- The top five life insurance companies in Canada with an A+ strength rating from AM Financial are Canada Life, Sun Life, Manulife, Industrial Alliance, and Ivari

- We have rated the top 16 Canadian insurers based on coverage amounts, premium rates, application process, rider options available, and financial strength rating

- When choosing a life insurance company, consider their underwriting policy, claims process and settlement ratios, costs, riders, and customer service to ensure they meet your requirements

- Which are the best life insurance companies in Canada?

- Our Reviews: Best providers for term life insurance

- How did we rank life insurance companies?

- What is the cost of life insurance in Canada?

- What's the best type of life insurance?

- Market Changes and Innovations

- How to get the best term life insurance in Canada?

- Frequently asked questions

Choosing the best life insurance company in Canada depends on your financial goals and insurance needs. Whether you want to leave a legacy for your family, cover outstanding debts, or protect your business, having the right life insurance plan is crucial. However, with the number of players offering life insurance products, making the right choice can be hard. Each company has their own benefits and features that can suit different needs.

That’s why our licensed life insurance experts have reviewed and rated top Canadian providers to bring you our list of the 16 best rated life insurance companies in Canada. In this article, you will find honest insights on different life insurance providers and how they can meet your needs.

Which are the best life insurance companies in Canada?

Some of the best life insurance companies in Canada include Manulife, Canada Life, Desjardins, Empire Life, BMO, RBC, and more. However, depending on your needs, choosing the right one is important.

Our advisors have created a list of the best life insurance companies in Canada. Combining years of expertise and the unique benefits that each company offers, we have curated a list of the top 16 life insurance providers.

Top life insurance companies in Canada

The best life insurance company for you depends on your unique needs. But, if you’re looking for term life insurance coverage, our team recommends:

| Company | Best for… | AM best financial strength rating | PolicyAdvisor rating |

| Assumption Life | Simplified issue | A- | 5 |

| Beneva | Combo coverage | A | 4 |

| BMO | Affordability | A | 5 |

| Canada Life | Financial strength | A+ | 4 |

| Canada Protection Plan | Non-medical | NA | 5 |

| Desjardins | Stability | NA | 4 |

| Empire Life | Personalization | A | 5 |

| Equitable Life | Families | NA | 4 |

| Foresters | Giving back | NA | 4 |

| Humania | Quick issue | NA | 4 |

| Industrial Alliance | Flexibility | A+ | 5 |

| Ivari | Layering | A+ | 3 |

| Manulife | Digital innovation | A+ | 5 |

| RBC | Value for money | A | 5 |

| Sun Life | Buying in-person | A+ | 5 |

| Wawanesa | Price | A | 4 |

Choosing the right insurance company

While choosing a life insurance company, some of the factors that you should keep in mind are the underwriting, claims process, riders and optimizations, policy costs, and customer service. You should also look at added benefits for certain demographics such as business owners, doctors, and parents. If you are someone who has a pre-existing condition, you should consider companies that offer no-medical life insurance plans.

A good indicator of any company is the claims settlement ratio. This is where you look at the ratio of claims received versus settled. A higher ratio is always a good indicator.

Detailed ratings and reviews of the top life insurance companies in Canada

Best for Simplified Issue: Assumption Life

Our Assumption Life rating and review:

We’ve given Assumption Life Insurance Company 5 stars and rated them as the best life insurance provider for Simplified Issue policies. These policies do not ask you to do a medical exam, but may have some simple medical questions on the application.

Assumption Life offers 4 different types of non-medical policies, making them a great option for people who may have health issues. You can also get bigger amounts of coverage if you opt for full underwriting.

Unique selling point (USP): Wide range of non-medical policies designed for those looking to qualify without medical underwriting

Types of life insurance offered: Term life, whole life, guaranteed life

Pros:

– Multiple term coverage options

– Simplified, non-medical issue options available

– Quick, easy electronic process

– Decreasing option available for mortgage coverage

Cons:

– Wide range of options can be confusing

– High policy and rider fees on non-medical policies

Best for Combo Coverage: Beneva

Our Beneva rating and review:

We’ve given Beneva Life Insurance 4 stars and rated them as the top provider if you want combined coverage. Their insurance products, riders, and features let you get a lot of different types of insurance in one place.

