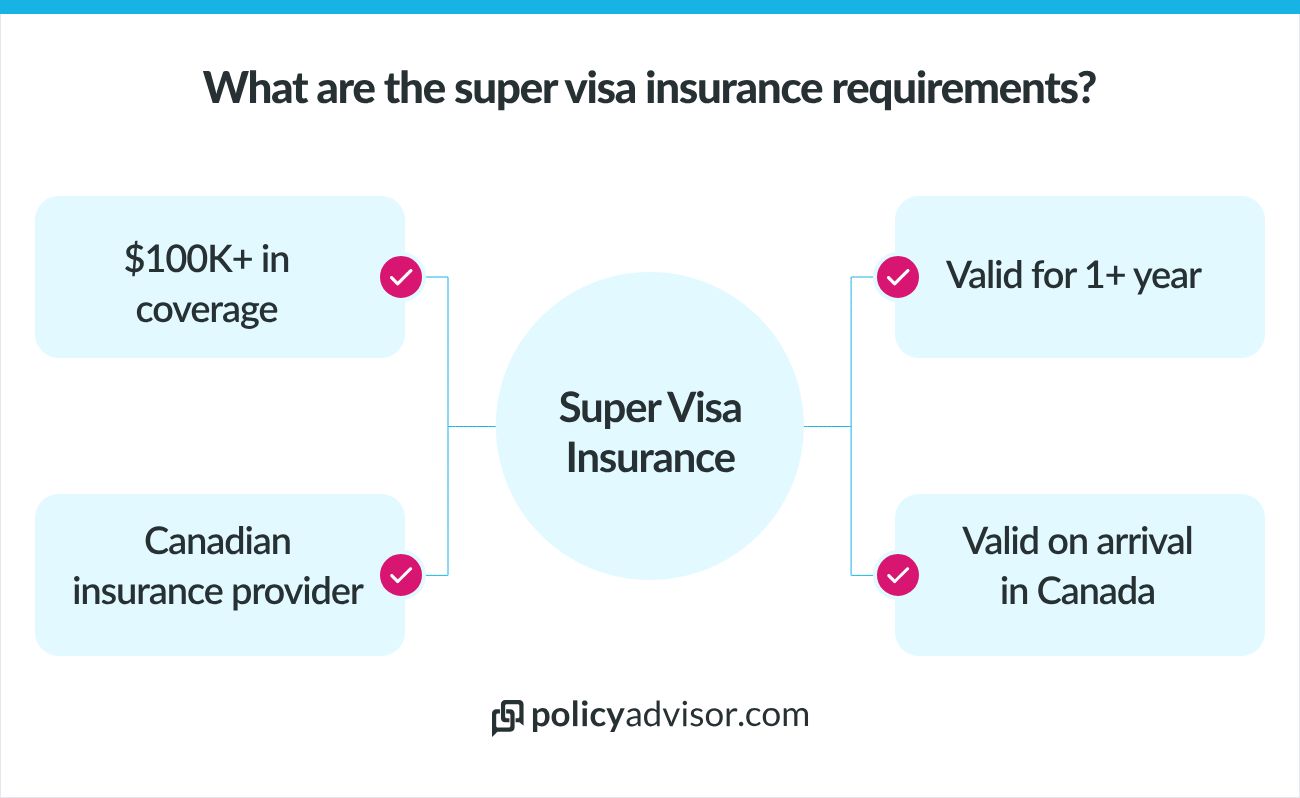

- To qualify for a Super Visa, visitors must have valid medical insurance from a Canadian company with at least $100,000 in coverage for a minimum of one year, including emergency care, hospitalization, and repatriation. Insurance must be active upon arrival and available for review by immigration officials

- Visitors to Canada aren’t covered under public healthcare. A single hospital stay can cost $10,000 or more, and major surgeries can exceed $100,000. Super Visa insurance protects against these out-of-pocket costs

- Most policies cover emergency care, ambulance services, diagnostic tests, follow-up treatment, and even repatriation. Many plans also cover stable pre-existing conditions if they’ve remained unchanged for 90–180 days before travel, depending on the provider

- Super Visa insurance typically costs $100–$200 per month, but premiums increase with age and health conditions. Opting for a higher deductible can significantly reduce premiums—for example, a $5,000 deductible may save hundreds annually compared to a $1,000 deductible

Many Canadian citizens and permanent residents began their lives in the country as immigrants. As they put down roots, buy their first home or start a family, they often wish to have their parents or grandparents visit them.

