The Best

Life Insurance

in Ontario

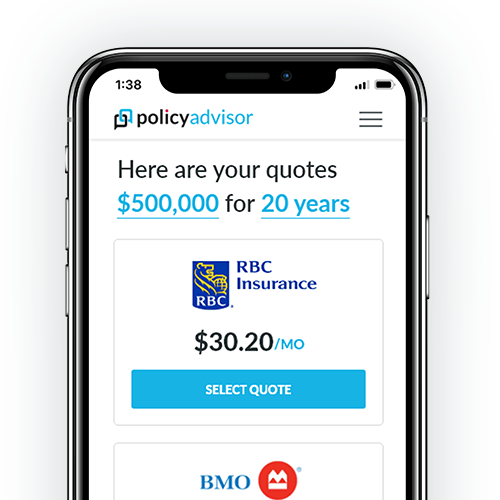

PolicyAdvisor is a digital insurance broker in Ontario that can help you apply for coverage online

Whether you need term life insurance, whole life insurance, no medical life insurance or any other type of coverage available in Ontario, PolicyAdvisor has you covered.

Our simple-to-use tools and expert advisors have been helping Ontarians get life insurance quotes and coverage easily and online.

- Save Time. Get no-obligation quotes from Ontario’s top life insurance companies in minutes.

- Save Money. Compare quotes from multiple insurance providers at once to ensure you get the best price.

- Shop Anywhere. PolicyAdvisor’s online insurance tools lets you shop and compare quotes on your phone or computer from anywhere you have an internet connection.

- Personalized Service. Every PolicyAdvisor customer is assigned their own experienced insurance advisor. They don’t work on commission, and instead ensure you get the right coverage that fits your budget.

The easiest way to get life insurance quotes online in Ontario

Some online insurance brokers simply collect your contact information and have a representative call you to start the same old process to get a life insurance quote. We’re different.

- Provide basic details

Give us some basic details about your age, sex, and smoking status and we can get started. - Choose your coverage

Enter the term and amount of insurance you’re looking for, or simply use a slider to get to the correct number. - Get a quote and customize it

Choose a life insurance quote from 20 Canadian insurance companies. Change the term, amounts, and more to suit your unique needs.

Not sure of exactly how much life insurance you need? No worries!

Finding the sweet spot for how much life insurance Ontarians need is no enviable task. You don’t want to choose so little as to not cover any outstanding debts as well as the cost of living in Ontario for those you leave behind.

At the same time, choosing an amount that’s too large may prove costly in the future. What if you realize you may not have needed that much insurance coverage and could have saved some money?

A common rule of thumb is to choose 8-10 times your yearly income as your death benefit. For a more precise answer, take into account any debts you have, your family’s living expenses, future education needs of your children, plan for end-of life expenses and any other allocations (e.g. charitable donations) you may want to make.

Our life insurance needs calculator takes your financial situation and allocation preferences into account and helps you determine the right amount of life insurance coverage in Ontario.

the best insurance companies in Ontario

The country’s top insurance companies offer unique policies to fit the individual coverage needs of anyone living in Ontario. Having the choice and knowledge to pick the policy and provider that’s right for your situation goes a long way in protecting you and your loved ones against unforeseen circumstances.

That’s why PolicyAdvisor partners with 20+ of Canada’s top insurance companies – the most by any online broker. We make sure you have the greatest number of options when choosing the insurance company to protect yourself and your loved ones.

We can help Ontarians obtain a term life insurance policy from Assumption Life, Beneva, BMO Insurance, Canada Life, Canada Protection Plan, Desjardins, Empire Life, Equitable Life, Foresters, Humania, iA Group, ivari, Manulife, RBC, and Wawanesa.

How much does Life Insurance cost in Ontario?

One of the major factors by which life insurance premiums are calculated in Ontario is your age. It should come as no surprise that Ontario life insurance premiums rise as you get older – but did you know your age is determined by your nearest birthday.

Click on any of the ages here to find out more about Ontario life insurance rates at these stages in one’s life, or click on the calculator button to find out how much your policy might cost in less than 5 minutes.

Can I get life insurance in Ontario with no medical exam?

Many people in Ontario live with medical conditions and health issues they assume will prevent them from getting insurance coverage. Others need insurance coverage more quickly than traditional medical underwriting takes. Fortunately, Ontarians can get an insurance policy without a medical examination or bloodwork.

Given the recent global pandemic and a greater focus on physical distancing, many are uncomfortable with the thought of going to a crowded lab for medical tests or inviting a stranger into their home for a medical exam.

PolicyAdvisor offers several ways for those in Ontario to apply for life insurance without a face-to-face meeting. Besides an aversion for blood tests or prior health concerns, there are several other reasons someone might elect for non-medical life insurance. In these cases, a simplified or guaranteed issue insurance policy provides more options.

You can shop for quotes, speak to a licensed Ontario online insurance broker, and apply for life insurance all without leaving your own home or having a face-to-face meeting.

More Ontario Facts

- With more than 250,000 lakes across the province, about 20% of the world’s freshwater can be found in Ontario.

- With a population of over 13.6 million people, Ontario is home to almost two-fifths of Canada’s entire population

- While they have the motto We The North, Ontario’s NBA team, the Toronto Raptors are situated further south than both the Minnesota Timberwolves and the Portland Trailblazers.

1-888-601-9980

1-888-601-9980