Beneva is rare in that they include an Extreme Disability Benefit for free in all of their life insurance plans. You get double the coverage than usual, and that’s unique!

Unique selling point (USP): Offers a built-in disability insurance rider with all life insurance policies. Simplified and guaranteed issue life insurance coverage offered in under 60 minutes for those in good health.

Types of life insurance offered: Term life, whole life, universal life, simplified issue life insurance (term and whole), guaranteed issue permanent life insurance

Pros:

– A built-in Extreme Disability Benefit is unique in the industry

– Options to add critical illness and monthly disability indemnity for comprehensive financial protection

– Several optional riders: accidental death and dismemberment and children’s term coverage

– Preferred rates available starting at $250,000

Cons:

– Longer turnaround times for policy approval other than no-medical plans

Best for Affordability: BMO Insurance

Our BMO Insurance rating and review:

We’ve given BMO Insurance 5 stars and rated them as the best company if you’re looking for affordable coverage. Most of their policies have good prices and can be used for multiple purposes.

BMO’s term life insurance is a great option for just about anyone — individuals, couples, or business owners. On top of their great pricing, their plans cover most of the standard features expected in a life insurance plan in Canada.

Unique selling point (USP): Offers a Performance Bonus with their whole life plans that is guaranteed to never be negative. All life insurance policyholders get access to BMO Insurance Health Advocate Plan—a comprehensive health counselling and personal assistance service.

Types of life insurance offered: Term life, whole life, universal life

Pros:

– Great value for cost

– Can exchange 10-year term into longer term products

– Compassionate benefit program—death benefit advance in event of terminal illness

– Option to convert term policies to whole life without medical examination

– Electronic contract delivery

– Multi-policy discount available

Cons:

– No digital policy, only paper policies are issued

– Longer term life policies (25 and 30 year) are not renewable

– No online account

Best for Financial Strength: Canada Life

Our Canada Life Insurance rating and review:

We’ve given Canada Life Assurance Company 4 stars and rated them as the top choice for financial strength. Which is to be expected considering they’re the biggest insurance companies in Canada.

Canada Life earns billions in annual premiums, with $396 billion in assets and a financial strength rating of A+ from A.M. Best. They’re extremely stable, and they have great life insurance policy options to boot.

Unique selling point (USP): Unique Business Protection Growth life insurance rider lets business owners add more coverage as their business grows. No maximum coverage limit on whole life policies

Types of life insurance offered: Term life, permanent life (participating whole life and universal life)

Pros:

– Multiple term coverage options (5-50 years)

– Multiple rider options for single and joint policies

– Options to convert into permanent coverage

Cons:

– Minimum $100,000 coverage or $500 annual premium required

– Limited access to online account features

Best for Non-Medical Policies: Canada Protection Plan

Our Canada Protection Plan rating and review:

We’ve given Canada Protection Plan 5 stars and rated them as the best provider for No-Medical policies. These plans do not ask you for a medical test or have medical questions, but usually cost a bit more.

Like Assumption Life, Canada Protection Plan also gives you great options if you’re looking for life insurance coverage without doing medicals. They have both simplified or guaranteed insurance policies available.

Unique selling point (USP): Multiple products offering simplified, no-medical coverage for applicants across all health categories. Most products are available through a quick, simple, online application without any medical tests

Types of life insurance offered: No-medical and simplified issue, term life, permanent life

Pros:

– Affordable premiums, including no-medical policies

– Available to temporary residents such as those on a student or work visa

– Most plans offer life protection

– Most products available through an easy online application without any medical tests

– Customers can pay annual premiums by credit card

– Decreasing term option available (ideal for covering mortgage debt)

– Digital e-policy

Cons:

– Premiums can be more expensive than competition

– Coverage ends at age 80 (most other Canadian providers end at 85)

Best for Stability: Desjardins Insurance

Our Desjardins Insurance rating and review:

We’ve given Desjardins 4 stars and rated them as the best company for stability. Saying that they’re a well-established company would be putting it too mildly.