However, did you know that a single hospital stay in Canada can cost visitors over $10,000 without insurance? Super Visa insurance helps protect your parents or grandparents from these high medical costs during their stay.

In this article, we’ll cover everything you need to know about Super Visa insurance and how it can help keep your loved ones safe while they visit.

What is Super Visa Insurance and why do you need it?

Super Visa insurance is a crucial requirement for parents and grandparents applying for the Canadian Super Visa, a special visa that allows them to visit Canada multiple times.

It’s valid for up to 10 years, and visitors can stay in Canada for up to 5 years each time they visit. Parents and grandparents can even request to extend their stay by 2 years at a time while in Canada. In comparison, a normal visitor to Canada visa only lets visitors stay up to 6 months.

This long-term visa offers an excellent opportunity to reunite families, but to qualify, applicants must show that they are covered by a valid travel medical insurance policy.

This coverage helps protect them from the high cost of emergency medical care in Canada, where a single hospital stay can cost over $10,000 without insurance.

Super Visa Eligibility Requirements

To be eligible for a Super Visa, the person applying must:

- Be the parent or grandparent of a Canadian citizen or Canadian permanent resident

- Have a letter written by their child or grandchild stating that they will provide financial support to the visa holder during their stay

- Provide proof that their child or grandchild meets the minimum income requirement (Low Income Cut off Minimum (LICO))

- Provide a copy of their child or grandchild’s Canadian passport or Permanent Resident Card (PR Card)

- Take a medical exam and show they are healthy enough to enter the country

- Provide proof that they have adequate insurance coverage from a Canadian insurance company (super visa insurance)

Visit the Government of Canada’s website for more details about the requirements for the government’s super visa program.

Super Visa insurance checklist: What you need to apply

The minimum requirements a Super Visa insurance policy has to meet are:

- Must be valid for at least one year from the date the visa holder arrives in Canada

- Must have at least $100,000 in coverage

- Must cover emergency medical care, possible hospitalization, and repatriation

- Must be active and available for review by an immigration official each time the visa holder enters Canada

- Must have been bought from a Canadian insurance company or an insurer approved by the Office of the Superintendent of Financial Institutions (OSFI)

What is the LICO requirement for a Super Visa?

If you’re applying for a Super Visa for your parents or grandparents in 2025, it’s essential to meet the Low Income Cut-Off (LICO) requirements set by Immigration, Refugees and Citizenship Canada (IRCC).

These thresholds demonstrate that you have sufficient financial means to support your visiting family members during their stay in Canada.

The required income level depends on the total number of people in your family unit, including yourself, your spouse or common-law partner (if applicable), your dependents, and the parent(s) or grandparent(s) you wish to invite.

| Number of family members | Minimum gross income required |

| 1 person | $29,380 |

| 2 persons | $36,576 |

| 3 persons | $44,966 |

| 4 persons | $54,594 |

| 5 persons | $61,920 |

| 6 persons | $69,834 |

| 7 persons | $77,750 |

| Each additional person | $7,916 per member |

Note: Your family size includes yourself, your spouse or partner (if applicable), your dependents, and the parents or grandparents you’re inviting under the Super Visa. These amounts reflect the minimum income you must show through documents such as your Notice of Assessment (NOA), employment letters, or recent pay stubs.

How does medical insurance work for Super Visa?

Super Visa medical insurance provides emergency health coverage for 365 consecutive days in Canada for parents and grandparents of Canadian citizens or permanent residents.

There is no expiry exclusion during the policy period, meaning your coverage remains valid for the full term unless cancelled. Another benefit is that you can temporarily return to your home country during the coverage period without needing to cancel your plan when you return to Canada, depending on your policy.

Most insurers offer deductible options (e.g., $0, $500, $1,000), which can lower your premium by agreeing to pay a portion of the claim amount yourself. Coverage is available for individuals up to 89 years of age, although premiums increase with age and the presence of pre-existing conditions.

What does medical insurance for Super Visa cover?

