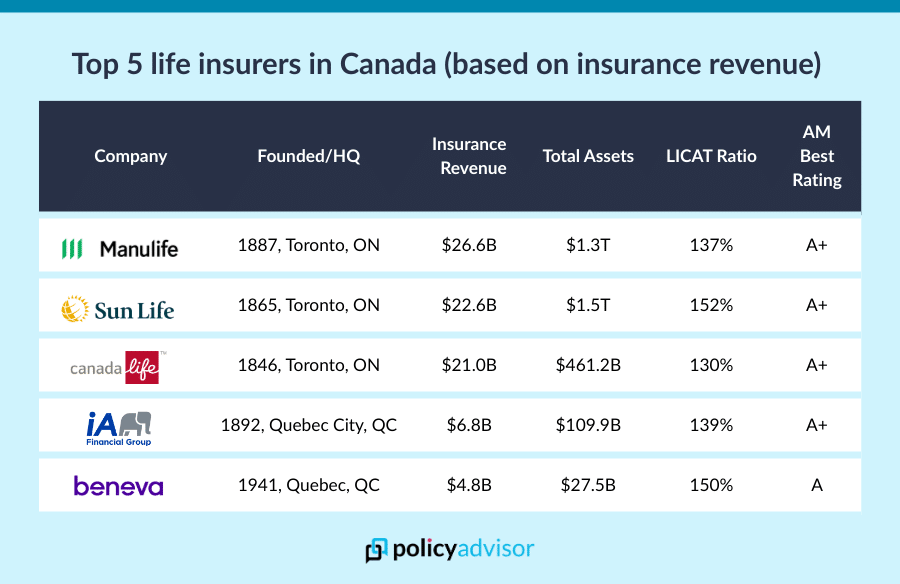

- The biggest life insurance providers in Canada for 2026 include Sun Life, Manulife, Beneva, Canada Life, and Industrial Alliance (iA)

- LICAT ratios across top insurers reveal a high level of financial resilience, which is critical in ensuring policyholders' long-term security

- Choosing the right insurer involves more than just size; smaller or niche companies may offer better value through competitive rates and personalized service

Largest Life Insurance Companies in Canada (2026)

Here is a list of all 40 insurers, and further examine 28 leading companies to highlight their products, strengths, and key differentiators.

| Serial No. | Company | Founded / HQ | Insurance Revenue | Total Assets | LICAT Ratio | AM Best Rating |

| 1 | Manulife | 1887, Toronto, ON | $26.6B | $1.3T

|

137%

|

A+ |

| 2 | Sun Life | 1865, Toronto, ON | $22.6B | $1.5T | 152% | A+ |

| 3 | Canada Life | 1846, Toronto, ON | $21.0B | $461.2B | 130% | A+ |

| 4 | Industrial Alliance (iA) | 1892, Quebec City, QC | $6.8B | $109.9B | 139% | A+ |