Desjardins is one of Canada’s top ranked life insurance companies and financial groups, one of the biggest and oldest providers, and one of the world’s 50 safest banks and financiers. Their term life products can meet a wide range of needs.

Unique selling point (USP): Offers no-medical life insurance to seniors aged between 50-75, a rare offering in the industry. Reduced premiums when purchasing two or more coverages

Types of life insurance offered: Term life, permanent life, life insurance over 50, participating life, universal life

Pros:

– Several optional riders and benefits

– Robust suite of critical illness, disability, and permanent life insurance available

– Multi-policy discount available

– Top 10 largest insurance company based on annual premiums

– Digital e-policy

Cons:

– Premiums can be more expensive than competition

Best for Personalization: Empire Life

Our Empire Life rating and review:

We’ve given Empire Life 5 stars and rated them as the best insurer for personalization. They give you a lot of leeway to choose the options that work best for you. This is flexible and affordable coverage that can suit many Canadians perfectly.

Their Solution series offers 10-year, 20-year-, or 30-year term insurance, or permanent insurance that covers you up to age 100. Or you can get an annual renewable term that lasts for 1-year increments.

Unique selling point (USP): A suite of life insurance products for all age groups and demographics—children, families, seniors, business owners, and those with pre-existing conditions. Solution 100 term policy has cash value (rare in the market)

Types of life insurance offered: Term life, permanent life, permanent participating life, no-medical life insurance

Pros:

– Some of the most versatile coverage options in Canada

– Instant approval possible

– Highly competitive premiums

– Comprehensive rider options

Cons:

– Individuals above 75 years of age cannot purchase Empire Life whole life insurance policy

– Limited term options

Best for Families: Equitable Life

Our Equitable Life rating and review:

We’ve given Equitable Life 4 stars and rated them as the best company for families. They make it easy for you to add coverage for multiple people on one policy. This helps families save on fees and put some cash back in their wallets.

Unique selling point (USP): Great for a strategy called “laddering”, where you only pay for coverage as you need it. Reduced premiums when purchasing two or more coverages

Types of life insurance offered: Term life, whole life, universal life

Pros:

– Options to bundle coverage with critical illness

– Preferred clients automatically qualify for EquiLiving critical illness insurance

– Can create family plan by adding child term rider

Cons:

– Limited term offerings

– Equitable does not have a non-participating whole life insurance option to choose from

Best for Giving Back: Foresters Financial

Our Foresters Financial rating and review:

We’ve given Foresters Financial 4 stars and rated them as the best company for giving back. Many of their products come with a unique perk: a charitable benefit feature where they will donate to a charity of your choice on your behalf.

Foresters is also a great choice if you have changing needs. Their term insurance is simple and straightforward, but they also have options that give you better coverage if your needs change in the future and you need insurance to match that.

Unique selling point (USP): Charitable benefit feature where Foresters will donate all or part of your death benefit to a charity of your choice. MyForester member benefits, including grants, scholarships, access to well-being programs, and more, for life insurance policyholders

Types of life insurance offered: Term life, whole life

Pros:

– Multiple term coverage options

– Simplified and quick fulfillment options available

– Unique community membership benefits (discounts on hotels, attractions, learning libraries, wills, gift cards, online shopping, etc.)

– $1,000 bereavement assistance with whole life plans to help beneficiaries cover counseling services upon the insured’s death

– Quit-smoking Incentive Plan offers lower premiums to those who stop smoking for at least two years after they buy a policy

Cons:

– Premiums can be more expensive than competition

– No online access to policy details

Best for Quick Issue Options: Humania

Our Humania Assurance rating and review:

We’ve given Humania Assurance 4 stars and rated them as the best company for quick issue policies. Their main term life insurance product is designed to make it easy for you to get approved fast.

Humania’s policies usually don’t have many requirements. Most are done online and can be approved on the spot. They also let you choose coverage for multiple terms, up to a maximum of 30 years or until age 80.