A standard medical insurance for Super Visa holders covers a broad range of emergency medical services and hospital-related costs. Here are the typical benefits included in a comprehensive policy:

- Emergency hospitalization and medical care

- Prescription medications (usually limited to a 30-day supply per prescription)

- Emergency dental treatment

- Ambulance services, including air ambulance if medically necessary

- X-rays and diagnostic tests, including MRIs, CT scans, and bloodwork

- Follow-up treatment related to the initial emergency

- Medical appliances, such as crutches, braces, or wheelchairs

- Private-duty nursing and home care (if medically required)

- Repatriation of remains in case of death

- Companion accommodation if a family member needs to stay with the patient

- Emergency surgeries or procedures

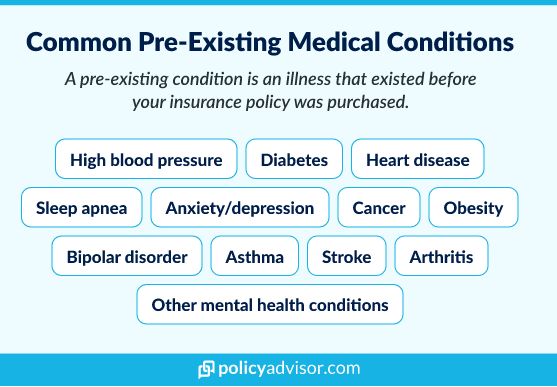

What diseases are covered under Super Visa insurance?

Pre-existing condition coverage may be available under Super Visa insurance if declared and considered stable, including high blood pressure, type 2 diabetes, high cholesterol, thyroid disorders, GERD, osteoarthritis, asthma, benign prostatic hyperplasia (BPH), stable angina, and controlled depression or anxiety.

Coverage applies only if these conditions have not shown any changes in symptoms, treatment, or medication for a specified period (usually 90 to 180 days) and any emergency arising from them is sudden and unexpected.

For example, suppose someone has controlled diabetes or high blood pressure and experiences a related complication during their visit. The treatment may be covered in such a case, provided the condition was stable before arrival and properly disclosed.

What does Super Visa insurance NOT cover?

Most Super Visa insurance policies do not cover:

- Routine doctor visits

- Planned vision or dental care (like cosmetic surgeries)

Remember, this is a type of medical travel insurance for visitors to Canada. It’s meant to help if something unexpected happens and you need medical assistance.

Does Super Visa insurance cover pre-existing medical conditions?

Yes, Super Visa insurance will cover pre-existing conditions or medical conditions that you already had before you applied if they are stable. Stable means your condition has not:

- Gotten worse

- Caused new symptoms

- Caused you to need new medication or treatment

- Cause a new diagnosis

Most Canadian providers say that your pre-existing health issue has to meet these conditions for at least 180 days (about 6 months) to be considered stable and included under your health insurance plan for the Canadian Super Visa.

But note that this can be different for different providers. The amount of time your condition has to be stable, also called a “minimum stability period”, can be anywhere from 90-180 days.

Is Super Visa insurance mandatory?

Yes, you need to have Canadian medical insurance for a Super Visa application to be approved. The insurance policy must also be active when the visa-holder arrives in Canada.

How much Super Visa insurance coverage do you need?

While the minimum requirement for medical insurance coverage for a Super Visa is $100,000, many choose to go above those minimum requirements. It is possible to purchase up to $1 million in Super Visa insurance coverage. Given the high cost of medical treatment without public healthcare coverage and the advanced age of the typical Super Visa insurance applicant, opting for a higher medical coverage amount is common.

What is the least amount of coverage needed for Super Visa insurance?

The minimum coverage level for Super Visa insurance is $100,000. But keep in mind that you might need more than this. The insurance policy has to at least cover the cost of health care, hospitalization, and travel if your visiting family has to return home while still getting medical help.

How much do medical expenses cost in Canada without Super Visa insurance?

A single medical emergency in Canada can cost over $10,000 for visitors without Super Visa insurance. Since parents and grandparents visiting under the Super Visa program are not covered by Canada’s public healthcare system.

Such expenses must be paid out-of-pocket for all medical care, including hospital stays, emergency treatment, diagnostics, and more.

Uninsured medical expenses in Canada for Super Visa applicants

| Medical Service | Estimated Cost (CAD) |

| Emergency Room Visit (basic) | $800 – $1,500 |

| Hospital Stay (per day) | $3,000 – $5,000 |

| Intensive Care Unit (ICU) (per day) | $5,000 – $10,000+ |

| Minor Surgery | $3,000 – $15,000 |

| Major Surgery | $20,000 – $100,000+ |

| MRI or CT Scan | $800 – $2,500 |

| Ambulance Services | $500 – $1,000+ |

How much does Super Visa insurance cost?

