan does not need to be repaid during your lifetime. If desired, the outstanding loan balance can simply be deducted from the policy’s tax-free death benefit.

- Tax-saving: Potential tax deductions as per CRA rules, depending on how proceeds are used

- Self-paying: If employed correctly, an IFA can cover the cost of your life insurance coverage and be reinvested into projects that generate enough returns to cover interest, too

What are the disadvantages of an IFA?

While an IFA can be quite convenient, it also comes with some disadvantages, from fluctuations in interest rates to a complex structure, and a few more that have been listed in the section below:

- Only permanent life insurance qualifies: To get IFA, a permanent life insurance policy, including whole and universal policies, will be applicable; term policies do not qualify for this

- Capital-intensive: IFA requires sufficient disposable income or savings to pay premiums upfront

- Ongoing interest: An IFA is a line of credit, so interest continues for the period the loan is outstanding

- Risky: Interest can potentially outpace the rate of return on your investments, leaving you out of pocket

- Reduced death benefit: The amount borrowed might reduce the death benefit left for your surviving spouse, family members, or other beneficiaries

- Strict requirements: Some providers may ask for additional collateral, have age or income minimums, and may only accept policies from specific insurance companies

- Complex: An IFA is an advanced insurance strategy that can be difficult to grasp and effectively use

Our licensed life insurance advisors at PolicyAdvisor can help you decide if an IFA is right for you and guide you through the process of setting it up.

Immediate financing arrangement vs policy loan

Here is a table highlighting the difference between the IFA and policy loan:

IFA vs policy loan

| Features | IFA | Policy loan |

| Lender | Third-party lenders like Equitable Bank, Manulife, DUCA, etc | The insurance company directly |

| Collateral | A permanent life insurance policy is assigned to the lender | Policy’s cash surrender value is assigned |

| Loan amount | Up to 100% of the CSV or the premium paid | Typically, 90% of the CSV |

| Repayments | Interest-only payments | Flexible, any outstanding amount is deducted from the death benefit |

| Additional fees | Set-up fees are involved | No set-up fee is involved |

What can insurance immediate financing arrangements be used for?

The good part of IFA is that you can use the loan proceeds for pretty much anything you need. Most people use it for:

- Estate planning or estate equalization

- Offsetting insurance premium costs

- Reinvestment opportunities (real estate purchases, etc.)

- Business expansion, new ventures, etc.

- Business succession planning

In general, an IFA strategy tends to be used for long-term estate planning in conjunction with business or investor liquidity needs. One of the main reasons for this is that it is most effective when you have some way to generate the funds that will offset interest.

Otherwise, there are more cost-effective ways to access funding if your needs aren’t as complex, such as if you just need funding to renovate the house. In that case, an insurance policy loan or even just a simple personal loan from the bank might suit you just fine.

You should get professional advice from a licensed advisor to find out whether an IFA or another option would best suit your purposes.

What are the costs associated with immediate financing for life insurance?

The main costs involved in an IFA are:

- Interest rate: The interest rate is decided by the lender on the amount borrowed. This can vary depending on the lender and the market conditions

- Administration fees: These may be charged when you first get your IFA set up, but they are usually not that expensive

- Potential tax: Loan interest may be deductible for tax purposes if used for business or investment

- Policy costs: Ongoing insurance premiums and policy charges to maintain coverage and cash value

How do you get an IFA in Canada?

You can only get an IFA set up with a financial institution like a bank or lender. But you should start by speaking with an insurance advisor at PolicyAdvisor to look into whole life policies and find out if an IFA is a good insurance strategy for you.

After you get your policy, you can then sit down with your lender to agree on credit terms, collateral requirements, and more.

Which Canadian Lenders offer IFA programs?

Some of Canada’s leading life insurance companies have special programs for IFAs through their banking arms. This includes:

An experienced advisor can help you assess the different products offered and see which one can best help you reach your financial goals.