Unique selling point (USP): Humania’s no-medical life insurance product has a unique eligibility criteria—working status. If an individual with a pre-existing condition is working, they are eligible for up to $300,000 of simplified issue term coverage

Types of life insurance offered: Term life, no-medical term life

Pros:

– Competitively priced premiums

– Simplified and quick fulfillment options available

– Non-medical coverage options available

– Automatic approval for critical illness and debt disability coverage for those with standard health plans

– Digital e-policy

Cons:

– Limited life insurance product portfolio—no whole or universal life insurance is available

– Term coverage only available until age 80

– No online access to policy details

Best for Flexibility: Industrial Alliance

Our iA Financial Group rating and review:

We’ve given Industrial Alliance (iA) 5 stars and rated them as the best for flexibility. They’re one of the few insurers that lets you customize your term length with their unique Pick-A-Term product.

You can pick anywhere between 10-40 years for term coverage with iA Financial Group, letting you match your term insurance with any specific number of years, like if you’re using life insurance to cover your mortgage.

Unique selling point (USP): Their Pick-A-Term product is rare in the market and lets individuals choose the length of their term life insurance. With Specialized life insurance, policyholders get an annual bonus that increases their death benefit

Types of life insurance offered: Term life, permanent life, participating life, universal life, specialized life insurance

Pros:

– Flexible plans allow personalized coverage

– Both level and decreasing options

– Non-medical coverage options available

– Optional disability rider — can be used with decreasing coverage for mortgage protection

– Digital e-policy

– Underwriting can be more accommodating than competitors

Cons:

– Premiums can be more expensive than competition

Best for Layering: ivari

Our ivari rating and review:

We’ve given ivari 3 stars and rated them as the best provider if you want to do a layering strategy. Laddering is when you buy multiple term life policies that end at different times. You can terms of 10, 20, or 30 years with this company.

ivari makes it easy for you to get multiple policies that overlap, so you can create custom coverage that is just perfect for you. You can get just one term life policy, or you can combine policies with more terms or different types of insurance.

Unique selling point (USP): Excellent for layering or laddering multiple policies for extended coverage at affordable rates

Types of life insurance offered: Term life, universal life, simplified and guaranteed issue

Pros:

– Several optional riders, including children’s insurance

– Multiple term coverage options

– 30-year term has flexible options upon maturity

– Online access to account

– Digital e-policy

Cons:

– Premiums can be more expensive than competition

– No whole life insurance options

Best for Digital Innovation: Manulife

Our Manulife rating and review:

We’ve given Manulife 5 stars and rated them as the best for digital innovation. This company almost needs no introduction. It’s one of the biggest insurers not just in Canada but in the entire world — an industry leader in every sense.

Manulife was one of the first companies to take more of the life insurance process online in Canada. Their underwriting uses advanced technology to approve up to $2 million in life insurance without needing a medical exam.

Unique selling point (USP): The Manulife Vitality program rewards policyholders for maintaining a healthy lifestyle. With Manulife Vitality, policyholders can get gift cards, discounts, and even an Apple watch!

Types of life insurance offered: Term life, permanent life, guaranteed issue

Pros:

– Immediate cash value growth and guaranteed cash value in the early years with their Manulife Par product

– Offers a fully electronic, digital fulfillment

– Offers cash advance in event of terminal illness

– Option to increase coverage up to 5th anniversary of certain term policies (rare in the market)

– Digital e-policy

Cons:

– Premiums can be more expensive than competition

– No non-participating whole life insurance options

Best for Value For Money: RBC Insurance

Our RBC Insurance rating and review:

We’ve given RBC Insurance 5 stars and rated them as the best company if you want value for money. They have some of the most competitive premiums in the Canadian life insurance market.

RBC Insurance offers a best-in-class term life insurance product. They already beat the competition on price alone. And you can choose from different term lengths and coverage amounts.

Unique selling point (USP): Some of the best term products on the market at the most affordable premiums. Term exchange lets policyholders exchange a Term 10 policy with a Term 15, 20, or 30 policy without additional medical underwriting

Types of life insurance offered: Term life, term 100, whole life, universal life, guaranteed acceptance

Pros:

– Affordable premiums — among the most competitive in the industry

– Max. coverage of $25 million

– Pick-a-term feature (rare in the market)

– Multiple rider options

– Five dividend options with their whole life plans, highest among Canadian insurers

– Digital e-policy

– Online access to account

– Quick, easy application process: just 10 questions for coverage under $1 million

Cons:

– Cash value is only accessible after 5 years for Growth Insurance policyholders

– No non-participating whole life insurance options

Best for In-Person Purchase: Sun Life Financial

Our Sun Life Insurance review and rating:

We’ve given Sun Life Insurance 3 stars and rated them as the best for buying in-person. Their products are most often sold in-person through a professional like an insurance broker or advisor.