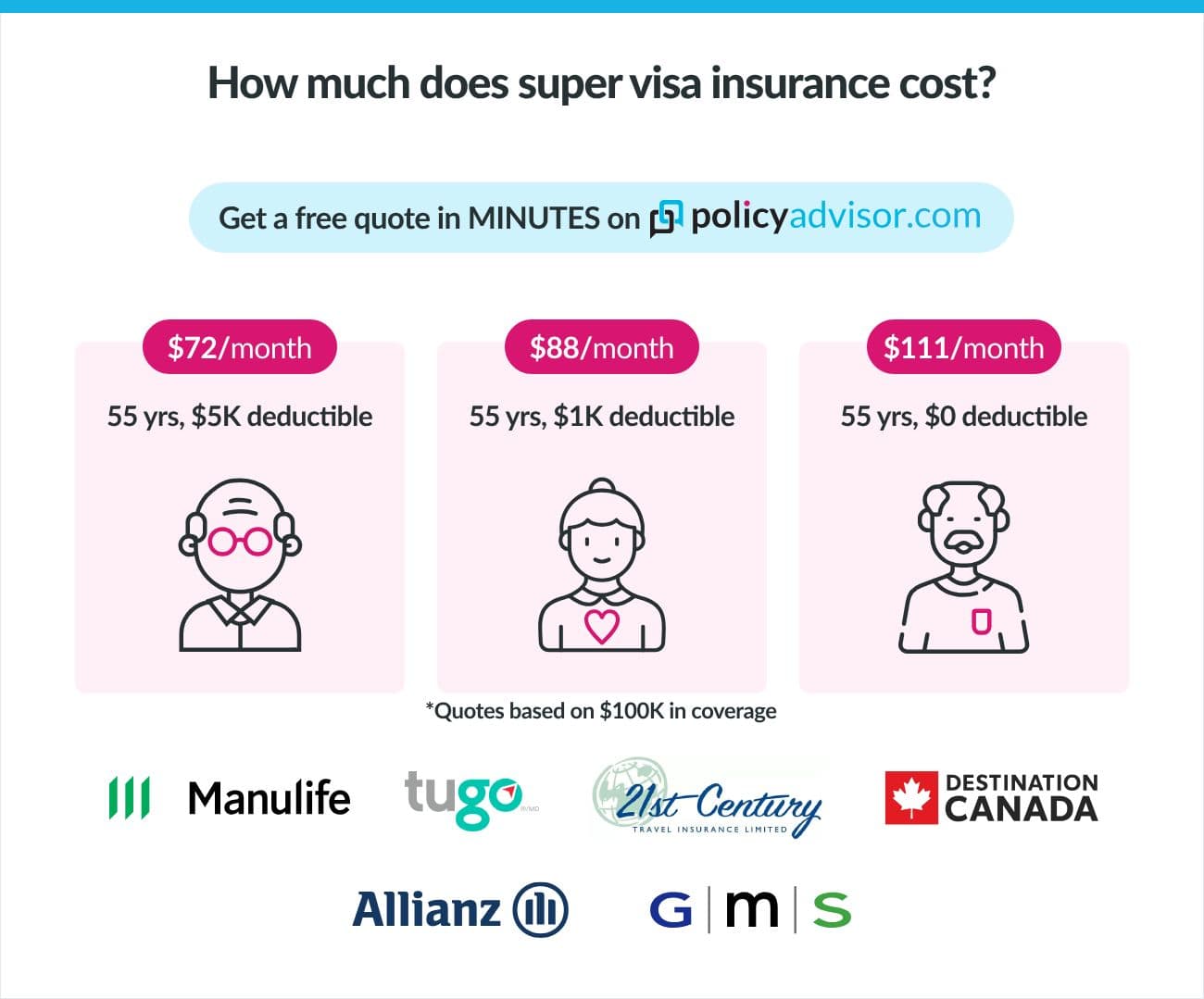

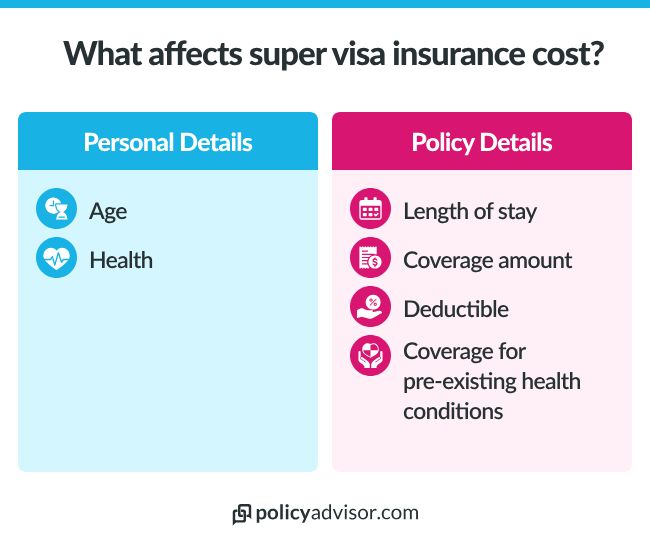

Super Visa insurance can cost between $100 to $200 per month for each parent or grandparent visiting Canada. But the exact cost of Canadian Super Visa insurance fees can vary, depending on factors like:

- Age

- Health & medical history

- Policy length

- Amount of coverage

- Deductible

Originally, Super Visa insurance had to be paid in full at the time of purchase. But as of December 2022, there are options to pay in monthly installments instead. Someone can also sponsor their parents or grandparents and buy the Super Visa insurance on their behalf. Read more about Super Visa insurance payment options.

The below table shows how much Canadian Super Visa insurance might cost at different ages.

Super Visa insurance premiums based on age

| Age | Monthly premium |

|---|---|

| 55 years | $1,110/month |

| 60 years | $1,241/month |

| 65 years | $1,588/month |

| 70 years | $2,187/month |

| 75 years | $2,713/month |

*Quotes based on a 365-day Super Visa insurance policy with $100,000 in coverage and a $1,000 deductible.