| 5 | Beneva | 1941, Quebec, QC | $4.8B | $27.5B | 150% | A |

| 6 | Desjardins | 1948, Levis, QC | $4.3B | $470.9B | 146% | — |

| 7 | RBC Insurance | 1864, Toronto, ON | $2.3B | $28.6B | 135% | A |

| 8 | Empire Life | 1923, Kingston, ON | $1.4B | $19.7B | 151% | A |

| 9 | BMO Life | 1817, Toronto, ON | $1.3B | $20.1B | 130% | A |

| 10 | The Co-operators | 1945, Guelph, ON | $1.0B | $10.5B | 168% | A |

| 11 | Securian Canada | 1955, Toronto, ON | $990M | $1.2B | 153% | A |

| 12 | Equitable Life | 1920, Waterloo, ON | $920M | $10.2B | 169% | A |

| 13 | ivari | 1927, Toronto, ON | $822M | $14.6B | 131% | A+ |

| 14 | Blue Cross Canada | 1939, Various | $686M | $2.3B | 135% | A- |

| 15 | Brookfield/Blumont Annuity Co. | Toronto, ON | $383M | $7.5B | 147% | — |

| 16 | Primerica | 1977, Duluth, GA | $359M | $4.1B | 191% | A+ |

| 17 | Chubb Life | 1882, Toronto, ON | $342M | $345M | 163% | A+ |

| 18 | Metropolitan Tower | New York, NY, USA | $331M | $2.3B | 171% | A+ |

| 19 | Wawanesa | 1896, Wawanesa, MB | $300M | $11.5B | 165% | A |

| 20 | Foresters | 1874, Toronto, ON | $0.2B | $1.8B | 200% | A |

| 21 | Combined of America | 1922, Chicago, IL | $230M | $1.1B | 176% | A+ |

| 22 | UV Insurance | 1889, Drummondville, QC | $225M | $2.4B | 172% | — |

| 23 | Humania | 1874, QC | $200M | $678M | 185% | A+ |

| 24 | TD Life | 1855, Toronto, ON | $155M | $344M | 200% | — |

| 25 | Assumption Life | 1903, Moncton, NB | $147M | $2.3B | 165% | A- |

| 26 | TruStage Life | 1902, Toronto, ON | $120M | $2.4B | 165% | A- |

| 27 | CIGNA Life | 1982, Bloomfield, CT | $111M | $136M | 245% | A |

| 28 | British Insurance Co. (Cayman) | Cayman Islands | $77M | $471M | 176% | — |

| 29 | Knights of Columbus | 1882, New Haven, CT | $76M | $30.3B | 274% | A+ |

| 30 | American Income Life | 1951, Waco, TX | $71M | $64M | 169% | A+ |

| 31 | New York Life | 1845, New York, NY | $42M | $696M | 353% | A++ |

| 32 | CIBC Life | 1961, Toronto, ON | $29M | $164M | 494% | — |

| 33 | Aetna Life | 1939, Toronto, ON | $28M | $98M | 496% | A |

| 34 | Teachers Life | 1972, Waterloo, ON | $25M | — | 234% | — |

| 35 | Serenia Life | 1972, Waterloo, ON | $20M | $371M | 177% | — |

| 36 | American Health & Life | 1954, Fort Worth, TX | $17M | $64M | 576% | A- |

| 37 | AWP Health & Life SA | Paris, France | $15M | $38M | 271% | — |

| 38 | Connecticut General | 1957, Bloomfield, CT | $4M | $195M | 223% | A |

| 39 | Reliable Life | 1887, Hamilton, ON | $3M | $14M | 310% | — |

| 40 | Jackson National Life | 1961, Lansing, MI | $254K | $11M | 458% | A |

* Methodology and sources for the above table

We standardize “revenue” as Insurance Service Revenue under IFRS 17 and reconcile across sources. Where company-year figures differ, we use the latest audited report and note variances in footnotes.

- Office of the Superintendent of Financial Institutions (OSFI) financial data (2024)

- A.M. Best Financial ratings (2025)

- Company annual reports

Your benefits are protected: If a member life insurer fails, Assuris protects your policy up to $1,000,000 or 90% of the death benefit, whichever is higher. This safety net applies to most Canadians.

1. Manulife

Manulife Financial Corporation is one of the largest life insurers in Canada, and also one of the most globally recognized, with operations in Canada, the U.S. (through John Hancock), and multiple Asian markets. Founded in 1887, the company manages approximately $1.3 trillion assets under management and administration globally.

2. Sun Life

Sun Life Financial, Inc. is one of the largest life insurers in the world, and also one of the oldest, with a history spanning back to 1865.

Apart from Canada, they have a presence in the U.S. and in seven Asian markets, including China and India.

3. Canada Life

Canada Life is one of the oldest and most stable life insurers in the country. Up until recently, it came second to Manulife in the number of annual premiums, which was no surprise given that Manulife is one of the largest companies in the world.

In 2020, Great West Life merged with its sister companies, London Life and Canada Life, into the single Canada Life Assurance Company brand. That merger pushed Canada Life to the top of the charts.

4. iA (Industrial Alliance)

iA (Industrial Alliance) Financial Group is one of the largest insurance and wealth management groups in Canada. They also have operations in the United States. It was founded in 1892 and offers both individual and group benefits products.

iA is more than an insurance company; they also work in property management and real estate. They rent out many office spaces in major cities across Canada.

5. Beneva

Beneva, formed from the merger of Quebec-based SSQ Insurance and La Capitale, ranks among Canada’s top mid-tier life insurers by assets (~$27.5B) and regional presence.

SSQ Insurance was founded in 1944, while La Capitale was founded just a few years earlier, in 1940. Both companies were founded and operated on mutualist values, which have carried on with their merger into Beneva. This makes it one of the biggest mutual insurance companies in the country.