Sun Life’s term policies have standard features and optional benefits that can compete in the market. But their premiums may cost more than some other companies charge.

Unique selling point (USP): Impressive product portfolio with multiple term, participating and non-participating whole life insurance, and guaranteed whole life insurance

Types of life insurance offered: Term life, permanent life insurance

Pros:

– Multiple rider options

– Multiple options to convert to permanent coverage up to age 75 (most competitors stop at age 70 or 71)

– Non-medical coverage options available

– Max. coverage of $1 million for anyone legally living in Canada — not just citizens and permanent residents

– Digital e-policy

– Online access to account

Cons:

– Premiums can be significantly more expensive than competition

– Stricter underwriting process for pre-existing health conditions

Best for Price: Wawanesa

Our Wawanesa rating and review:

We’ve given Wawanesa 4 stars and rated them as the best for price. Their premiums are often among the lowest in the industry, and you get your pick of either term policies from 10-30 years or up to age 80.

Wawanesa can also be a good option if you want to layer your coverage. You can get a base term plan then add up to four term life insurance riders with different term lengths. You can do this all in one policy.

Unique selling point (USP): Term-to-age 80 plan offers level premiums for seniors with renewal up to age 100

Types of life insurance offered: Term life, whole life insurance

Pros:

– Affordable premiums — among the most competitive in the industry

– Range of coverage options allows for insurance laddering

– No policy or rider fees

– Coverage up to $500,000 approved without medical exam for those under age 45

– Digital e-policy

Cons:

– Longer turnaround times for policy approval

– Policies can only be converted into non-participating permanent products

Methodology: How did we rank life insurance companies?

Our life insurance company rankings were the result of in-depth research into key factors like:

- Coverage amounts: We evaluated the maximum and minimum coverage offered to ensure a range suitable for various financial needs

- Term lengths: Term lengths were assessed to give an overview of the variety of different company’s offerings

- Premium rates: We compared the cost of premiums to identify the most affordable options for consumers

- Application process: Analyzed the ease and convenience of applying for a policy, including underwriting requirements

- Online access: Reviewed the availability and functionality of online tools and account management features

- Rider options: Considered the range and flexibility of additional riders that can customize and enhance the base policy

- Key features: We have highlighted unique or standout features that add value to the policy.

- Financial strength rating: Examined the company’s financial stability and ability to meet its long-term obligations

- And more

Our team of licensed insurance advisors worked together to carefully assess the different policies available in Canada. Using this, we narrowed down a list of the best insurance company for life insurance products that meet diverse needs.

How much does life insurance cost?

The cost of life insurance depends on factors such as your age, smoking status, gender, medical history, coverage amount, and policy type.

Term life policies normally cost a lot less than whole life. This is because it usually doesn’t last as long and doesn’t have extra features like cash value and dividends.

Average term and whole life insurance rates for smokers and non-smokers

| Age Group | Term Life – Nonsmokers | Term Life – Smokers | Whole Life – Nonsmokers | Whole Life – Smokers |

| Male / Female | Male / Female | Male / Female | Male / Female | |

| 25-34 | $15 / $13 | $30 / $25 | $275 / $250 | $350 / $300 |

| 35-44 | $20 / $18 | $45 / $35 | $350 / $300 | $475 / $400 |

| 45-54 | $50 / $40 | $100 / $80 | $500 / $425 | $700 / $575 |

| 55-64 | $100 / $80 | $180 / $150 | $750 / $625 | $1,100 / $900 |

| 65+ | $200 / $150 | $350 / $300 | $1,200 / $1,000 | $1,800 / $1,500 |

*Representative values based on average monthly costs of term and whole life premiums for $100,000 in coverage from Canada’s best life insurance companies.