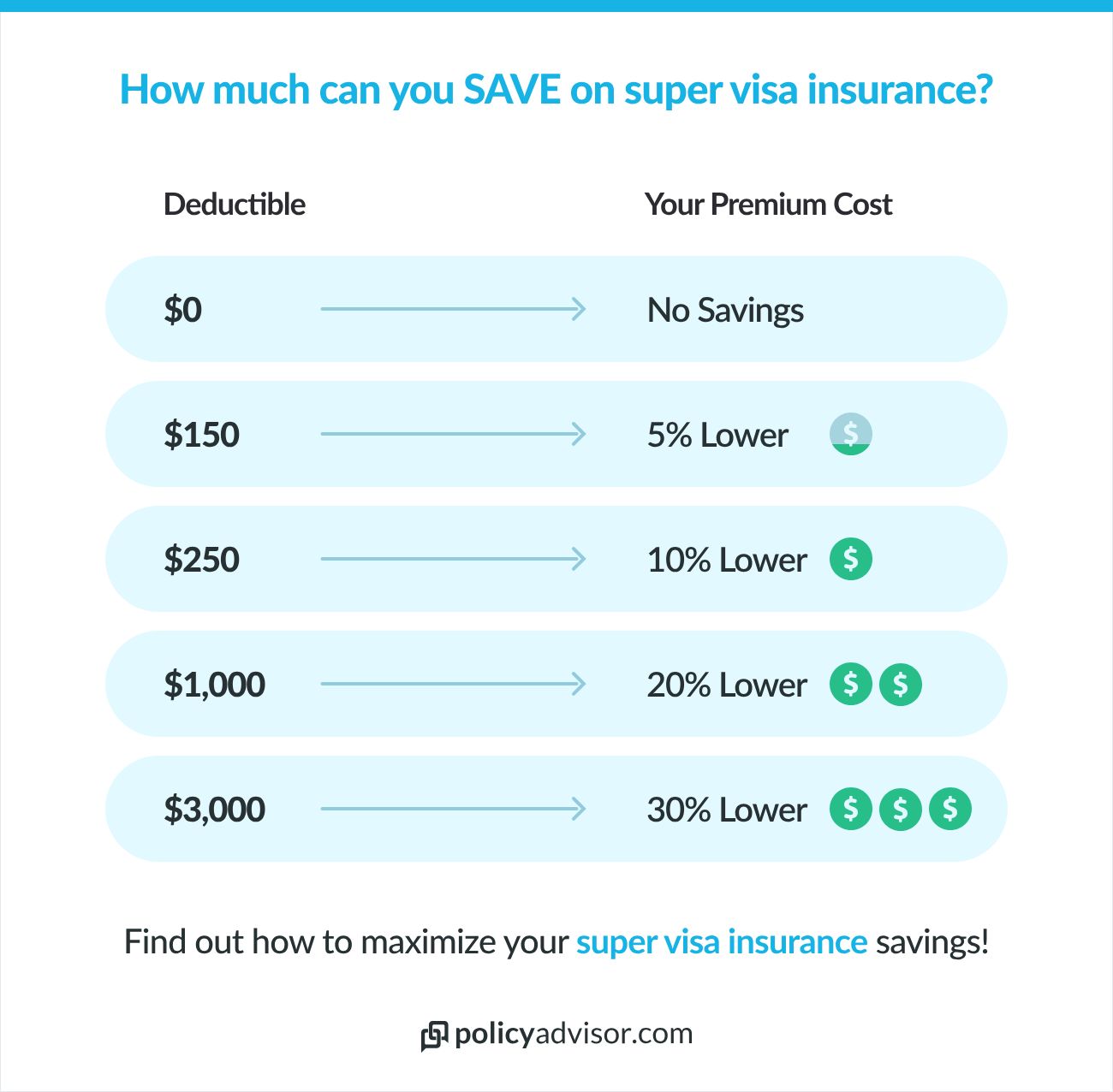

What is the deductible for Super Visa insurance?

The deductible of your Super Visa insurance policy is the amount of money you decide to pay for medical care before your coverage kicks in. Different insurance companies offer different deductible amounts. Some deductibles can be zero, which means you don’t have to pay anything. Others can be thousands of dollars.

You can save money on your insurance costs based on the deductible options you choose. The chart below shows how choosing a higher deductible can make your insurance premiums lower.

How much can you save on Super Visa insurance with deductibles?

One of the pros of choosing a higher deductible is that you will pay less monthly or annual costs for your insurance coverage. On the other hand, choosing a lower deductible is the opposite.

When you have a zero-dollar deductible, you don’t have to pay anything upfront for medical expenses. But you’ll have to pay a higher premium each month. Some people decide to pay a deductible, so their premiums are lower. They then pay for smaller medical expenses, like prescription drugs, when they need to.

Here’s how different deductibles affect Super Visa insurance premiums with some of Canada’s top insurers.

Super Visa insurance premiums based on deductible

| Company | $1,000 Deductible | $5,000 Deductible |

|---|---|---|

| Company A | $1,501 annual premium | $1,219 annual premium |

| Company B | $1,518 annual premium | $1,234 annual premium |

| Company C | $1,110 annual premium | $902 annual premium |

*Based on premiums for a 365-day Super Visa insurance policy for 55-year-old with $100,000 in coverage.

Which are the best Super Visa Insurance providers in 2025?