6. Desjardins

Desjardins is well known across Canada, offering a wide variety of financial services and insurance products.

The company mainly focuses on life, health, and home insurance, and wealth management services. They also offer business services like point-of-sale payments and cash management.

7. RBC Insurance

The Royal Bank of Canada (RBC) is one of North America’s most well-known financial institutions. RBC Insurance is the division that provides insurance products and services to individuals and businesses across Canada.

8. Wawanesa

Wawanesa Mutual is the parent company of Wawanesa Insurance, which sells life and other insurance products. Founded in 1896 and based in Winnipeg, Manitoba, the company also operates as Wawanesa General in the United States, primarily selling property and casualty insurance in California and Oregon.

9. BMO

BMO Financial Group is one of the largest financial institutions in Canada, if not the world. It was founded in 1817 as the Bank of Montreal.

BMO Insurance is a part of BMO that sells insurance policies and similar services.

10. Equitable Life

Equitable Life Insurance Canada is a federally regulated mutual life insurer, governed by federal rules. Like Beneva and Wawanesa, Equitable is also a mutual company that is partly owned by some of its clients.

11. Empire Life

Empire Life was founded in Kingston, Ontario, in 1936. The company operates services, sales, and marketing centres throughout Canada. They are most well known for their permanent participating life insurance policies.

12. Foresters

Foresters Financial is a company that offers financial services in Canada, the US, and the UK. It was founded over 140 years ago, in 1870. Many of Foresters’ life insurance products help charities.

Many of its life insurance products support charities through claims, grants, or special programs. Foresters underwrite the insurance policies offered by Canada Protection Plan.

13. Co-operators

The Co-operators Group Limited is a leading Canadian co-operative company. They offer a wide range of insurance and financial services, mostly through a network of financial advisors and brokers.

14. ivari

ivari (formerly Transamerica Life Canada) was acquired by Wilton Re in 2015. They have been operating for more than 80 years, offering a variety of insurance policies and investment products.

15. Blue Cross

There are many different Blue Cross member plans in Canada. The Canadian Association of Blue Cross Plans is the group that represents all of them nationally.

Blue Cross is best known for group insurance and travel insurance. Canadians who are Blue Cross members can save money on insurance for various services, including vision, medical, and more, through their Blue Advantage program.

16. Securian Canada

Most people know Securian Canada by its old name, Canadian Premier Life. It is a company that offers financial management services and several insurance products.

17. Primerica

The Primerica Canada Insurance Company was started in 1986. It is a subsidiary of Primerica Life Insurance Company, offering insurance and other financial services.

18. Chubb Life

Chubb Life Insurance Company was founded in 1882. Now, they are a trusted and reliable provider of insurance in Canada. They have offices in Ontario, Quebec, Alberta, and British Columbia.

19. TruStage Life (Assurant Life)

The insurance company known as Assurant Life rebranded into TruStage in 2022 after it was bought by CUNA Mutual Group.

As an insurance company, they specialized in selling insurance for end-of-life planning, like funeral insurance and executor protection insurance. They also offer services like assessing and handling final documents (wills, trusts, etc.).

20. Combined Insurance Company of America

Combined Insurance Company of America is owned by Chubb Insurance Company in the US. It was founded in 1922 and sells insurance to people and businesses.

21. UV Insurance

UV Insurance, formerly known as UL Mutual, was founded in 1889 in Quebec.

22. Assumption Life

Assumption Life is best known for its no-medical term life plans. They were founded in 1903 in New Brunswick, Canada. But they were originally a fraternal society in Massachusetts, USA, before they decided to start selling insurance.

23. Knights of Columbus

Knights of Columbus is a Catholic fraternal organization founded in 1882 as a mutual benefit society for Catholic people who moved to the US. It provides coverage for members and their families, offers insurance and financial services, and actively engages in charitable work.

24. Humania

Humania Assurance was founded in Quebec in 1874 as a mutual society. They offer a lot of no medical life insurance options and are best known for how quickly they issue policies.

25. American Income Life

American Income Life was founded in 1951. The company now sells insurance in Canada, the US, and New Zealand. They focus on helping working families and members of credit unions, labour unions, and other associations get insured.

26. Serenia Life

Serenia Life is a U.S. fraternal benefit society that sells insurance in Canada. It was founded in 1972 and used to be called Faithlife Financial up until 2008. Their company is inspired by Christian values.