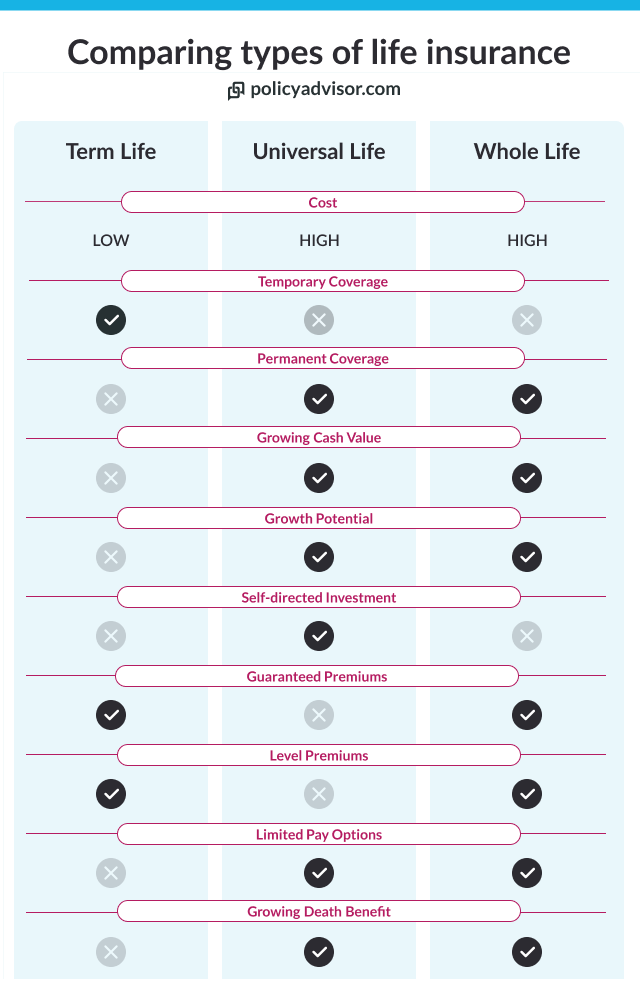

What’s the best type of life insurance?

The best type of life insurance policy again depends on your own circumstances, needs, and goals. It will be different for everyone. For example:

1. Term life insurance

This is the best option for you if you are relatively young and have short-term financial needs or obligations, such as paying off a mortgage or supporting young children.

Many Canadians prefer this type of insurance because it offers substantial coverage for a lower premium over a specified term, typically ranging from 10 to 30 years.

2. Whole life insurance

This type of insurance is ideal if you are looking for lifelong coverage that not only protects your beneficiaries but also allows you to accumulate savings over time.

Whole life insurance policies come with an investment component that builds cash value, which you can borrow against or use during your lifetime for various financial needs.

3. Universal life insurance

Consider this option if you desire the lifelong coverage provided by a whole-life policy but with more flexibility in managing the investment component.

Universal life insurance allows you to adjust your premiums and death benefits while giving you control over how the investment portion is allocated, potentially maximizing your policy’s value based on your financial strategy.

4. No-medical life insurance

This type of policy is most suitable if you have existing health issues or prefer not to undergo extensive medical examinations and answer detailed health-related questions.

No-medical life insurance offers the convenience of quicker approval and can provide peace of mind for those who might otherwise have difficulty qualifying for traditional life insurance policies.

If you’re unsure, book some time with one of our licensed advisors to get expert advice on which type of policy would best fit your needs.

Market changes and innovations in life insurance in Canada

The Canadian life insurance industry is evolving rapidly, driven by digital transformation and changing consumer expectations. At PolicyAdvisor, we constantly leverage artificial intelligence to improve your insurance-buying experience.

Some of the AI tools that we have built and implemented are:

- AI-powered life insurance calculator that analyzes your unique profile—age, health history, lifestyle factors—to generate personalized quotes from top Canadian insurers

- AI-driven advisor support that assess sentiment and engagement levels during consultations, helping our licensed experts customize policy suggestions based on individual concerns and preferences

- AI-assisted scheduling system automatically assigns the right advisor based on availability and expertise, ensuring our customers are matched with specialists who can address their specific insurance needs efficiently

Market trends also reflect growing demand for digital-first solutions and new policy types. Many of our insurance partners, including Sun Life, Manulife, Canada Life, and others, use predictive analytics to refine underwriting and offer faster approvals, sometimes without the need for a medical exam.