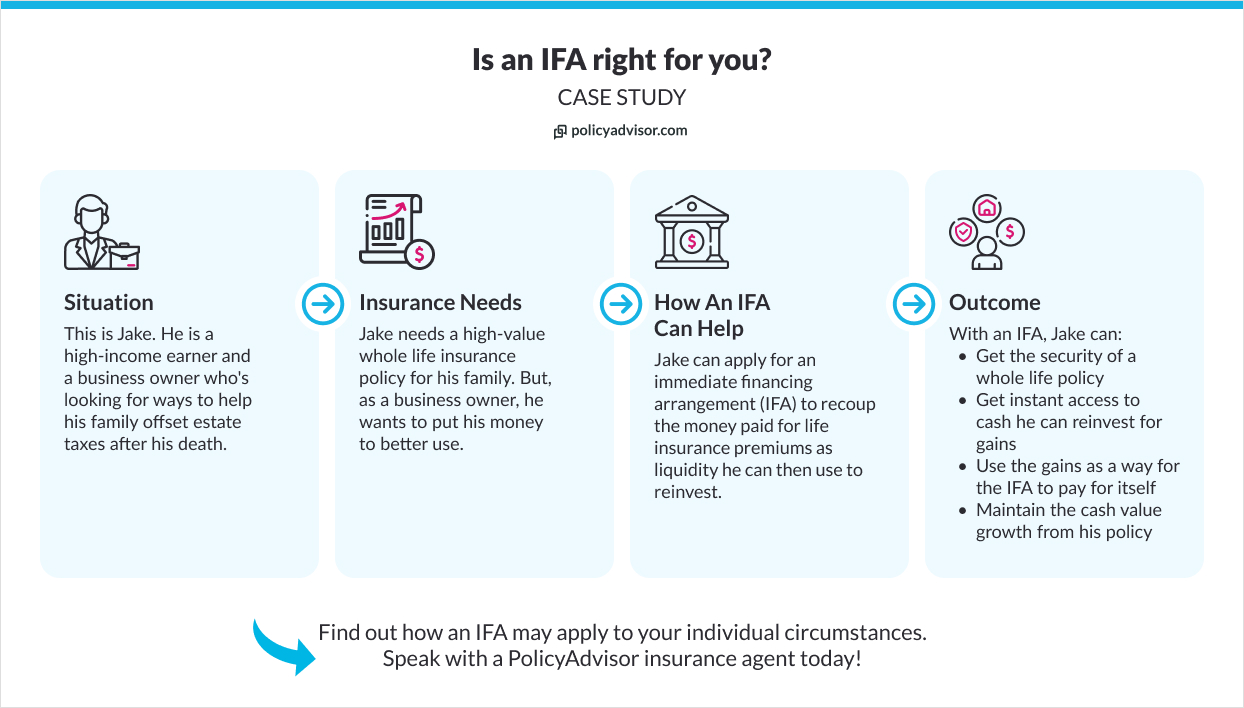

Is an immediate financing arrangement right for you?

An immediate financing arrangement can be a convenient financial tool and a great strategy to help you make the most out of your whole life policy. But, it’s not suitable for everyone.

An IFA may be a good option if you:

- Need a life insurance policy with a large death benefit

- Intend for their family to use the death benefit to offset tax liabilities

- Have significant disposable income or high retained earnings (in the corporation) to be able to pay premiums all at once upfront

- Have an income-generating business venture or project that can cover the interest

- Are a savvy business owner or investor who needs quick liquidity to deploy the proceeds of an IFA

Immediate financing arrangements vs infinite banking

If you have heard about the infinite banking concept (IBC), an IFA may sound similar to you. But they’re far from the same.

An IFA is a financial strategy that helps mostly high-net-worth clients quickly access funds while still building growth and covering their insurance premium payments. An IBC, on the other hand, allows individuals to leverage the cash value of their policies to finance purchases, investments, and other financial needs while maintaining control over the cash flow.

Key differences between an IFA and IBC

| Parameters | IFA | IBC |

| Purpose | The primary purpose of an IFA is to provide immediate access to funds by borrowing against a life insurance policy’s cash value. It’s typically used to finance large expenses or investments | The Infinite Banking Concept focuses on using whole life insurance policies as a tool for creating a personal banking system. It involves leveraging the cash value of the policy to finance purchases, investments, and other financial needs while maintaining control over the cash flow |

| Access funds | Funds can be accessed immediately through borrowing from a third-party lender against the cash value of the life insurance policy | Funds are accessed by taking policy loans from the insurance company against the cash value of the whole life insurance policy. The policyholder has control over when and how to access these funds |

| Loan repayment | The borrower is responsible for repaying the loan according to the terms of the loan agreement, typically with interest. The collateral loan proceeds can be used tax-free by the policy owner | The loan can be repaid flexibly, and there is no immediate tax trigger |

In summary, while both concepts involve leveraging the cash value of life insurance, an IFA focuses on immediate access to funds through borrowing against the policy, while the Infinite Banking Concept emphasizes creating a personal banking system using whole life insurance policies.

Either way, you should speak with a licensed professional before you make a decision. An experienced team of advisors like those at PolicyAdvisor can look at your current situation and help you figure out whether an IFA is the best choice.

Frequently asked questions

What is an immediate financing arrangement?

Immediate financing arrangement or IFA is a financial strategy that helps permanent life insurance policyholders to get an instant loan from financial institutions. IFAs are commonly used by high-income individuals and business owners looking for tax efficiency, flexibility, and long-term wealth planning.

Can I get an IFA before I get life insurance?

No, in general, banks or lenders will want to make sure your policy is secured or at least approved before they will agree to an IFA. Most will require that security first, and only then will they give you financing.

Can I only use life insurance for an IFA?

You can only use a permanent life insurance policy with a cash accumulation component for an immediate financing arrangement in Canada. This is because the financial institution will use the policy and its cash value as collateral security to recoup the advanced money if the credit arrangement falls through.

Other types of insurance policy e.g. term life policies, don’t have this cash surrender value aspect, so they’re not the ideal solution for collateral.

What’s the minimum amount I can borrow through an IFA?

The minimum amount for a line of credit varies by lender, but it’s typically set at $500,000 of minimum borrowing. Some lenders might offer a lower line of credit, like $250,000, if you’re including coverage for your spouse or business partner. Lines of credit for an IFA are usually established for a 10-year term.

An immediate financing arrangement (IFA) helps high-income earners immediately access funds from a lender by using your whole life insurance policy as collateral. You can use proceeds as a way to get a return on the life insurance premiums you paid, which then leaves you free to use that liquidity to reinvest. An IFA is a complex strategy, but it can be useful in helping you make the most of your policy without losing growth.