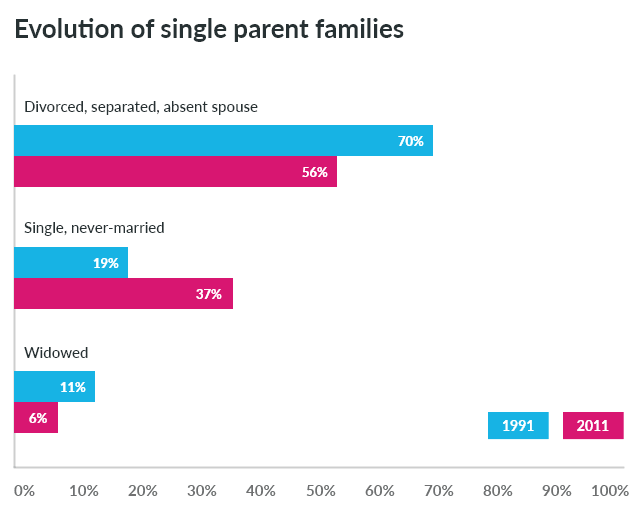

Single-parent families are more prolific than ever in Canada. The number of single-parent households was just under 300,000 in the ‘70s, today that number is closer to 700,000.

A single parent can find themselves in this situation for a number of reasons. The death of their partner, divorce and separation, or perhaps the simplest answer: that a parent chooses to raise a child or children by themselves. As Murphy Brown put it: “Whether by choice or circumstance, families come in all shapes and sizes, and ultimately what really defines a family is commitment, caring and love.”

Statistics Canada, Censuses of Population, 1931-2011

Regardless of the reason, and despite the network of family and friends one builds up along the way, single parents bear a greater responsibility in the raising and protection of their children.

Single parents are also disproportionately hit by mortgage rules. A single income often makes it harder to pass the mortgage stress test and to produce a downpayment (especially if you have to fork over 2-4 per cent of the closing costs to the CMHC).

According to data from Statistics Canada, lone-parent families have an average after-tax income of $44,600 in compared to $94,500 for dual parent families in 2016. Although resources may be exceptionally tight, a solitary parent still needs to plan for post-secondary education for their child, or children, while making housing payments and planning for retirement.

With such great responsibility – protecting children, their ongoing work responsibilities, and assets – it is understandable if single parents feel overwhelmed by their insurance choices. Since we are all about simplifying financial advice, here are 4 essential tips single parents should keep in mind as they shore up their insurance responsibilities in the near future.

1. The need for life insurance doubles as responsibility shifts to a sole parent

Just like with packing lunches, helping with homework, and constructing elaborate Halloween costumes, there is no one to pick up the slack or fall back on in any aspect of single parenting. One needs to do double the preparation, and that also extends to financials and planning for unforeseen life events.

If something happens to you (as a single parent), there is no other guaranteed income for your children to fall back on during your recovery or the rest of their formative years. It’s important to arrange an adequate financial cushion for your children, should you not be around.

Therefore, despite the army of newlyweds you see on every insurance provider’s website (hey, we’re guilty sometimes too), life insurance isn’t just for married people. It is actually acutely needed for single-parent families.

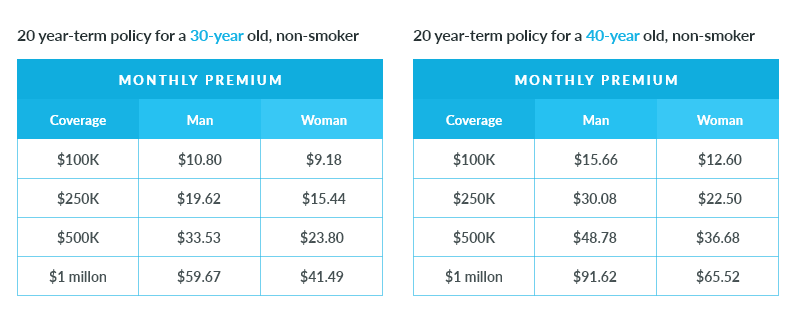

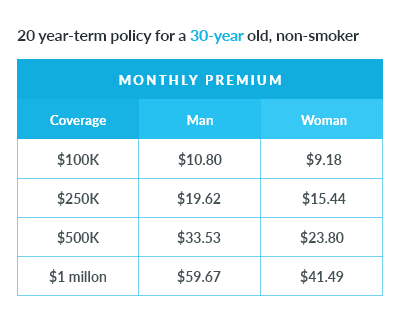

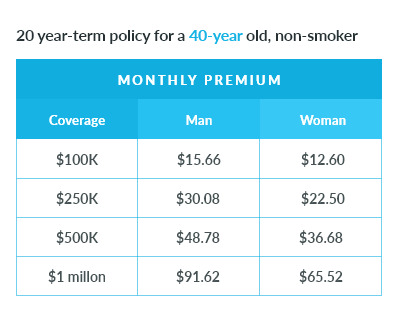

And don’t fret about setting aside a fortune for it. Specifically, term life insurance is a cost-efficient way to protect your children’s future in the event of your absence as the sole parent.