How to get the best term life insurance Canada?

You can find the best insurance policies for your needs on PolicyAdvisor. Our advanced AI calculator helps you instantly compare life insurance quotes from 30 of Canada’s top insurers—all under 60 seconds!

Prefer personalized guidance? Schedule a free, no-obligation call with one of our licensed advisors. Get answers to all your questions without the pressure of making a hurried decision.

Get started now and take the first step towards securing your family’s future with PolicyAdvisor!

Frequently asked questions

Which is the top insurance company in Canada?

The top 5 life insurance companies in Canada are Canada Life. Manulife, Sun Life, Industrial Alliance (iA), and Desjardins if you’re looking at size and financial strength alone.

In our ratings, we looked at more than just financial strength, though. Other policy details matter when you’re figuring out which ones are the best Canadian life insurance companies.

What’s the cheapest life insurance in Canada?

Term life insurance is the cheapest type of insurance policy in Canada. Premiums are lower because coverage is temporary, and the policies don’t have extra options like a savings & investment component — the way whole life insurance does.

Life insurance premiums depend on your personal details as well as your policy details. In general, you’ll get the lowest life insurance rates if you are:

- Young

- Healthy

- Non-smoker

- Female

What’s the best amount of life insurance to buy?

You should get enough life insurance to cover your family’s needs. The general rule of thumb is to get 10-12 times your annual income. But you may need more.

The best way to find out how much life insurance you should buy is to use our life insurance calculator. It will ask you some questions and then tell you the best amount for your needs.

How to get the best quotes for term life insurance?

You can find the best quotes for term life insurance on PolicyAdvisor.com. Our online platform lets you easily customize your plan and compare quotes from leading providers in under a minute.

Save time and money when you shop and compare online. Click the button below to get started now.

What are the best life insurance options for Canadians with pre-existing conditions?

Canadians with pre-existing conditions have several life insurance options, depending on their health status and coverage needs. Simplified issue life insurance requires no medical exam but may include a short health questionnaire. Guaranteed issue life insurance is available without medical questions but often comes with higher premiums and lower coverage amounts. Some insurers also offer rated traditional policies, where coverage is granted with adjusted premiums based on medical history.

Can non-residents buy life insurance in Canada, and what are the requirements?

Yes, non-residents can buy life insurance in Canada, but eligibility depends on factors like residency status, country of citizenship, and medical history. Most insurers require applicants to be in Canada during the application process and undergo medical underwriting.

Some policies may have additional restrictions for applicants from high-risk countries. Proof of ties to Canada, such as property ownership or financial interests, may also be necessary.

What should parents know about buying life insurance for their children?

Parents can purchase life insurance for their children as a way to secure future insurability and provide financial protection. Child life insurance policies typically offer lifelong coverage with fixed premiums and the option to build cash value over time.

Some policies allow children to convert coverage into larger amounts without medical exams when they become adults. Riders on a parent’s policy can also provide affordable coverage for children.

What are the tax implications of life insurance payouts in Canada?

In Canada, life insurance death benefits are tax-free for beneficiaries. However, if the policy has a cash value component, any withdrawals or loans taken against it may be taxable. For business-owned policies, taxation depends on how the proceeds are distributed. Additionally, life insurance can play a role in estate planning, helping to offset potential taxes on assets passed to heirs.

Can life insurance policies be bundled with other types of insurance for better rates?

Yes, some insurers offer bundling discounts when life insurance is purchased alongside other policies such as home, auto, or critical illness insurance. Bundling can simplify policy management, reduce premiums, and provide enhanced benefits.

We’ve rated the Best Life Insurance Companies in Canada to help you figure out which provider you should choose. We looked at overall performance and features like the best options for couples and families, no-medical options, and more. Use this list as a guide to help you compare and shop for the best life insurance policy in Canada.

1-888-601-9980

1-888-601-9980