What is a life insurance laddering strategy?

Our insurance needs will vary throughout the course of our lives, based on changes around major life events, debts, and responsibilities and we require different amounts of coverage throughout the length of your policy’s term. A solution to this is something called life insurance laddering (insurance ladder strategy). Using life insurance laddering, you purchase multiple insurance policies with different coverage amounts to address specific protection needs for specific periods of time in your life, and they will expire as individual policies at different times. This strategy can and save you thousands of dollars in premiums.

One’s insurance needs vary throughout their lives. Generally, less coverage is needed in one’s young and single years. But, needs do increase after major life events such as getting married, buying a house, and having children. Then, as more time passes, debts and obligations decrease, and coverage needs decline simultaneously.

So how does one ensure they have the right amount of insurance coverage throughout their lives? More importantly, how does one ensure that we are not overpaying for coverage that we may not need in future years?

One solution is laddering, also known as a life insurance ladder strategy, a comprehensive plan that ensures you have multiple coverages in place to address specific needs and periods of your life and are paying only for the amount of coverage you need during these periods.

How does a life insurance ladder work?

At its most basic level, life insurance laddering entails purchasing multiple life insurance policies with different coverage amounts and durations. Each of these individual policies expire at different times. They are chosen to address specific protection needs for specific periods of time in your life. For example:

- a 10-year policy to cover your outstanding student debt

- a 20-year policy to help protect your children from their youngest years until they can complete their education and gain financial independence, and:

- a 30-year policy to cover the amortization period of your mortgage

This can be executed two ways: through a base life insurance policy with term life riders added to it. Or by purchasing a set of individual life insurance policies, purchased simultaneously.

You can save substantially on your combined life insurance premiums by enacting an insurance laddering strategy, especially through a base-policy plus rider strategy.

How to save money on life insurance with a ladder

Foremostly, you purchase the bulk of your coverage when you need it most, using favourable rates due to your age.

As time passes, and you catch up to expiring debts like large loans or mortgages, your coverage will be timed to also decrease as shorter duration policies terminate. Once those policies terminate, you no longer pay their premiums.

Some insurance companies also offer discounts on premiums when an applicant takes out multiple policies and/or riders.

Lastly, laddering offers a great way to combine and mix term life and permanent insurance coverage. A policyholder can have permanent life insurance as their base policy, and add one or more term riders layered on top to achieve the coverage they need.

A life insurance ladder can seem confusing, but a real-life example tends to help those curious insurance seekers understand the concept better.

For example, say you’ve just finished a specialized graduate program like medicine or law. You’re now starting your career, getting married, perhaps starting a family, and purchasing your first home. Wow, that’s a lot to cover, but not an uncommon situation for many first entering their professional careers.

And while it is a lot to cover, those obligations all occur over different time periods. Your student debt can be taken care of in 10 years, your children most likely leave your care in their 20s, and your home will be paid off in 30 years. You need the most coverage in those early years, but once your obligations have diminished in the last years of your mortgage, you simply don’t require the same amount of coverage.

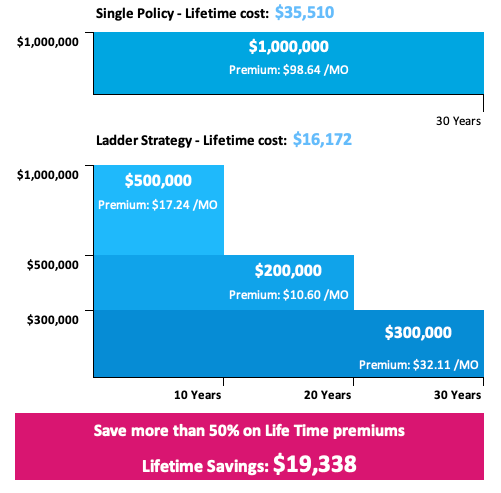

Here’s what a life insurance laddering strategy versus just term life insurance might look like in that situation.

*Premium figures for a 32-year-old non-smoker male.

Do I need a life insurance ladder?