In 2025, top Super Visa insurance providers in Canada include Manulife, Travelance, GMS, and Allianz.

- Manulife: One of the most trusted names in Canadian insurance, Manulife offers flexible Super Visa plans with optional coverage for stable pre-existing conditions. Their plans are widely accepted by immigration authorities and provide 24/7 emergency assistance

- Travelance: Known for its affordable premiums and customizable coverage, Travelance offers two plan tiers (Essential and Premier), making it easier for applicants to choose based on budget and coverage needs. They also allow higher coverage amounts and pre-existing condition protection

- GMS (Group Medical Services): GMS provides competitive rates and excellent pre-existing condition coverage for those who meet stability requirements. Their policies are ideal for seniors and long-term stays, offering coverage periods of up to 365 days

- Allianz: As a global brand, Allianz offers strong international support and robust Super Visa policies. Their plans include emergency medical coverage, repatriation benefits, and optional pre-existing condition coverage

These providers are recognized by IRCC, offer coverage up to $100,000 or more as required for Super Visa approval, and provide customizable options for families with varying health needs.

How to apply for Super Visa insurance?

Super Visa insurance is a mandatory requirement for parents and grandparents visiting Canada under the Super Visa program. It must provide at least $100,000 in emergency medical coverage for a minimum of one year. Applying for the right plan ensures compliance with visa requirements and protects against unexpected medical costs.