27. CIBC

CIBC Insurance is a part of CIBC (the Canadian Imperial Bank of Commerce), one of Canada’s biggest banks. The bank itself was formed in 1961 after two older Canadian banks merged into one. They later started selling insurance products too.

28. Reliable Life

Reliable Life has been helping Canadians with insurance since 1887. They are also part of a company called the Old Republic International Corporation, which is listed on the New York Stock Exchange. Reliable Life mostly sells travel insurance and accident insurance for students.

What’s new in our 2026 insurance company rankings?

For 2026, we’ve updated how we compare the biggest and best insurance companies in Canada to give a more complete and accurate picture.

Our updated approach looks beyond size and reputation. We now focus on financial strength, product quality, and customer satisfaction.

- We measure financial strength by looking at each insurer’s total assets, LICAT ratio (a key solvency indicator), and credit ratings from AM Best, S&P, and Moody’s. This helps us understand how stable and reliable each company is when it comes to paying claims.

- We also evaluate the range and flexibility of insurance products available, including life, health, and supplemental coverage. Insurers offering more customization, modern features, and digital tools score higher in this area.

- Lastly, we consider the customer experience—from how quickly claims are paid to how easy it is to manage your policy online. We review third-party ratings, client feedback, and the overall quality of digital services.

This new ranking system makes it easier for you to compare insurance companies in Canada and find the one that fits your needs best.

IFRS 17: How it changes reported revenue in 2026 rankings

International Financial Reporting Standard 17 (IFRS 17) replaced IFRS 4 (Insurance Contracts) for Canadian life insurers beginning January 1, 2023. It requires companies to recognize revenue based on the value of insurance services provided over time rather than on gross premiums received. This change often results in lower headline revenue numbers under the new standard, reflecting a more transparent and economically relevant view of insurance operations.

What it means for policyholders:

IFRS 17 does not change your premiums or coverage. You still receive the same benefits. However, it gives you a clearer view of how insurers manage risk and earn profits.

For investors, this standard improves transparency, reduces earnings volatility, and provides better insight into long-term financial performance.

How to choose the right insurer

When comparing the top life insurance companies in Canada, it’s important to go beyond size and brand recognition. Choosing the right provider means assessing financial strength, coverage options, premium affordability, and regional relevance.

Whether you are a young family, business owner, retiree, or high-net-worth individual, matching your needs with the right insurer can lead to better protection and long-term value.

| Category | What to look for |

| Financial strength |

|

| Coverage needs |

|

| Premium affordability |

|

| Digital and human support |

|

Is it better to choose a bigger insurance company?

Buying a policy from one of the biggest insurance companies in Canada may not always be the best choice. Just because a company is the biggest, it does not mean that it is the right company for your needs. Sometimes, going with a smaller company may be to your advantage.

This is why it is best to speak with our licensed advisors. They have intimate knowledge of the Canadian insurance market and can recommend the best provider for your specific needs.

Comparing large vs. small insurance companies

Choosing the right insurer depends on what matters most to you. Larger companies offer scale, extensive coverage options, and advanced technology, while smaller companies provide personalized service, flexible products, and local expertise. The table below highlights key differences to help you decide.

| Feature | Big insurance | Small insurance |

| Experience | Decades of industry expertise | Stable, often niche-focused |

| Coverage Options | Term & permanent, high limits | Tailored products, flexible riders |

| Price | Slightly higher, depends on scale | Competitive, sometimes lower |

| Customer Service | Fast, multiple offices & agents | Personalized, flexible, responsive |

| Accessibility | Extended hours, nationwide | Limited locations/hours |

| Technology | Advanced tools for quotes, claims, policy management | Simpler tech, more customization |

| Values & Ethics | Standard corporate practices | Local, mutual, or ethically aligned |

Still looking for the top insurance companies in Canada?

If you’re still not sure whether one of the largest Canadian insurance companies is right for you, our advisors are happy to help you out! Schedule a call and let our experts answer your questions about what is offered by Canadian insurance companies, big and small.

Online insurance brokers like PolicyAdvisor.com let you compare insurance quotes from 30 of the country’s best insurance companies. Schedule a call or try out our instant insurance quoting tools to see how much you can save by comparing quotes online

Frequently asked questions

How often do rankings of life insurance companies change?

Rankings can change annually or even more frequently, depending on factors like financial performance, customer service ratings, innovation, and regulatory changes. A company’s solvency, claims handling, and market share can all influence its position in industry reports or consumer rankings.

