Life Insurance

in Toronto

Get a no-obligation quote for life insurance in Toronto!

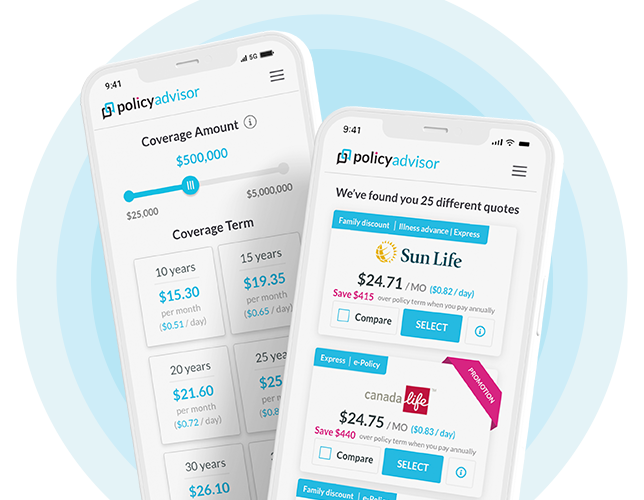

Get Instant Quotes from the Top 25 companies in Canada

Get the best life insurance in Toronto, Ontario

Toronto, the heart of Canada, is hugely preferred by Canadians as the best city to settle down. The city offers the best infrastructure, a diverse culture, and the most promising opportunities for its residents. Having life insurance can shield families living in Toronto, Canada, from any unfortunate incidents resulting from the unfortunate demise of an earning member.

Why should you get life insurance in Toronto?

A life insurance policy can provide financial security and can help cover the following:

- Debt or mortgage

- Funeral expenses

- Cost of living

- Children’s education

- And more

Key considerations for life insurance in Toronto

Some of the key factors to consider when purchasing life insurance in Toronto are:

- Cost of living

- Demographic profile

- Unique lifestyle factors

- Life expectancy in Toronto

- Cost of funerals in Toronto

As the capital city, Toronto is definitely one of the most expensive cities in Canada. Several reports suggest that the cost of living in this city is 88% higher than most other cities in the world.

Additionally, Numbeo’s estimator projects that a family of four may require around $5,500 per month (excluding rent) to sustain a life in Toronto. With such high rates of living, affording a decent lifestyle may become tedious, especially in the absence of a proper income source.

This is where life insurance payouts can come in handy. Life insurance policies can ensure that the dependent family’s overall economic needs are taken care of in the absence of an earning individual.

Toronto’s demographic profile indicates an overwhelming population of working-age individuals. According to Statistica Canada, 69.2% of the city’s population is between 15 and 64 years old.

17.5% of the working population consists of young adults between 25 and 34 years old. These young individuals are at lower mortality risks and can purchase life insurance policies at a much lower cost.

In Toronto, several factors related to the individual’s lifestyle may determine the cost of their life insurance policy. Some common factors include:

- Health status

- History of pre-existing diseases

- Smoking status

- Work environment

Living in a densely urbanized city can expose individuals to several health-deteriorating factors, which may adversely impact life insurance premiums. Additionally, individuals working high-risk jobs in hazardous work environments such as construction may have to pay a higher premium.

Need help to find the best life insurance quotes in Toronto, Ontario?

Reach out to our team of licensed insurance advisors at any time. We’re happy to help walk you through it or find the best deals for you!

An individual’s age plays a crucial role in determining the cost of their insurance premium. According to Toronto’s Central Health Integration Network, the city’s average life expectancy is 78 for men and 83 for women.

With the life expectancy rates being quite high, it is possible that the value of life insurance premiums may be lower in Toronto, especially for the younger population.

Funerals can be expensive, especially for a grieving family who lost their loved one. The average cost of a funeral in Toronto typically ranges between $5,000 to $15,000. Life insurance payouts can be a great support for families in covering funeral costs and reducing the financial burden on the surviving family.

The cost of life insurance in Toronto depends on the age, gender, health status, and policy details. Here are some numbers for life insurance in Toronto.

- Average coverage amount per person: $504,000

- Average premium starts at $26.50-$56.5 per month

- Premiums for term life insurance in Toronto can go up to $200 per month

Best for simplified issue:

Best for combo coverage:

Best for affordability:

Best for financial strength:

Best for non-medical:

Best for stability:

Best for personalization:

Best for families:

How do I find the best life insurance quotes in Toronto?

Speaking to a licensed insurance advisor can ensure you get the best life insurance quote in Toronto. An insurance expert, such as those at PolicyAdvisor, can help you assess your needs and find tailored coverage for yourself.

Once you get a life insurance quote, that rate is locked in if you purchase the policy. So, no matter what happens in the future, you’ll be guaranteed that same rate!

On the other hand, insurance usually costs more the older you get. Getting an affordable life insurance quote today will always be your best bet to finding the lowest rates and locking them in!

You can get even lower quotes by switching up some of the features of your policy.

Life insurance prices can change based on a wide range of personal details, like gender, age, and health history. But it can also change based on the type of life insurance plan (term or permanent), term length, coverage amount, deductible, and payment options, among other factors.

Take a look at the table below to get an idea of how changing the amount of coverage can change your life insurance quote.

Term life insurance quotes in Toronto, Ontario?

| Coverage | 10-year term (female, smoker) | 20-year term (female, non-smoker) | 10-year term (male, smoker) | 20-year term (male, non-smoker) |

| $250,000 | $25.28 | $18.40 | $28.73 | $13.98 |

| $500,000 | $40.10 | – | $49.20 | $26.70 |

| $1,000,000 | $51.00 | – | $76.50 | $50.02 |

*Representative monthly premiums, based on a term life insurance quotation for 29-30 year old male and female in regular health.

Why choose PolicyAdvisor for life insurance in Toronto?

Whether you need term life insurance, whole life insurance, no medical life insurance or any other type of coverage available in Toronto, PolicyAdvisor has you covered.

Our easy-to-use tools and expert advisors can help with life insurance quotes in Toronto.

- Save time. Get no-obligation quotes from Toronto’s top life insurance companies in minutes

- Save money. Compare quotes from 30+ insurance providers at once to ensure you get the best price

- Shop anywhere. PolicyAdvisor’s next-gen insurance tools let you shop and compare quotes on your phone or computer from anywhere

- Personalized service. Every PolicyAdvisor customer in Toronto is assigned their own experienced insurance advisor

Getting life insurance is one of the biggest decisions of your life, so it makes sense that you want to be sure. Reach out to our team if you need any help! Or visit our Life Insurance Learning Centre to get all the answers to your questions before you get started.

Frequently asked questions

What is the best life insurance in Toronto?

The best life insurance option in Toronto will depend on your unique circumstances and needs. It may also depend on a few crucial factors, such as:

- Age

- Medical history

- Income status

- Quality of lifestyle

It’s best to have an in-depth discussion with a life insurance broker in Toronto. Once they assess your unique needs, they will find the best insurance option for you.

Where can I get the best life insurance quotes in Toronto?

Most life insurance companies provide competitive ratings in Toronto based on a few comparable factors. We advise you to find an expert broker who can direct you to the best life insurance companies in Toronto and their key offerings.

Once you find the policy that best suits your needs, you can ask your broker to send you a quote for the same.

What is the best life insurance in Toronto for seniors?

There are several life insurance companies that have created policies keeping senior citizens in mind. However, life insurance for seniors may be more expensive.

Talk to an expert to compare the best plans, their premium rates, and their offerings, and choose the one that’s best for you.

1-888-601-9980

1-888-601-9980