Step-by-step process

- Determine coverage needs: Consider the applicant’s age, health status, and length of stay

- Speak to our licensed advisors: Our expert advisors will help you review policies from licensed Canadian insurance providers for coverage, exclusions, and cost

- Confirm eligibility: Ensure the applicant meets any medical or age-related underwriting requirements

- Purchase the policy: Buy a plan with $100,000+ coverage valid for at least 365 days in Canada

- Get proof of insurance: Obtain the official insurance certificate to include in the Super Visa application

Common application mistakes to avoid

- Purchasing insufficient coverage: Anything under $100,000 will not meet Super Visa requirements

- Overlooking exclusions: Failing to review exclusions for pre-existing conditions or age limits can result in denied claims

- Incorrect coverage dates: The policy must start on the date of arrival in Canada and last for one year

Missing the insurance certificate: You must include proof of insurance with your Super Visa application

Can I buy Super Visa insurance on behalf of my visiting family?

Yes, Canadian citizens and permanent residents can purchase a Super Visa insurance policy on behalf of their parent(s) or grandparent(s). In fact, most do!

With a Super Visa, the person who sponsors their family’s stay in Canada is responsible for their expenses during their visit. This includes any medical expenses that may not be covered by insurance. Since sponsors are already responsible for the costs of their guests, many of them decide to buy their super visa insurance too. This helps them make sure they have the right coverage and get additional coverage if they need to.

Can I get Super Visa insurance with a pre-existing condition?

Yes, you can get Super Visa insurance with a pre-existing condition. Many Canadian insurance providers offer Super Visa insurance plans that include coverage for stable pre-existing conditions, such as diabetes, high blood pressure, or heart disease, as long as the condition has been medically stable for a specific period before the policy start date.

Key things to know about Super Visa pre-existing condition coverage

- Stability periods vary: Some insurers require your condition to be stable for 90 days, while others may require 6 to 12 months

- Premiums may be higher: Plans with pre-existing condition coverage often cost more

- Partial coverage options: Some plans offer limited coverage or higher deductibles

- Medical questionnaires required: You may need to complete a health declaration or screening

- Conditions that may be excluded: Cancer under active treatment, recent heart surgery or stroke, uncontrolled diabetes or hypertension, and conditions with recent hospitalizations

What does “medically stable” mean?

A medically stable condition means that:

- There have been no new symptoms or worsening of the condition

- No new medications or treatments were prescribed or changed

- No hospitalization, test referrals, or specialist consultations occurred for the condition

This stability must be maintained within a defined period, usually 90 to 180 days, depending on the insurance provider.

Can I get a refund on Super Visa insurance if the visa is rejected or unused?

Yes, you may be eligible for a full or partial refund on Super Visa insurance depending on your situation. Insurance providers in Canada offer flexible cancellation and refund options to help protect your investment in case plans change.

Full refund if the Super Visa is not approved

If your parents’ or grandparents’ Super Visa application is rejected by IRCC, most Canadian insurance companies will issue a full refund of the premiums paid. You will need to provide the visa refusal letter from Immigration, Refugees and Citizenship Canada (IRCC) and submit a refund request before the insurance policy start date.

Partial refund for early departure from Canada

If your parents or grandparents leave Canada before the one-year coverage period ends, you may be entitled to a partial refund for the unused portion of the Super Visa insurance. To qualify:

- The visitor must have left Canada permanently

- No claims should have been made on the policy

- You must provide proof of departure, such as boarding passes or a stamped passport

Refund amounts vary by provider and are calculated based on the number of unused months, minus any cancellation fees (if applicable).

Are there alternatives to Super Visa insurance?

No, there are no alternatives to Super Visa insurance. A hard rule for the visa to be approved is having proof of medical insurance coverage. A Super Visa medical insurance policy is the only option to meet this requirement.

But there are other visitor’s visas and immigration programs that do not need super visa insurance. They include:

- The 6-month standard visitor visa

- The electronic travel authorization (eTA) for travellers from eligible countries

- A passport for travellers from visa-exempt countries

- The Parents and Grandparents Sponsorship Program (PGP). This program lets Canadian citizens and permanent residents sponsor their parents and/or grandparents to become permanent residents of Canada.

Canadians can also consider regular travel insurance for parents or grandparents if they plan on visiting for a shorter period of time. They may not need as much coverage as insurance for a Super Visa, so they can save on costs by getting a regular plan instead.

How to find the best Super Visa insurance quotes

Use our free online quoting tool to get the best Super Visa insurance quotes instantly!

Our blog on the Best Visitors Insurance in Canada also has more details about which of the best Super Visa insurance providers you should choose.

Or, connect with our friendly insurance agents if you want personal help. We have years of experience helping Canadian families get travel insurance policies for their relatives. Our advisors would be happy to walk you through the steps and go over multiple coverage options so your family can get the best plan for your needs.