What factors affect the financial stability of life insurance companies?

Financial stability is typically measured by solvency ratios, capital reserves, investment performance, and underwriting profits. Companies with diverse investment portfolios, strong risk management practices, and consistent profitability are generally more stable and reliable over the long term.

Can I buy life insurance from a company not based in Canada?

You can only purchase life insurance from international companies that are licensed to operate in Canada. These insurers must comply with Canadian regulations and are monitored by federal or provincial insurance regulators. Buying from an unlicensed foreign insurer could leave you unprotected or unable to enforce your policy.

What are the benefits of choosing a large life insurance company over a smaller one?

Large insurers often offer a wider range of products, stronger digital platforms, and greater financial stability. They may also have more streamlined claims processes and better access to additional services, such as financial planning tools or wellness programs. However, smaller insurers may provide more personalized service or competitive pricing.

How do consumer ratings affect life insurance companies?

Consumer ratings influence a company’s reputation and can guide potential customers during their decision-making process. Positive reviews can enhance trust, while repeated complaints may raise concerns. While not the sole factor, consumer feedback is a helpful indicator of service quality and client satisfaction.

What should I do if I am not satisfied with my life insurance provider?

You should begin by reviewing your policy, identifying specific concerns and contacting your insurer’s customer service to discuss your issue. If the problem persists, you can file a complaint with your provincial insurance regulator. If you are considering switching providers, ensure your new policy is active before cancelling the old one to avoid any coverage gaps.

Which are the best insurance companies in Canada for 2026?

The best insurance companies in Canada for 2026 are determined by their financial strength, customer satisfaction, product innovation, and digital capabilities. Leading providers include:

- Sun Life, for strong client satisfaction and wellness-focused products

- Manulife, for innovation and global reach

- Canada Life, for scale and comprehensive coverage options

- Industrial Alliance, for regional expertise and competitive pricing

- Beneva, for a mutual insurance company

How do I choose between the largest insurance companies in Canada?

Choosing the right insurer involves assessing several factors such as financial strength (A.M. Best ratings and LICAT ratios), product suitability based on your needs, pricing competitiveness, quality of service and claims experience, and access to digital tools for convenience and support.

Are bigger insurance companies always better?

Larger insurance companies offer advantages such as financial stability, broad product availability, and extensive support networks. However, they may not always be the best fit. Smaller or regional insurers can provide more competitive pricing, personalized service, and flexible options tailored to specific needs.

What is the difference between the top 10 and top 20 insurance companies in Canada?

The top 10 insurers are typically national leaders with large-scale operations and diversified offerings. The top 20 includes regional and specialized insurers that may excel in niche markets or offer unique advantages in pricing, service, or policy design.

How often do rankings of the biggest insurance companies change?

Rankings among Canada’s top five life insurers tend to remain consistent year over year. However, changes can occur due to mergers, premium growth, or shifts in market strategy. Notably, Canada Life’s position strengthened following its merger with Great-West Life and London Life.

Can I trust the financial ratings of Canada’s largest insurance companies?

Yes. Canada’s major insurers are rated by independent global agencies such as A.M. Best, Moody’s, S&P Global, and DBRS Morningstar. These ratings reflect a company’s financial strength, claims-paying ability, and long-term stability, and are reviewed regularly.

Do the top Canadian life insurance companies operate nationwide?

Yes, all top life insurance companies in Canada are licensed to operate nationwide. While some have stronger regional footprints, such as Desjardins and iA in Quebec or Wawanesa in the West, they serve clients across the country either directly or through licensed advisors.

What makes the best insurance companies in Canada in 2026 different from previous years?

Top insurers in 2026 are distinguished by their investment in digital transformation, faster underwriting through AI, integrated wellness and health features, ESG investment practices, and personalized insurance solutions using data and analytics. These enhancements improve both accessibility and client experience.

The biggest life insurers in Canada stand out for their size, stability, and strong coverage options. Sun Life, Manulife, Canada Life, Beneva, and Industrial Alliance (iA) consistently rank among the top providers for financial strength and reliability.

Canadian Life and Health Insurance Association (CLHIA). Canadian Life & Health Insurance Facts, 2024 Edition. Toronto: CLHIA, 2024.

International Financial Reporting Standards Foundation. IFRS 17 Insurance Contracts: Fact Sheet. London: IFRS Foundation, 2023.