Using a life insurance ladder is largely dependent on your future plans. For many people, expenses decrease over time and, correspondingly, so do their coverage needs. For example, once you’ve paid off your mortgage and children are financially independent, the amount of insurance you actually need would be much less than before.

Laddering is for you if:

- You have large – but temporary – obligations: A mortgage or other debts, cost of living for children, funding children’s education, and other needs that taper off slowly as you age. Although you need a large amount of immediate coverage, this will greatly decrease as time passes.

- You have pre-existing health conditions or hazardous hobbies/travel plans that will result in higher future insurance rating, and thus increase your cost of insurance down the road.

But, if you don’t have solid plans for your future, a life insurance ladder may not be your best option at the moment. If you are very young without any liabilities or dependents, simple term life insurance may make more sense for your immediate needs.

This is also true if you want to leave a large financial legacy for your loved ones, irrespective of your needs.

How a life insurance ladder differs from a single term life insurance policy

| SINGLE TERM LIFE POLICY | LADDER STRATEGY |

|---|---|

| Flat or level coverage over time | Varying / reducing coverage over time |

| Single protection needs that do not change/amortize with time | Multiple coverage needs that reduce with time eg mortgage coverage and children’s education |

| Flat/level premiums that stay the same over time | Premium reduces as coverage expires over time |

| Easier to understand and structure | Allows personalization of coverage to address specific life protection needs |

What are the drawbacks of laddering life insurance?

There are three issues associated with a life insurance ladder strategy:

Difficult to understand and manage

Ladder policies are more complicated than straight term life policies. Some may find it confusing to deal with a base policy and additional term riders, each with their own premium amounts, coverage amounts, and durations.

It is also important to ensure that as your riders reach the end of their duration, that they expire and not auto-renewed. A ladder strategy needs more careful management than a regular term life policy.

However, a good life insurance advisor – like those at PolicyAdvisor – should be able to clearly and concisely explain a ladder strategy that works for you.

Lower coverage

With a life insurance ladder strategy, you acknowledge that your coverage decreases over time. Lower coverage in the future will also have lower purchasing power. While hundreds of thousands of dollars will still be a significant sum in the future, economic inflation will continue to erode the value of money over time. What you intended for your beneficiaries in 2020 might be that much more expensive in 2040 or 2050 due to inflation. While a ladder strategy allows you to reduce your coverage and premium payment, you have to ensure that you keep an adequate amount of coverage that can truly be of use to your beneficiaries when they need it.

Future needs are not yet defined

With a ladder strategy, there also comes the risk of the unknown. Should you need it, additional coverage will be much more expensive to get, as premiums increase sharply with age.

With careful planning, this should not be a major cause of concern; an insurance laddering strategy is designed to match your coverage needs from the outset. Generally, insurance needs decline over time.

Can I use a ladder strategy to increase my coverage over time?

Speaking strictly on a technical level, a ladder strategy refers to coverages purchased at a single point in time. And if you purchase multiple coverages with varying lengths at one time, your initial coverage will always be of the highest value and reduce with time as shorter duration coverages lapse.

You cannot establish coverage that only starts a few years later since it will require new medical underwriting at that point in time.

So, while not laddering as we described it above, you can always purchase multiple life insurance policies over time that allow you to increase coverage. Additionally, some life insurance providers and policies have the option to increase your coverage amount once the policy goes into force. This is typically accomplished through optional policy riders such as guaranteed insurability – though, additional premiums are required for this rider.

How do I start a life insurance ladder strategy?

Most major Canadian insurers allow a form of life insurance laddering through their coverage options.

Some insurers such as RBC allow you to layer multiple term riders on top of your base coverage, within one policy. Others, such as BMO, let you apply for multiple separate term life policies simultaneously, to implement a ladder strategy, while availing a multi-policy discount on the premiums.

PolicyAdvisor can suggest the best ladder strategy for you, as well as the right insurer to match your needs. Schedule a call today and start building your own insurance ladder with one of our licensed insurance advisors.

- Insurance laddering is also referred to as insurance stacking, insurance layering, or a life insurance ladder strategy

- If structured well, a life insurance ladder strategy can save you thousands of dollars in premiums

1-888-601-9980

1-888-601-9980