Frequently asked questions

Do you need to purchase a Super Visa insurance policy in Canada?

No, you do not have to physically be in Canada to buy Super Visa insurance. You just have to buy it from a Canadian insurance provider. But you can buy the policy whether you are in Canada or elsewhere. You can only apply for the visa itself from outside of Canada, though.

Can you get a discount if you buy several Super Visa insurance policies?

Yes, most insurance companies will give you a discount if you buy more than one Super Visa insurance policy at once. Each company has its own special offers and deals. Ask about the multi-policy discount to find out how you can save!

Do you need to take a medical test for Super Visa insurance?

No, you don’t need to go through a medical exam or do labwork to get Super Visa insurance. You will only be asked some questions about your health when you apply.

Be sure to only give honest and accurate answers to each question during the application process. If you give false information, your policy could be canceled. And if that happens, you risk losing your visa on the whole.

Can you get a refund for Super Visa insurance?

Yes, you can get a refund for Super Visa insurance. But only in some circumstances. For example, if you apply for a policy and get approved but your Super Visa application is denied. In this case, you can get a full refund for your Super Visa insurance policy.

Can you cancel Super Visa insurance?

Yes, you are allowed to cancel Super Visa insurance. But it doesn’t happen often because this kind of insurance is mandatory for the visa itself.

Let’s say your Super Visa application was accepted and you’re now using that visa to stay in Canada. You wouldn’t be able to cancel the insurance because that would also cancel your visa.

But let’s say you have to leave Canada earlier than expected, and you haven’t used your insurance plan. In that case, you can cancel your insurance policy and get some money back. But you might have to pay a cancellation fee.

Can foreign workers in Canada get super visa insurance for their families?

No, the parents and grandparents of foreign workers in Canada cannot get a Super Visa or insurance for Super Visa. It’s only available to the relatives of Canadian citizens and permanent residents. Foreign workers, like international students, are considered temporary residents in Canada. But their visiting relatives can still get standard travel insurance.

Does Super Visa insurance cover dental treatment or dental emergencies?

Yes, Super Visa insurance covers emergency dental expenses. Depending on your policy, Super Visa insurance can provide thousands of dollars in coverage for dental emergencies and expenses. Note that it does not cover planned dental treatment, like cosmetic surgery.

How long does Super Visa insurance coverage last?

Super Visa insurance coverage lasts for up to 1 year at a time. It’s bought in 1-year increments, so the Super Visa holder needs to get a new policy every year they remain in Canada.

Also keep in mind that if the visitor leaves Canada and comes back again, they will need to have new, valid Super Visa insurance coverage.

Why is Super Visa insurance so expensive?

Super Visa insurance can be expensive for several reasons, such as:

- Age: Super Visa insurance premiums increase significantly with age. For example, if you are 60–65 years old, you can expect to pay $1,200–$1,500 for a policy with $100,000 coverage. However, for those aged 70–75, the same coverage may cost $2,100–$2,700

- Pre-existing Health Conditions: Chronic illnesses, such as diabetes and heart disease, may result in higher premiums, as they pose a greater risk to insurers

- Deductibles: Choosing a lower deductible for your Super Visa insurance will result in higher premiums. Conversely, opting for a higher deductible will lower your premium costs

- Length of stay: The duration of your stay also affects your premiums, with longer stays leading to higher costs

Does Super Visa insurance cover doctor visits?

No. Super Visa insurance is primarily designed to cover emergency medical expenses, such as treatment for illnesses or injuries, prescription medications, diagnostic procedures like X-rays, ambulance services (ground, air, and sea), and essential medical equipment (e.g., crutches, slings, and wheelchairs).

However, it does not cover routine doctor visits or preventive care, including planned vision and dental care.

Which providers offer Super Visa insurance?

You can get a parent/grandparent Super Visa insurance policy from some of the best visitor insurance companies in Canada, like:

- Manulife

- Tugo

- Group Medical Services (GMS)

- Allianz

- 21st Century Travel Insurance Limited

- Destination Canada

- and more!

The different providers each have different packages. Connect with one of our agents to find out which would be best for you and your family today!

Super Visa insurance is a special type of travel insurance that’s only available to the parents and grandparents of Canadian citizens or residents who are staying in the country for a long period of time. It will cover any medical emergencies that may happen to your relatives during their stay.