Want to figure it all out? Check out our easy-to-use term life insurance quoting tool to see how much (actually how little) it may cost for you

2. Figuring out how much life insurance you need as single parent

Counting down the days until your children turn 18? That doesn’t mean much in Canada. The rate of children living with parents through young adulthood has been rising steadily for years, according to Statistics Canada.

Why? A bigger focus on secondary education, a job market which takes longer to achieve full-time work, increased housing costs and scarcity, and of course Spotify and Netflix – the essentials. Simply put: just because you are no longer your children’s guardian, doesn’t mean they stop depending on you.

Beyond raising them and keeping a roof over their heads, you may have plans down the road to help your children with further education costs or a downpayment for their first house. Planning ahead with the right insurance choices means you can ensure those young adult life years are covered and you can provide all the gifts you intend to later in life.

How much life insurance coverage you need depends on your individual financial situation, like the age of your child, whether or not you have a mortgage, whether or not you or your child is the beneficiary of your former partner’s policy, whether you receive any parental support payments, have larger financial assets like savings or RRSPs that can be passed on, and more. Don’t worry, we make it easy to do those calculations using our online life insurance calculator.

3. Considering critical illness insurance and disability insurance as a single parent

Statistics Canada, Census of Population, 2016

Your kids think you’re a superhero – but you’re not invincible.

Illnesses and unexpected accidents happen, even beyond stepping on a Lego. Should something happen besides a bump or scrape, leading to a serious illness or disability, you could be in a tight spot as the sole breadwinner for your family.

So protect yourself. Critical illness insurance can potentially offer you a lump sum amount of money while you recover from a serious illness. While much of it may go to expenses involved in your medical care, the funds may also be used against the extra expenses you incur in taking care of your family during this difficult period as well. To learn more about critical illness insurance read our honest guide or use our calculator to find out how much critical illness insurance would cost for single parent.

In the same vein, if you become disabled and unable to work, the loss of your paycheque can be devastating. Like most Canadians, you may depend on your monthly wage to pay for your mortgage or rent, or supporting childcare and other family expenses. Disability insurance – both long-term and short-term – can replace those wages and gives you the best option to provide for your family near the same level they are used to. To learn more about disability insurance read our honest guide or get an instant quote to find out how much disability insurance could cost for a single parent.

4. Ensure will and trustee issues are squared away

All the coverage in the world doesn’t matter, if there are issues after your death around how your children access the funds you’ve ensured for them. Should something happen to you, you want to ensure you have a plan for a seamless transfer of your assets and that your child will not face financial hardship.

And it’s not just assets we’re talking about. You want to make sure even your debts and liabilities are ironed out, to both ensure your children receive what you intended for them, and to eliminate any stress or hardship that messy legal proceedings could entail.

Appointing a beneficiary on any policies you choose grants easier access to the proceeds or in some cases specifies who would look after the policy proceeds until your children are old enough to receive it.

And lastly, as a single parent, making a will is one of the most important things you do when planning for your children’s future. A will is used to determine who receives your assets and who will be appointed the sole caregiver of your kids. It’s a hard decision to make, but choosing a beneficiary that is financially and emotionally able and willing to care of your assets for your children is essential for your own peace-of-mind. Should you become incapacitated, naming a trusted individual as Power of Attorney in your will, gives someone the authority to take care of financial affairs when you can’t.

Although these are only 4 tips, they are pretty big thinking points for a single parent – just think about the size of a policy for a child celebrity! Luckily you should only have to think about them once. Taking these protective steps early in your child’s life is easier and less expensive than waiting until life gets a little more complicated. Take a few minutes with PolicyAdvisor’s insurance checkup and see how easy it is to prepare for your family’s financial security.

Regardless of the reason, and despite the network of family and friends one builds up along the way, single parents bear a greater responsibility in the raising and protection of their children, and life insurance is an important plays part.

1-888-601-9980

1-888-601-9980